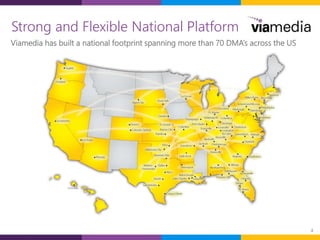

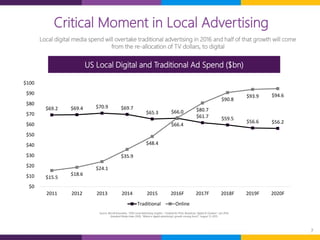

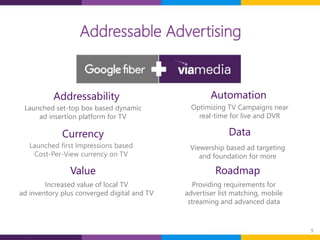

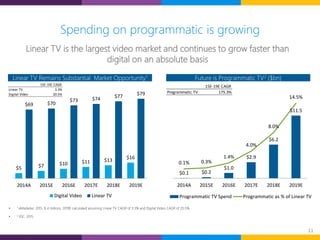

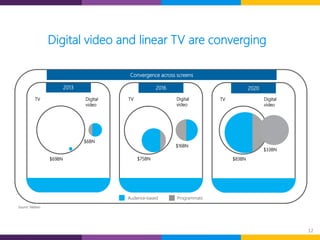

Viamedia is an independent provider of local TV advertising across 60+ MVPD partners in 71 markets and 32 states. It has a national technology platform and footprint spanning over 70 DMAs across the US. Viamedia is the 4th largest local video ad sales organization and manages over 1 million ads per day for 12,000 advertisers through its centralized operations. Its technology platform includes the largest single instance of a traffic system in the world, and capabilities for multi-platform insertion and dynamic ad serving across linear and digital channels. Local digital media spending is increasing rapidly and will overtake traditional advertising by 2016, with half the growth coming from TV dollars moving to digital.