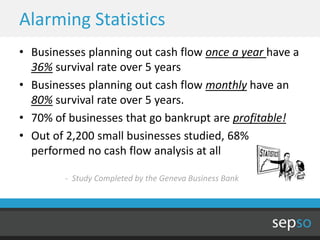

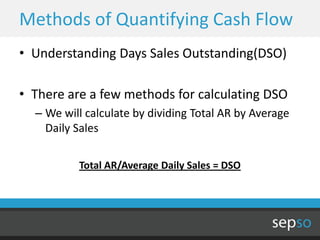

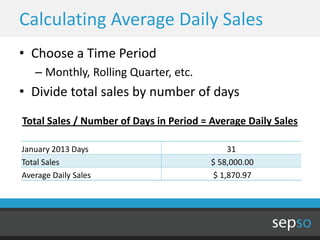

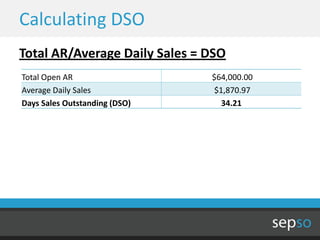

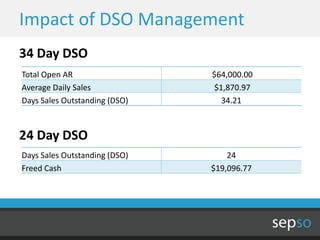

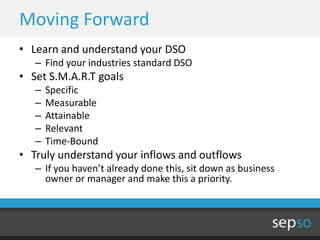

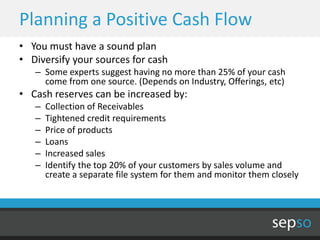

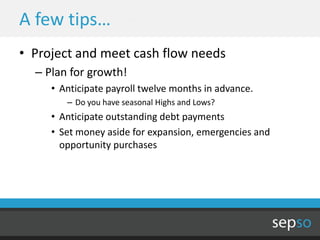

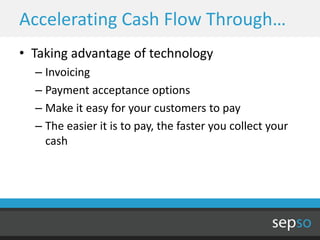

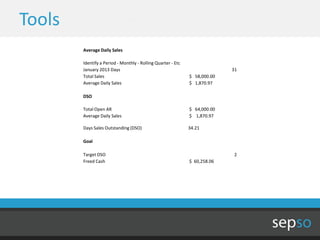

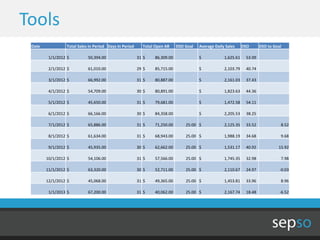

Cash flow management is critical for business success and survival. Managing days sales outstanding (DSO) is an important cash flow metric. The document discusses how a local development firm struggled with cash flow as their business grew 30% annually due to slow customer payments averaging 45 days. Calculating DSO by dividing total accounts receivable by average daily sales can help identify cash flow issues. Improving DSO through faster payment collection, payment reminders, and payment options can free up trapped cash and fund further growth. Technology tools can help streamline invoicing and payments to accelerate cash inflows.