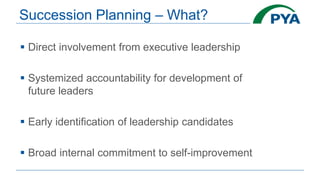

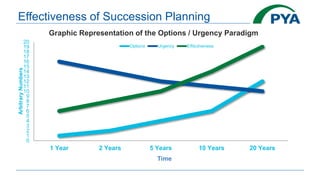

S. Mark Brumbelow gave a presentation on succession planning basics. He outlined identifying key players in the succession process such as owners, executives, employees and advisors. Goals for transition include defining roles and developing candidates. Tax opportunities include gain deferral for sellers and eased cash flow for buyers through organizational structure. Challenges include valuation, structure impacts, and family dynamics. The presentation emphasized starting succession planning early, aligning it to the business, and developing an alliance network.