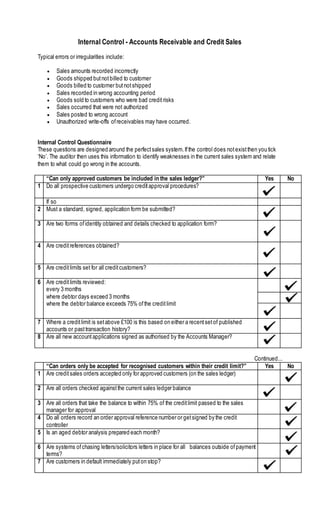

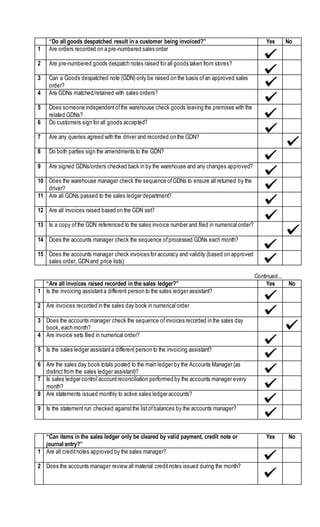

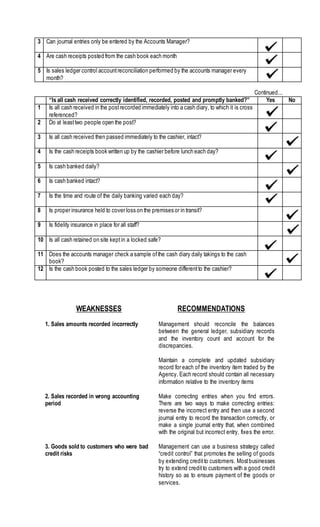

The document discusses typical errors that can occur in accounts receivable and credit sales such as incorrect sales amounts recorded, goods shipped but not billed, unauthorized write-offs of receivables, and sales posted to the wrong account. It then provides questions for an internal control questionnaire to assess weaknesses in a company's sales system and how errors could occur. Recommendations are provided for addressing weaknesses such as reconciling balances, making correcting journal entries, implementing credit control strategies, and double checking cash discounts.