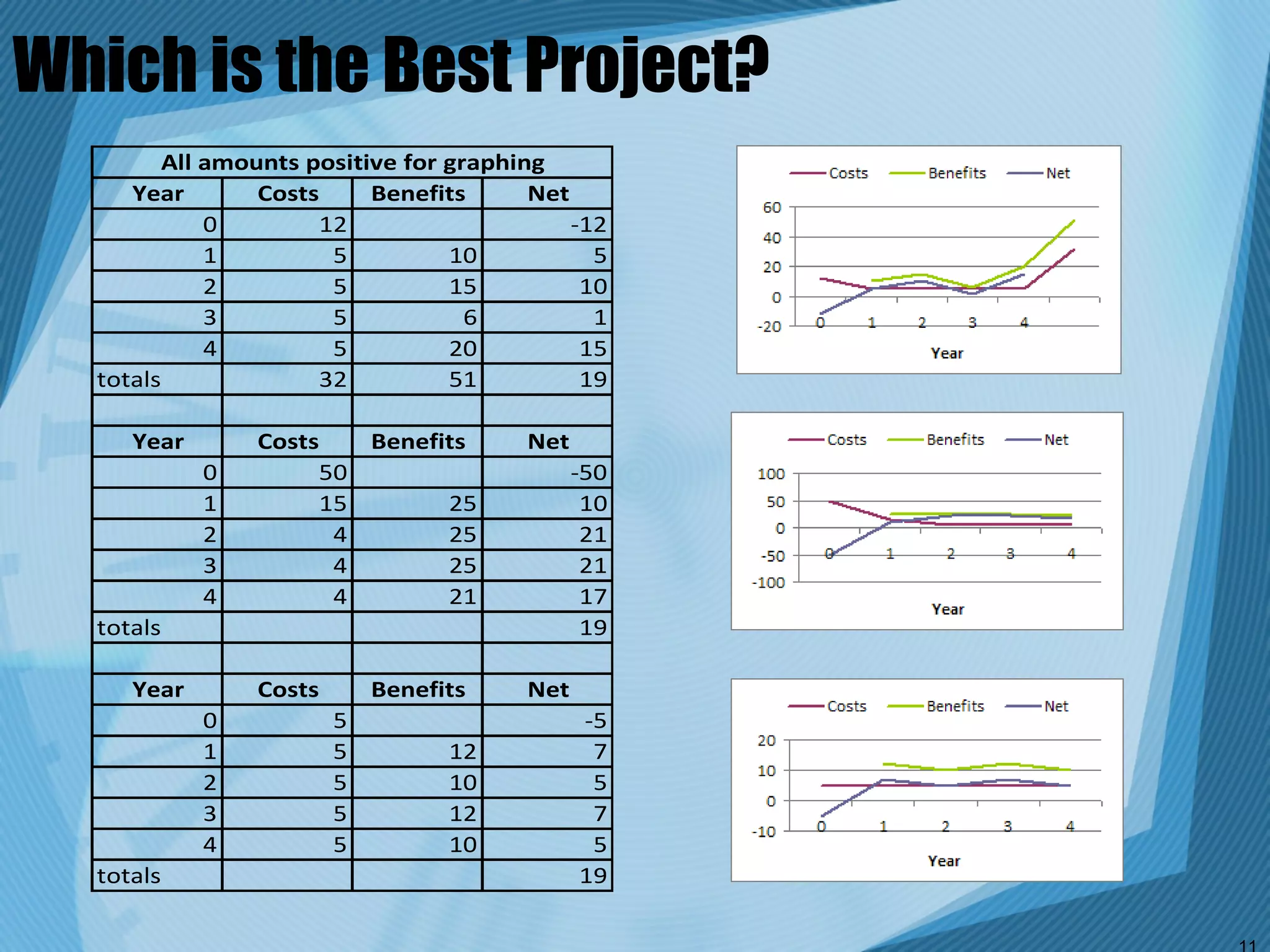

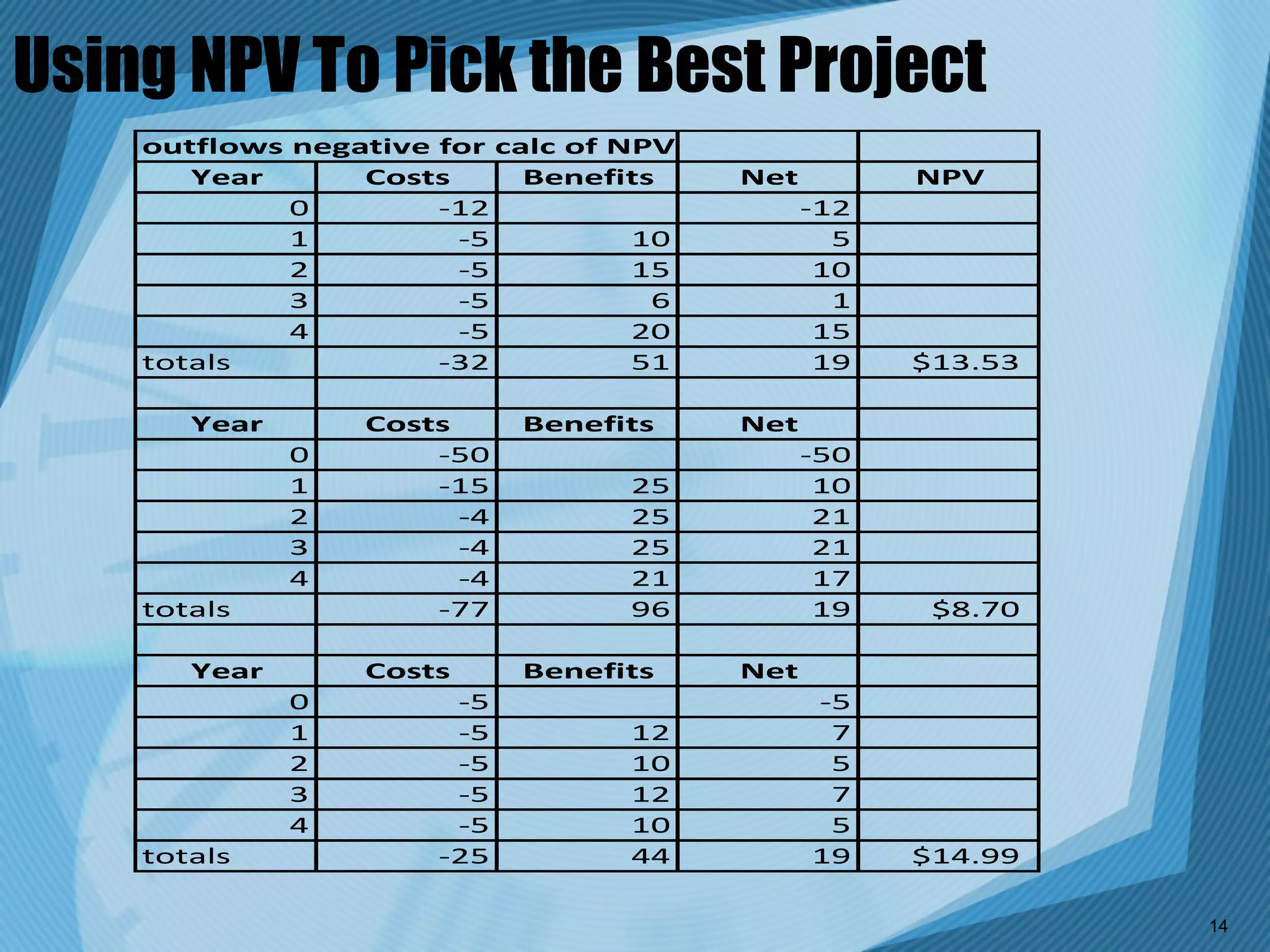

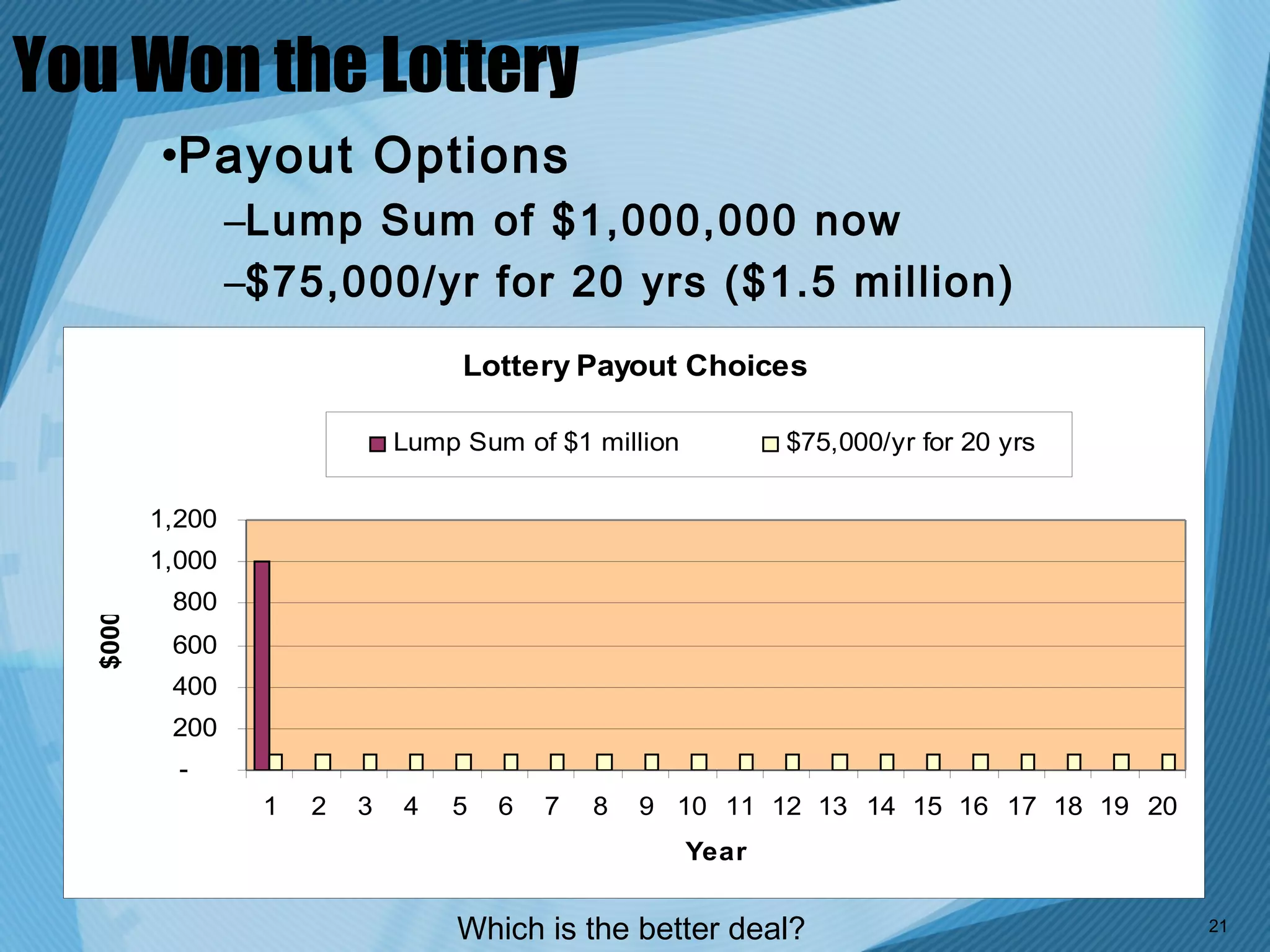

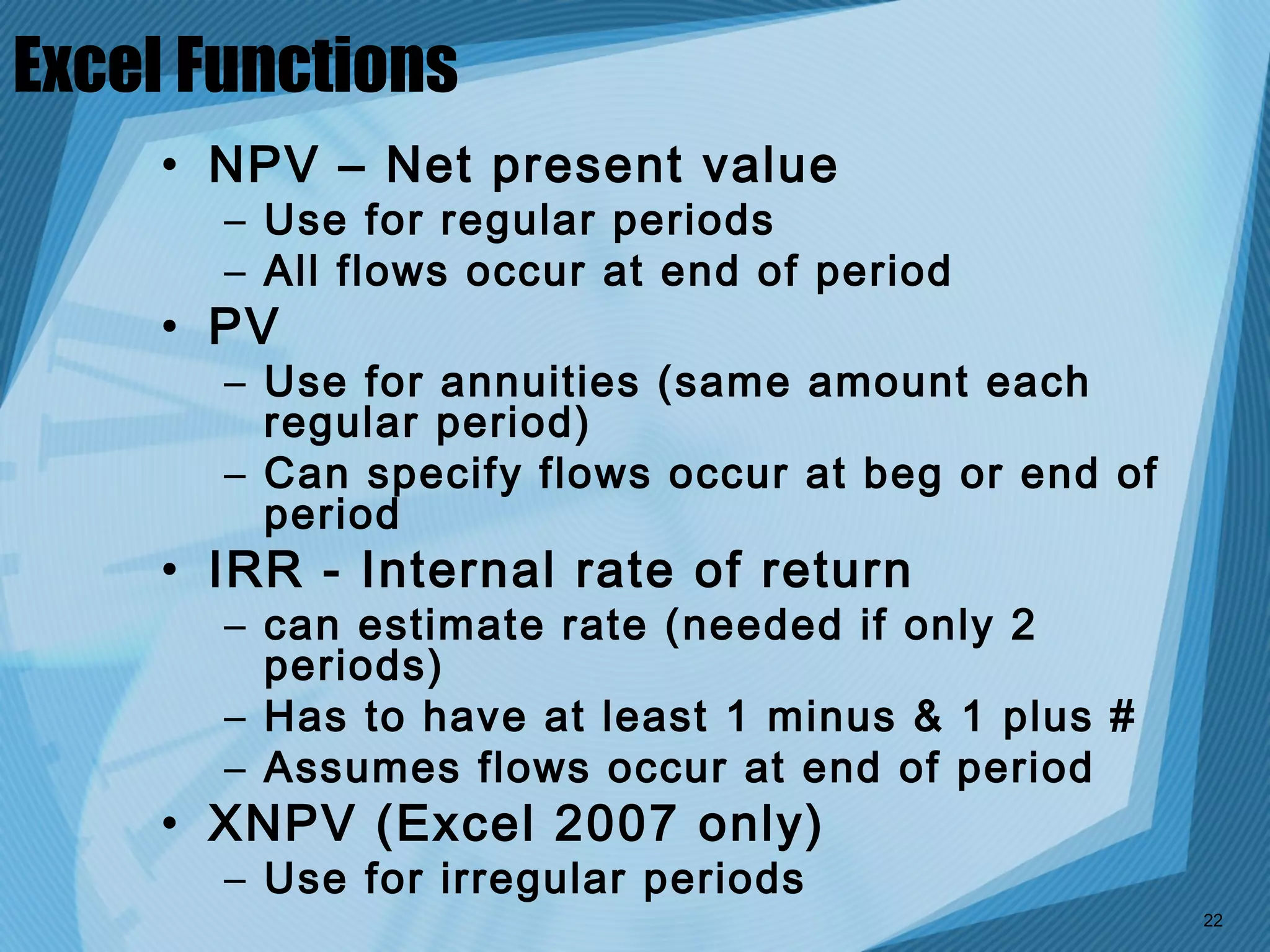

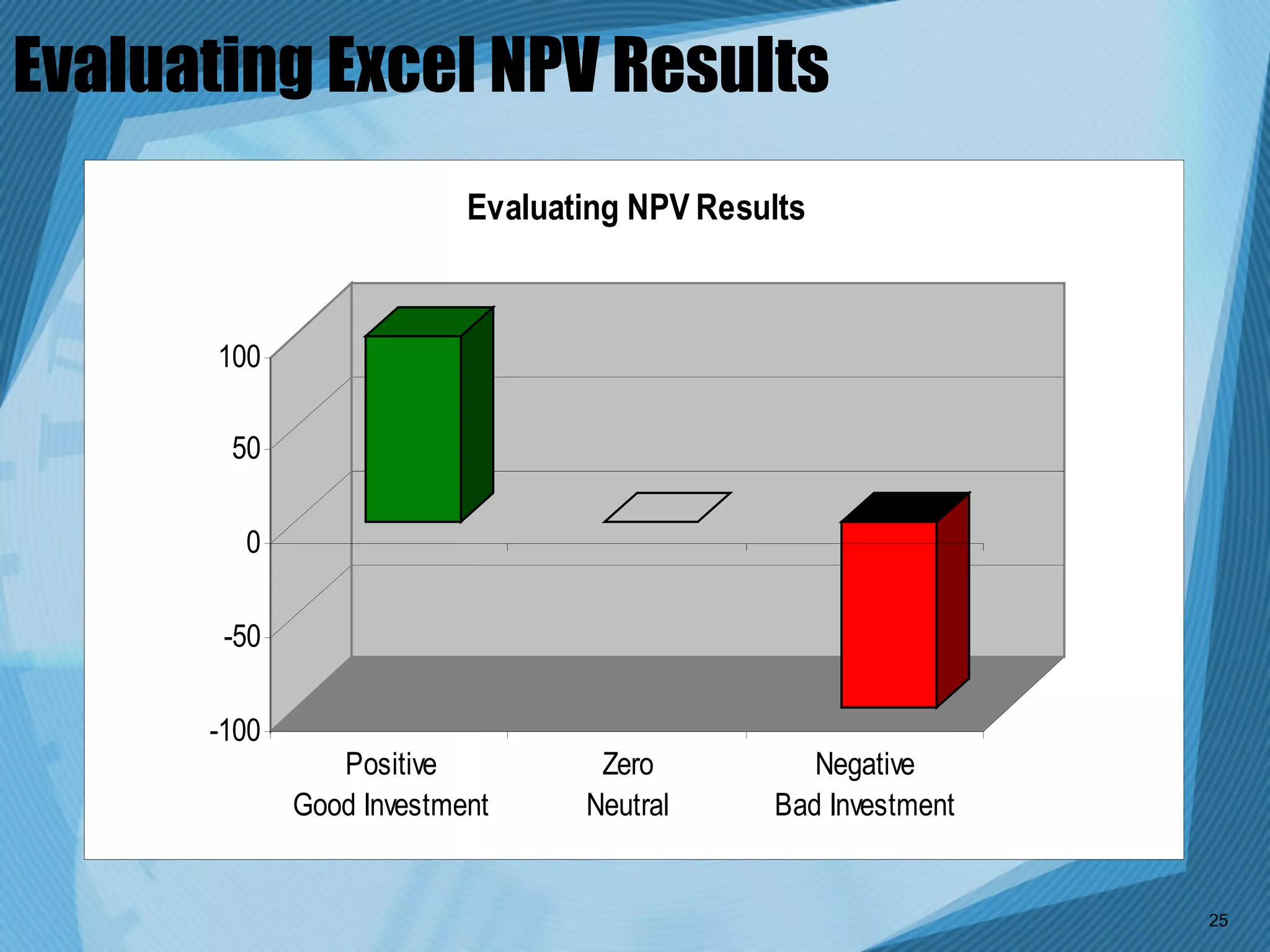

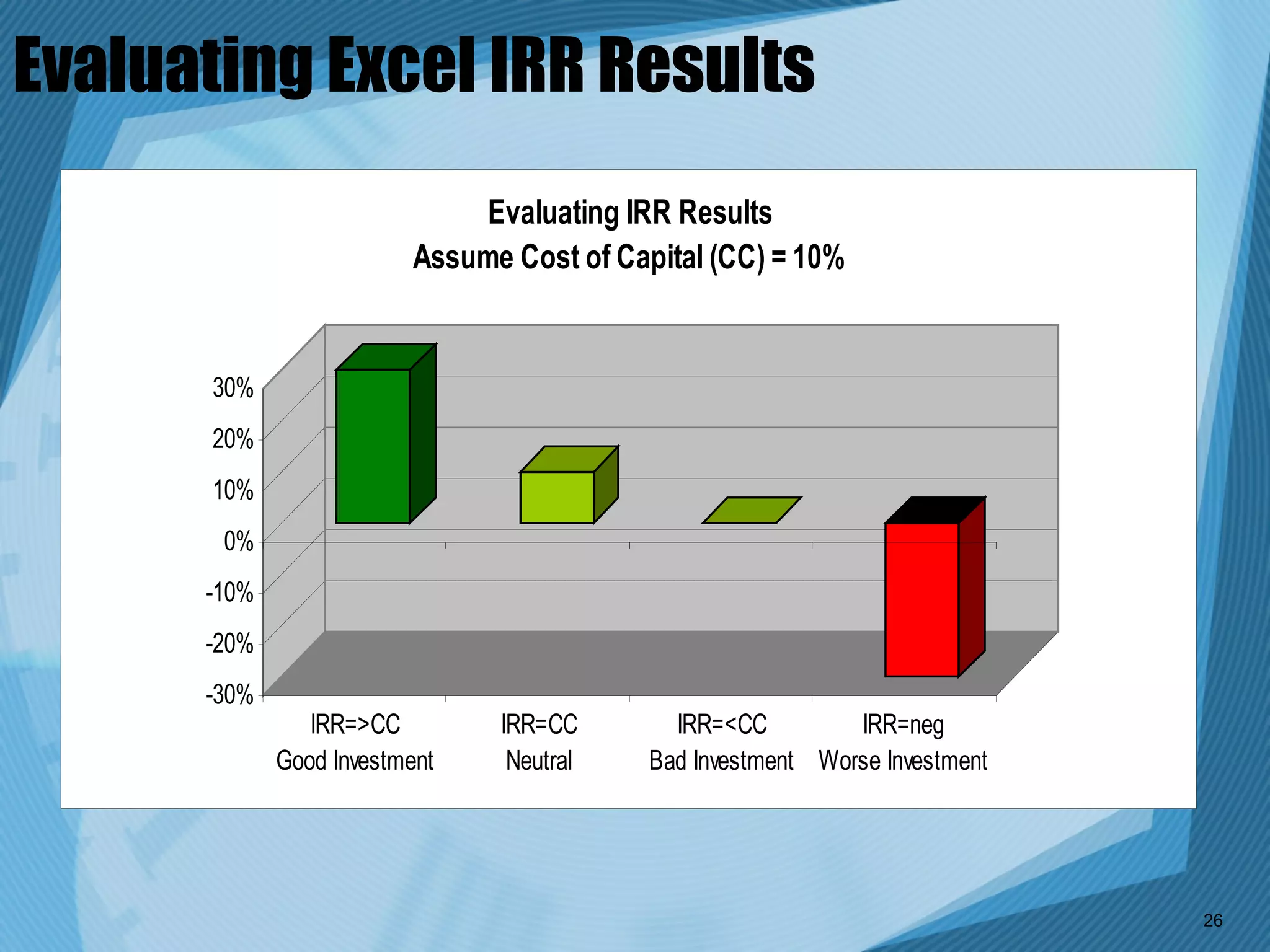

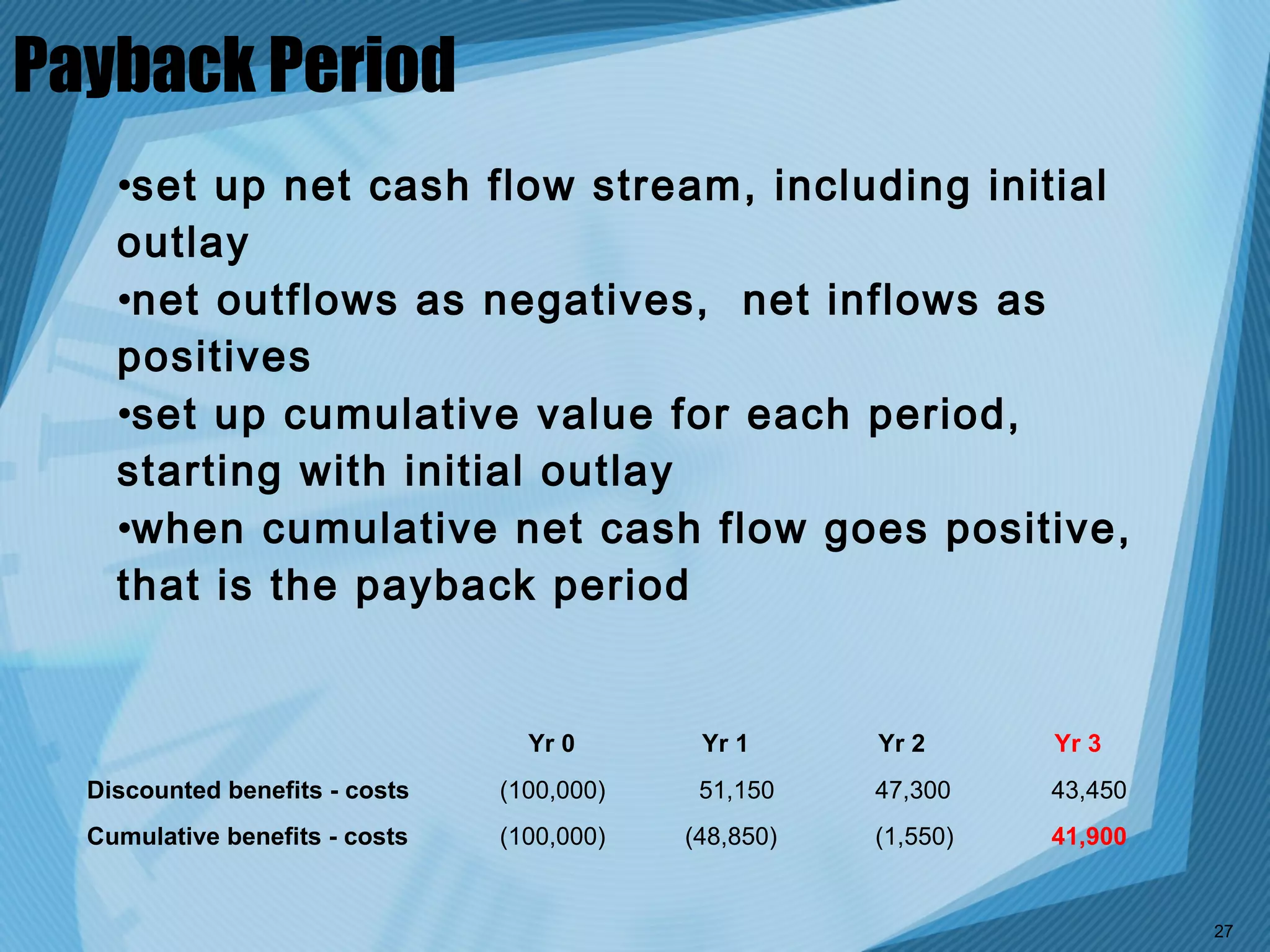

The document discusses the importance of time value of money concepts in project management and finance. It provides an overview of key time value of money concepts such as net present value (NPV), internal rate of return (IRR), discount rates, and cash flow analysis. Several methods for evaluating and comparing projects are presented, including using a weighted scoring model, balanced scorecard, and financial analyses like NPV. Excel functions for time value of money calculations are also reviewed.