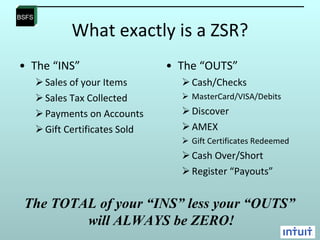

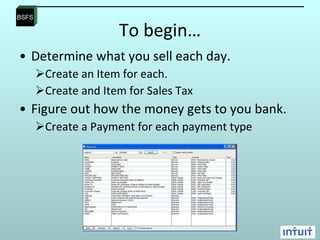

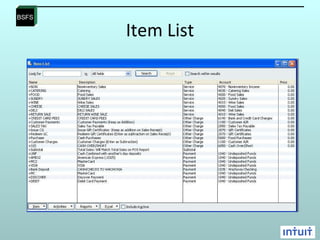

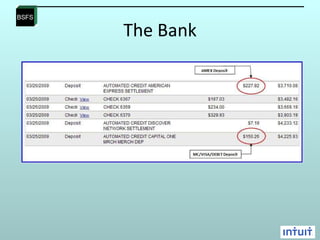

The document discusses the Zero Sum Sales Receipt technique for easily tracking daily sales and reconciling bank accounts. It recommends creating a sales receipt template with items for each product sold, payment types received, and sales tax collected. Business owners use this template to quickly enter daily sales figures from their point-of-sale system. This allows them to easily make deposits and reconcile accounts by ensuring the total sales and payments always balance out to zero. The document provides examples and advises determining item lists, duplicating point-of-sale summaries, and using the template daily to streamline bookkeeping.

![Thank you! [email_address] 386-852-5755 Cell Phone](https://image.slidesharecdn.com/the-zero-sum-sales-receipt-090803133309-phpapp02/85/The-Zero-Sum-Sales-Receipt-17-320.jpg)