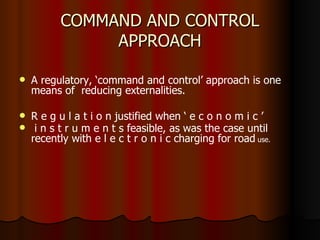

The document discusses negative and positive externalities, with a focus on those associated with transportation. It describes how negative externalities from transportation, such as exhaust emissions, noise, accidents, and traffic congestion, impose costs on society. However, GDP is not reduced to account for these external costs. The document examines different approaches to reducing transportation externalities, including command-and-control regulation and Pigovian taxes, which aim to make polluters internalize the external costs of their actions. It notes challenges in estimating externality values and tax levels.

![GOODS AND BADS IN TRANSPORT Transport services themselves are a ‘good’. They are an essential input into the production process and personal consumption. [...] By convention, however, national-income accounts do not include non-traded items .](https://image.slidesharecdn.com/transportsandexternalities-110419052839-phpapp02/85/Transports-and-externalities-3-320.jpg)