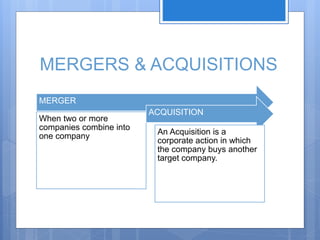

EY offers transaction advisory services to help companies with their capital planning needs like preserving, optimizing, investing, and raising capital. These services include mergers and acquisitions advisory, due diligence to validate financial statements and reduce risk, business valuations, and debt restructuring. EY's transaction advisory services aim to help clients grow and achieve their objectives through arranging capital, integrating businesses through M&A, and selecting partners to benefit from transactions. This supports clients' expansions which in turn generates employment and economic growth, thereby building a better working world.