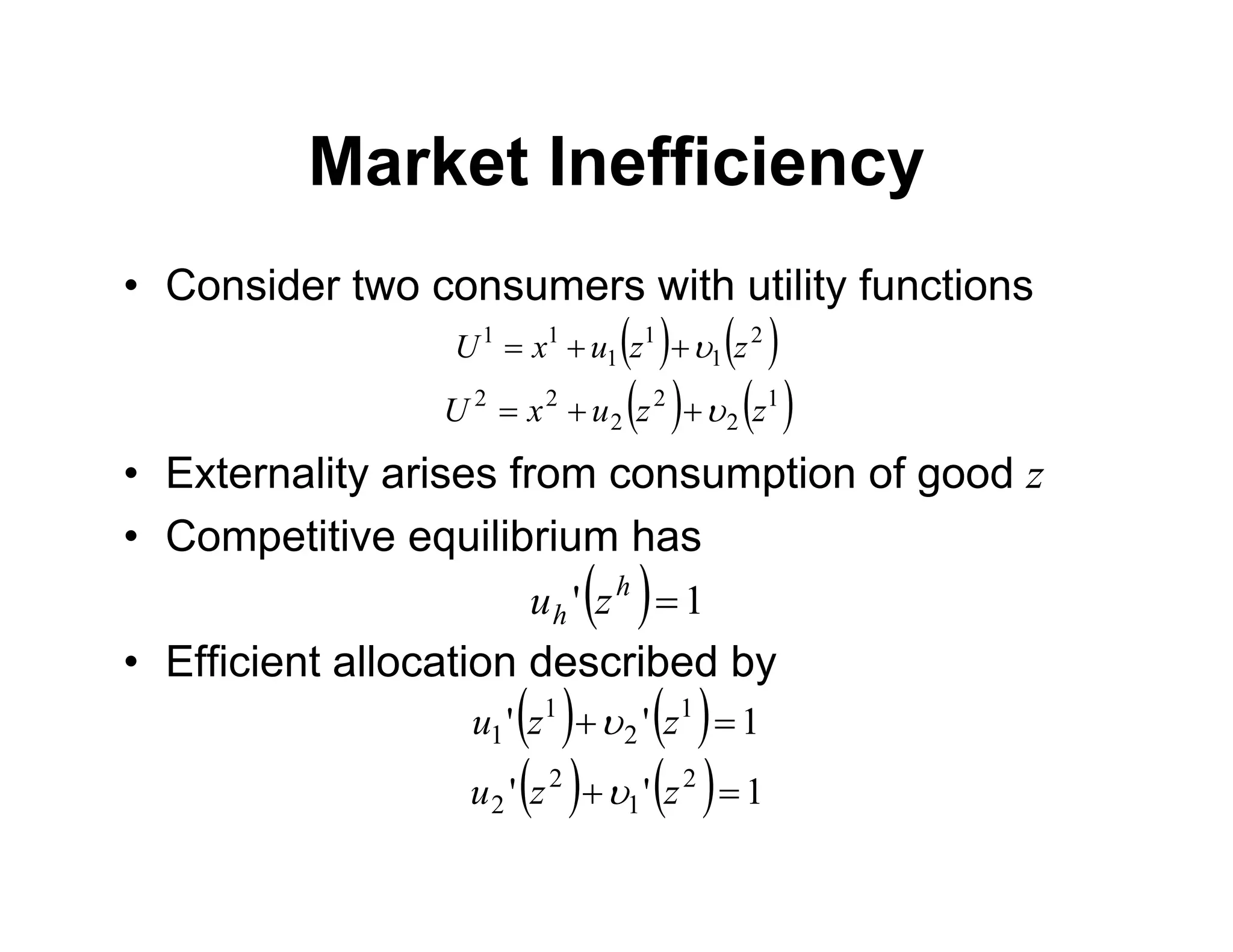

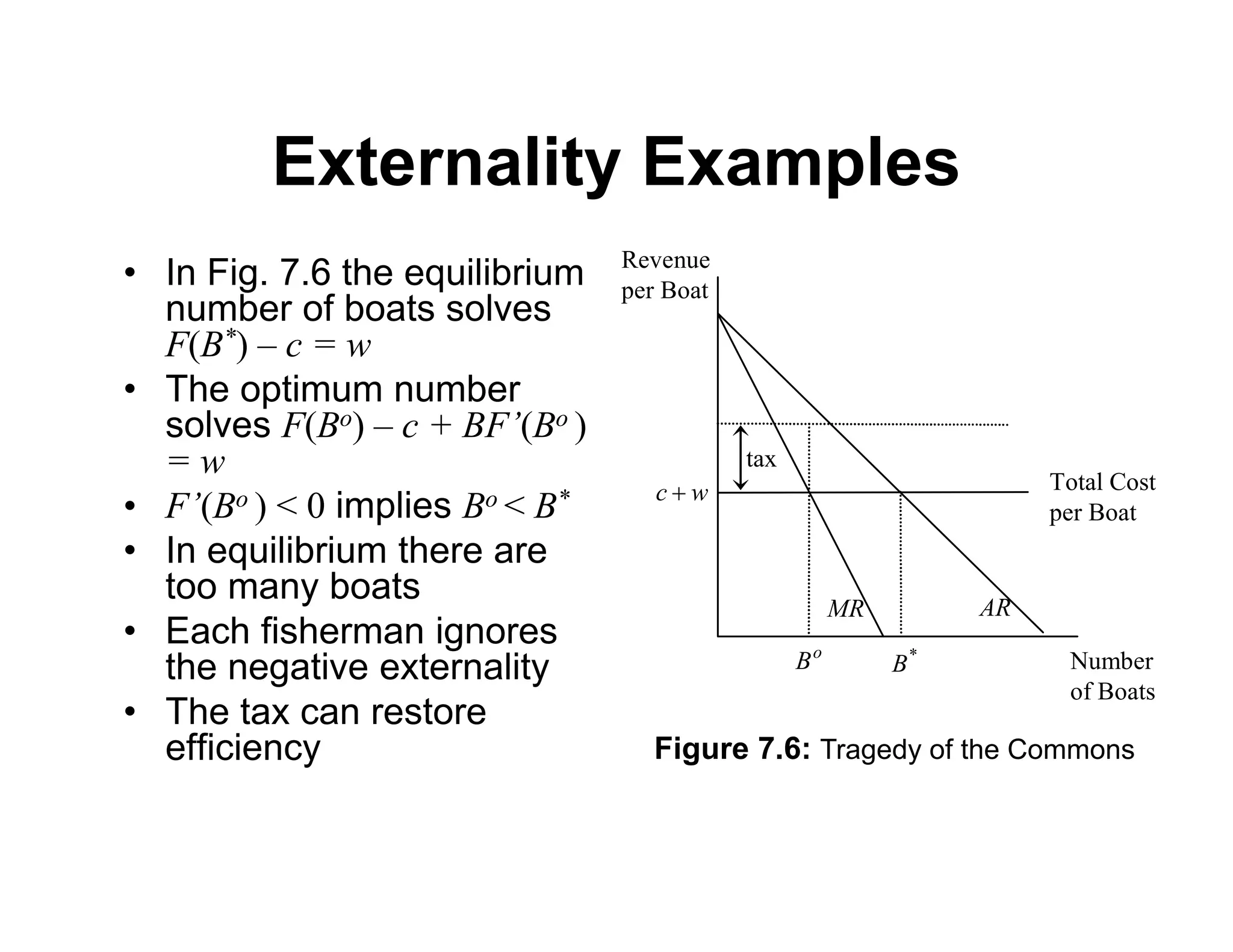

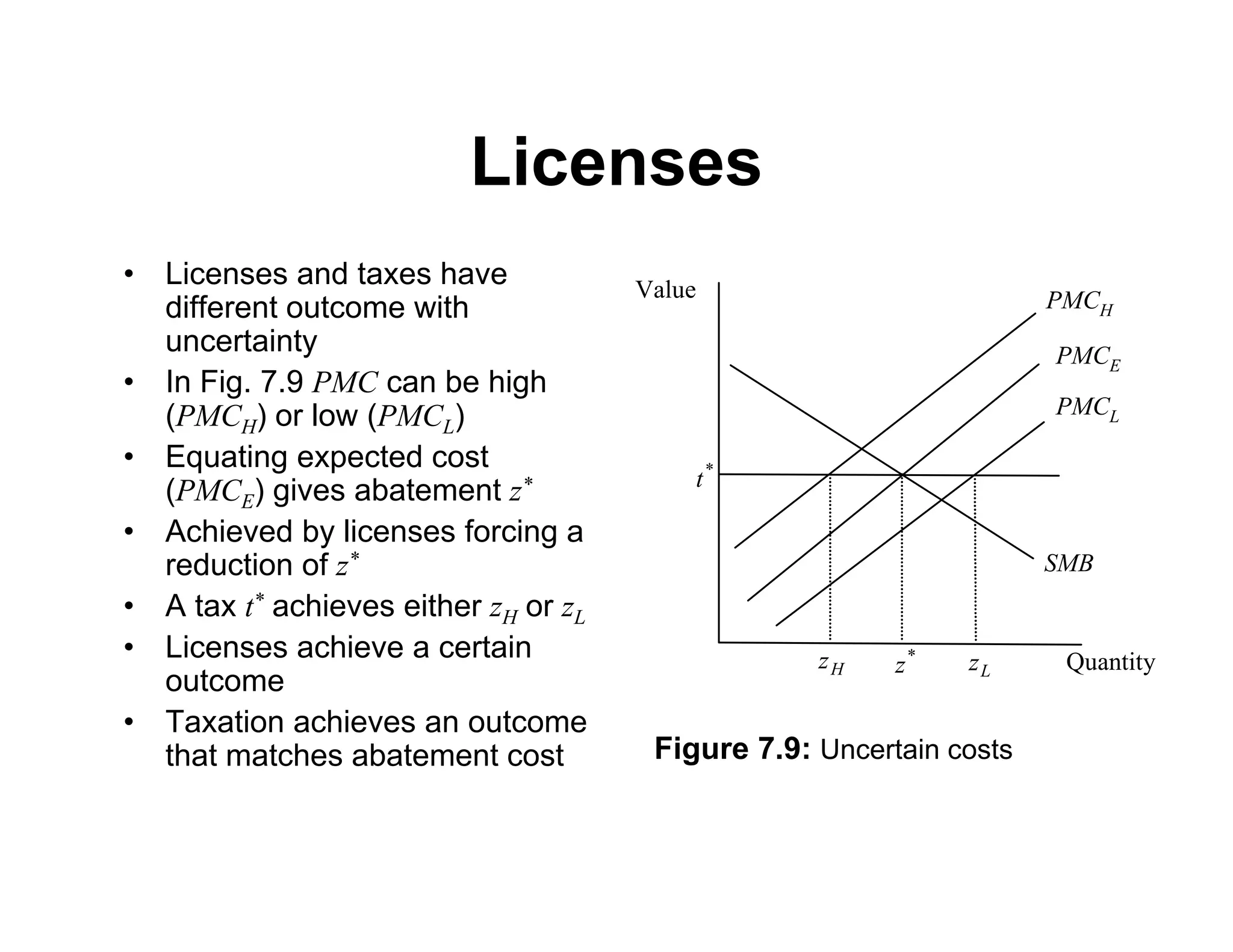

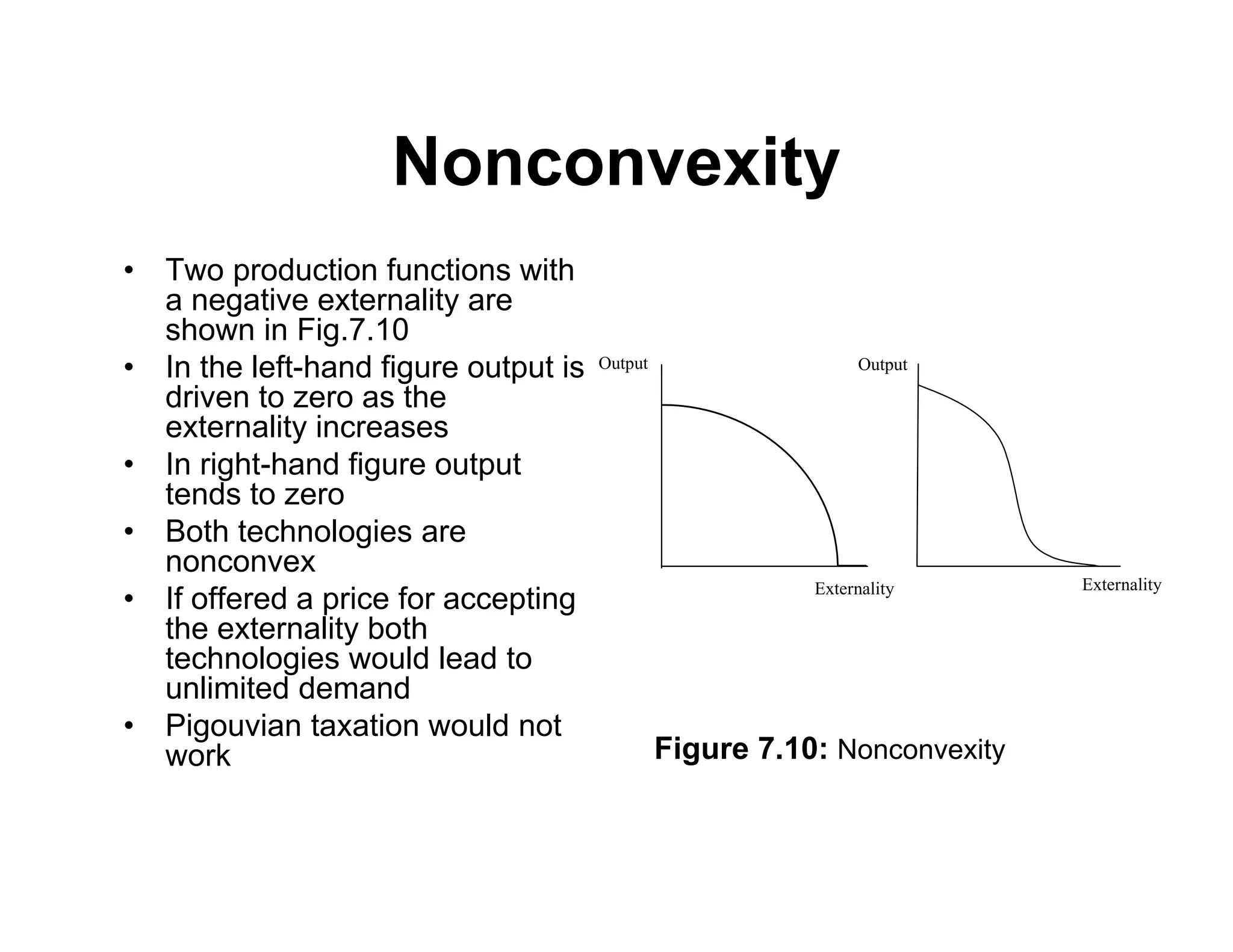

Chapter 7 discusses externalities, which are economic links between agents that are not reflected in market prices, leading to inefficiencies such as pollution and congestion. It outlines various types of externalities, including production and consumption externalities, and examines how they create market inefficiencies where private valuations diverge from social valuations. Solutions like Pigouvian taxes and marketable licenses are proposed to correct these inefficiencies, although practical limitations exist, as per the Coase theorem.

![Reading

• Essential reading

– Hindriks, J and G.D. Myles Intermediate Public Economics.

(Cambridge: MIT Press, 2006) Chapter 7.

• Further reading

– Bator, F.M. (1958) ‘The anatomy of market failure’, Quarterly

Journal of Economics, 72, 351—378.

– Buchanan, J.M. and C. Stubblebine (1962) ‘Externality’,

Economica, 29, 371—384.

– Coase, R.H. (1960) ‘The problem of social cost’, Journal of Law

and Economics, 3, 1—44.

– Lin, S. (ed.) Theory and Measurement of Economic Externalities.

(New York: Academic Press, 1976) [ISBN 0124504507 hbk].

– Meade, J.E. (1952) ‘External economies and diseconomies in a

competitive situation’, Economic Journal, 62, 54—76.](https://image.slidesharecdn.com/externalitieshindriksmylesch7slides-240809154449-3e88fc6c/75/externalities_hindriks_myles_ch7_slides-pdf-2-2048.jpg)

![Reading

– Pigou, A.C. The Economics of Welfare. (London:

Macmillan, 1918).

• Challenging reading

– Muthoo, A. Bargaining Theory with Applications.

(Cambridge: Cambridge University Press, 1999)

[ISBN 0521576474 pbk].

– Starrett, D. (1972) ‘Fundamental non-convexities in

the theory of externalities’, Journal of Economic

Theory, 4, 180—199.

– Weitzman, M.L. (1974) ‘Prices vs. quantities’, Review

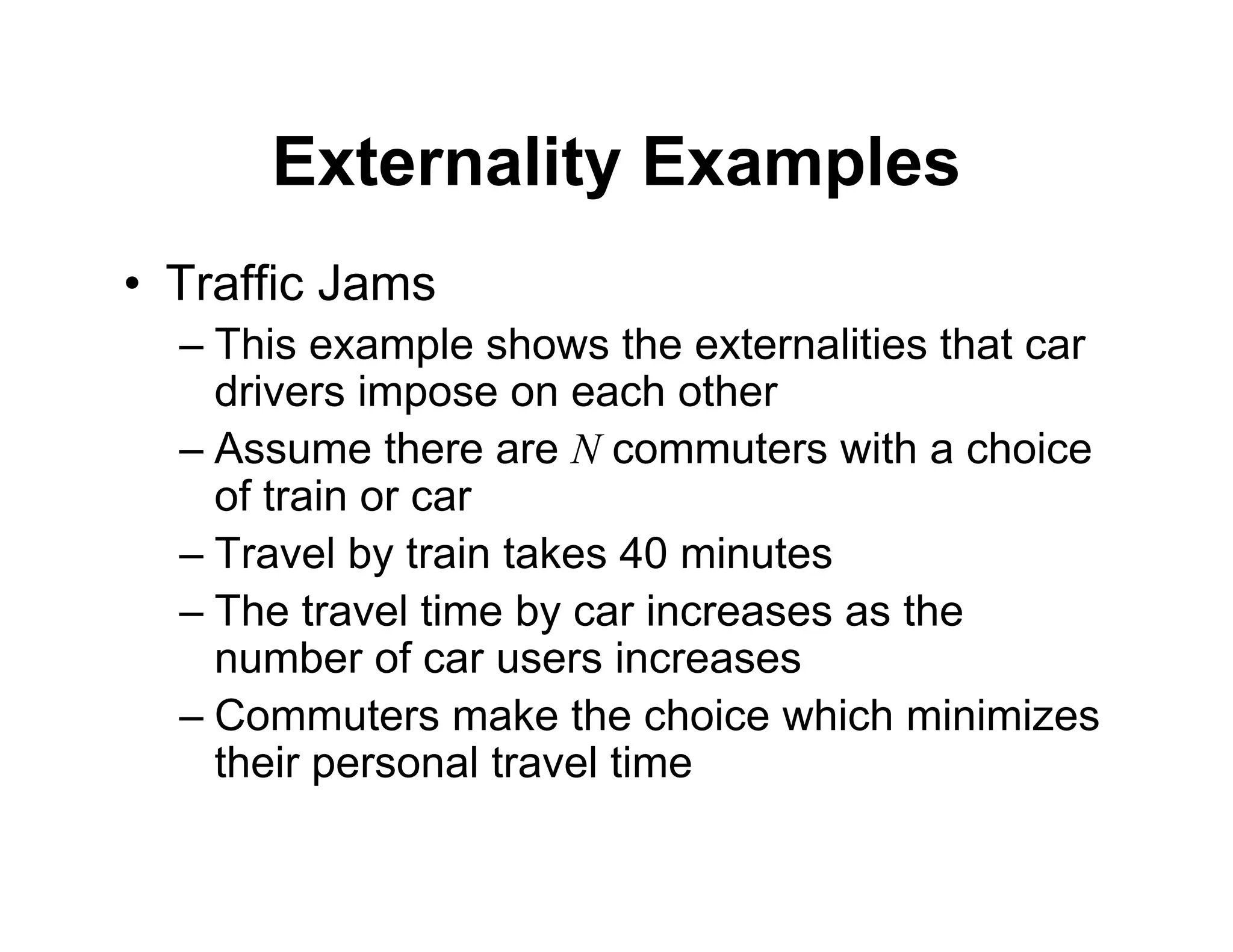

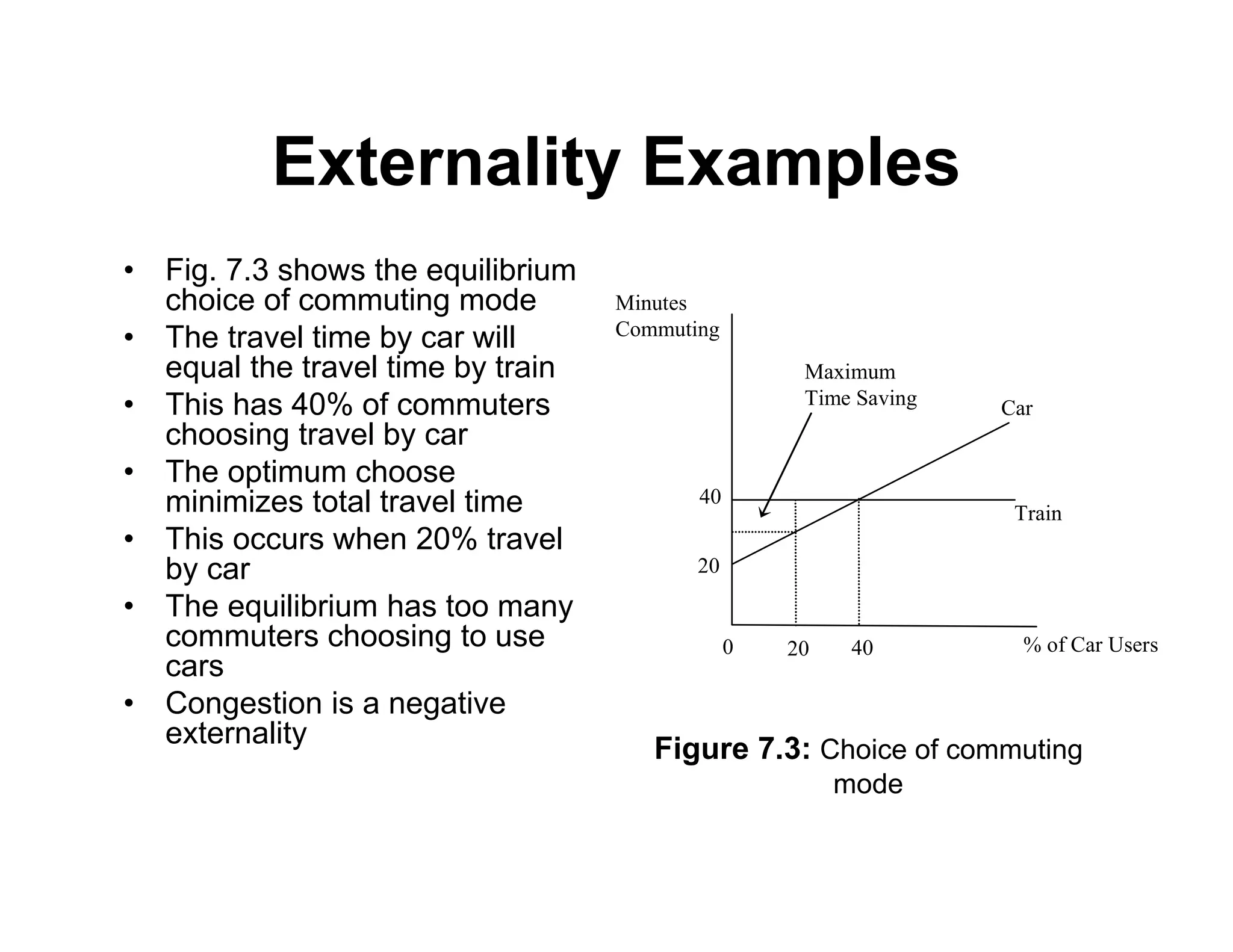

of Economic Studies, 41, 477—491.](https://image.slidesharecdn.com/externalitieshindriksmylesch7slides-240809154449-3e88fc6c/75/externalities_hindriks_myles_ch7_slides-pdf-3-2048.jpg)