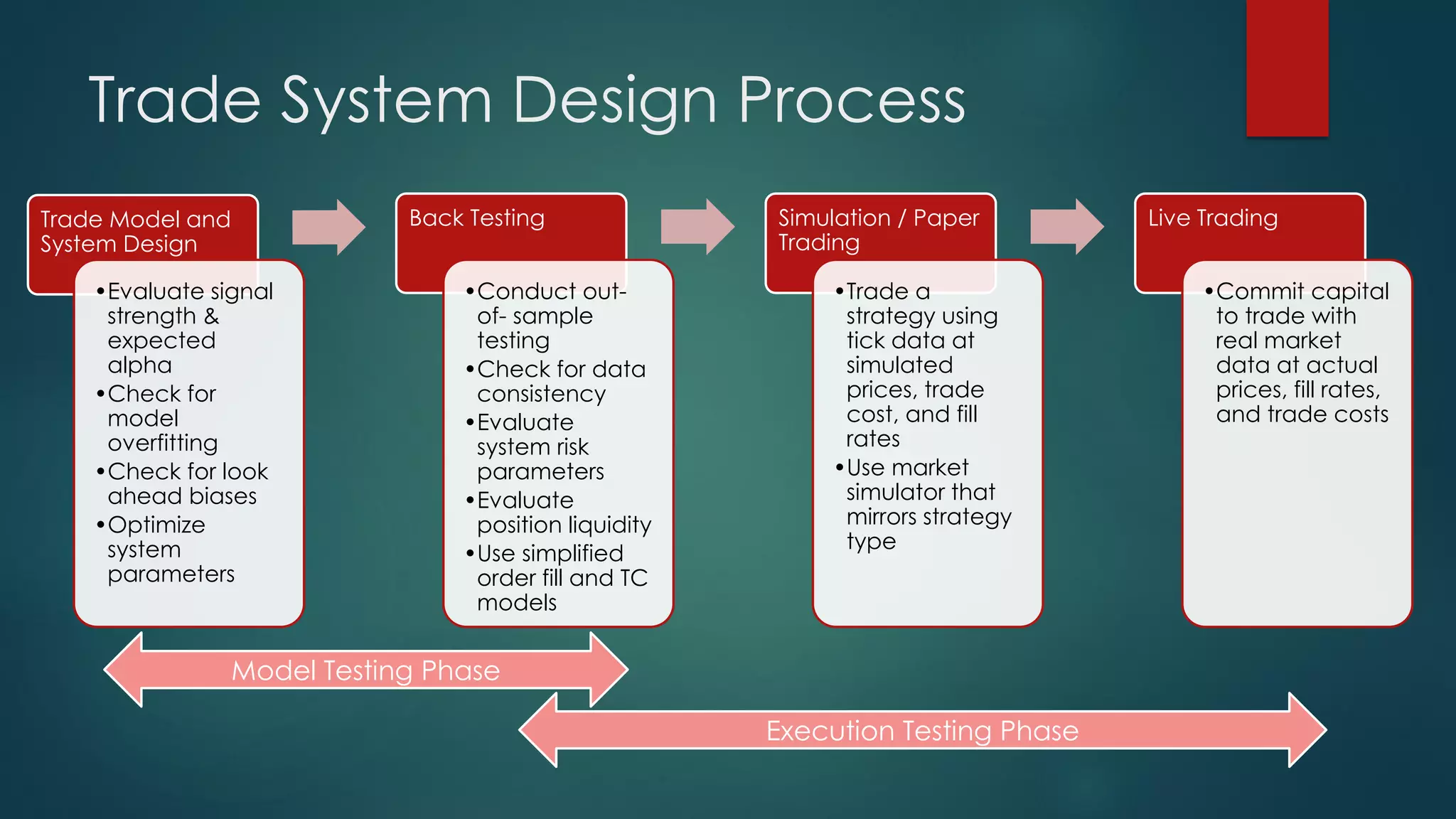

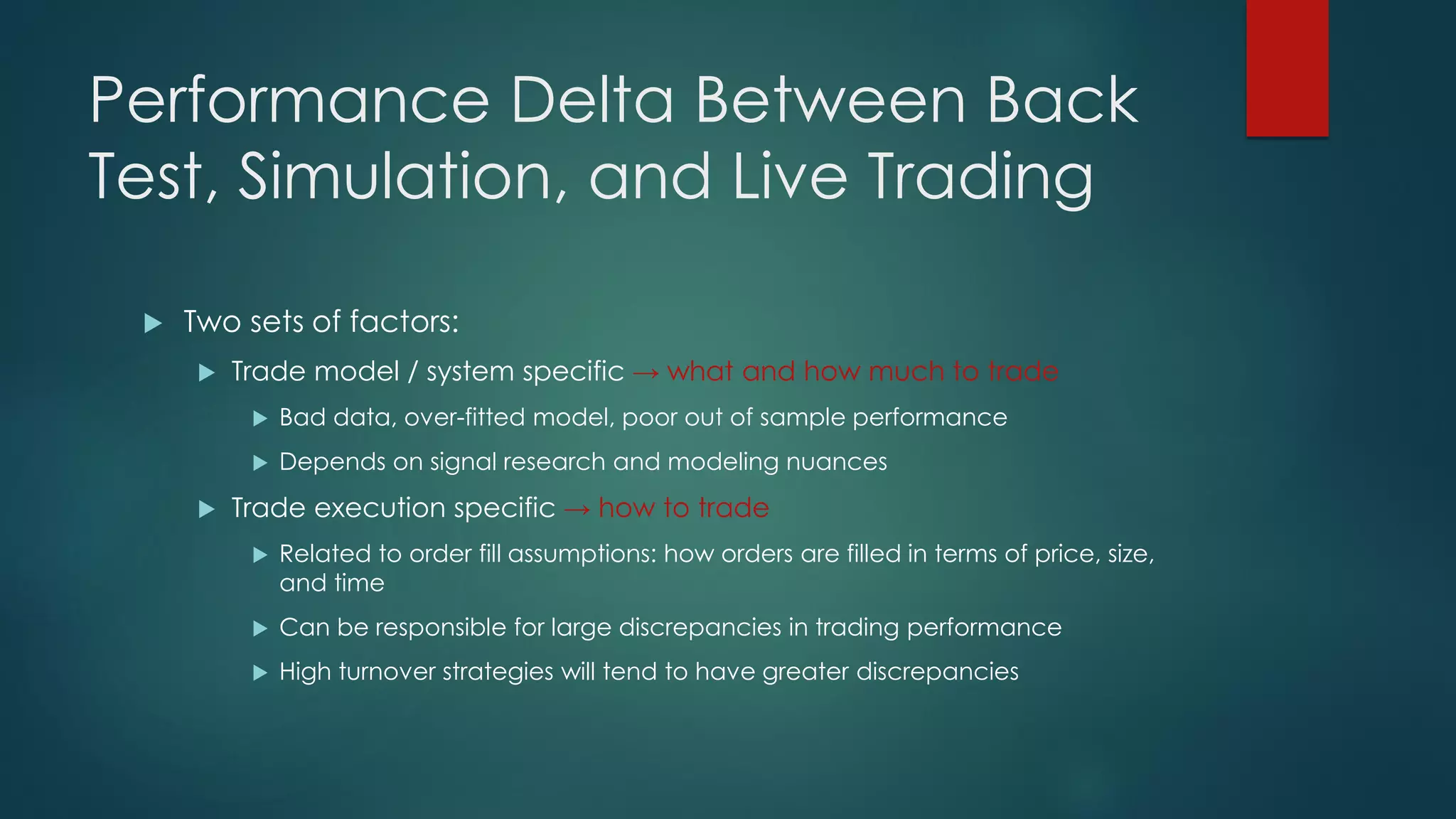

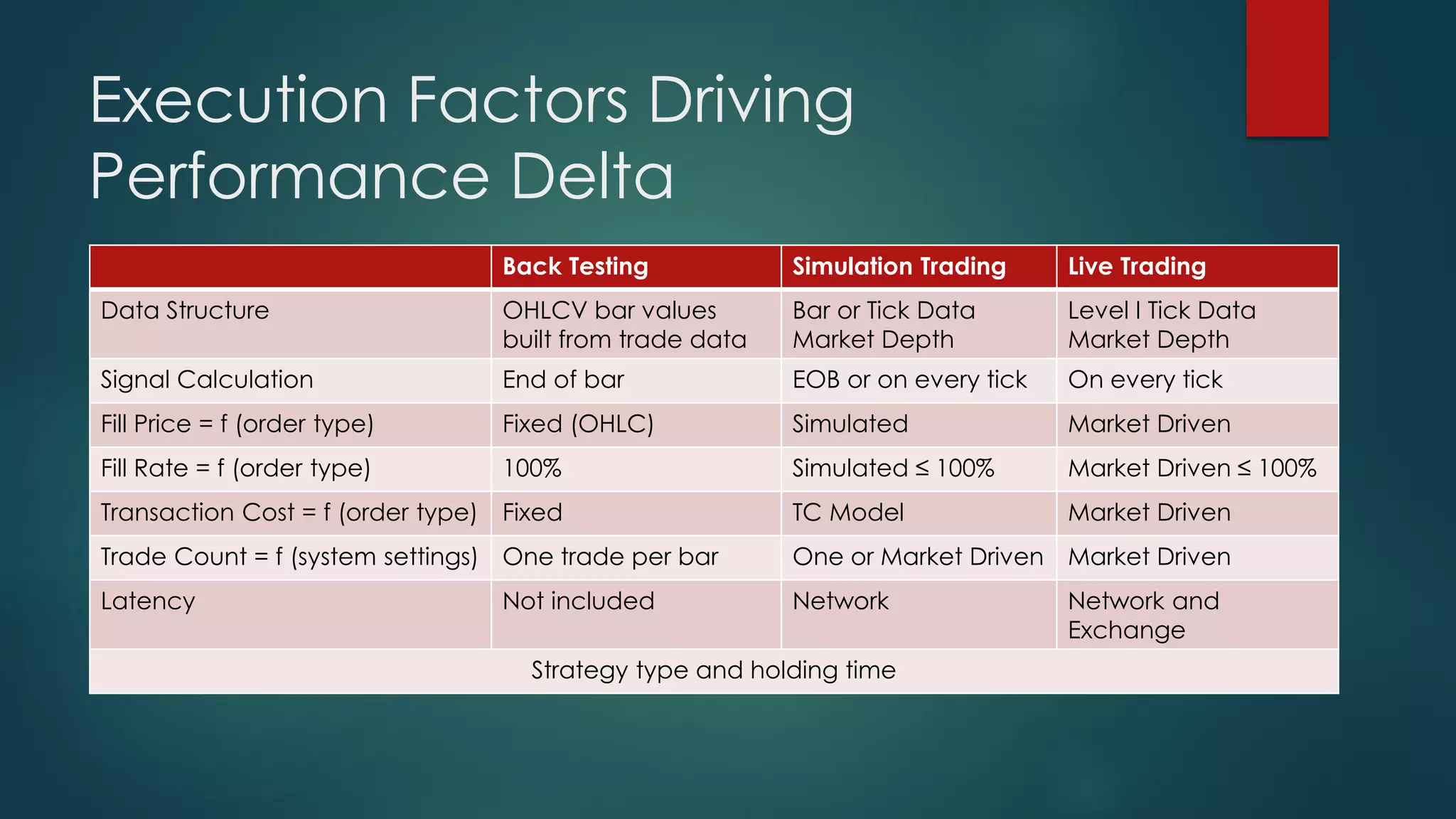

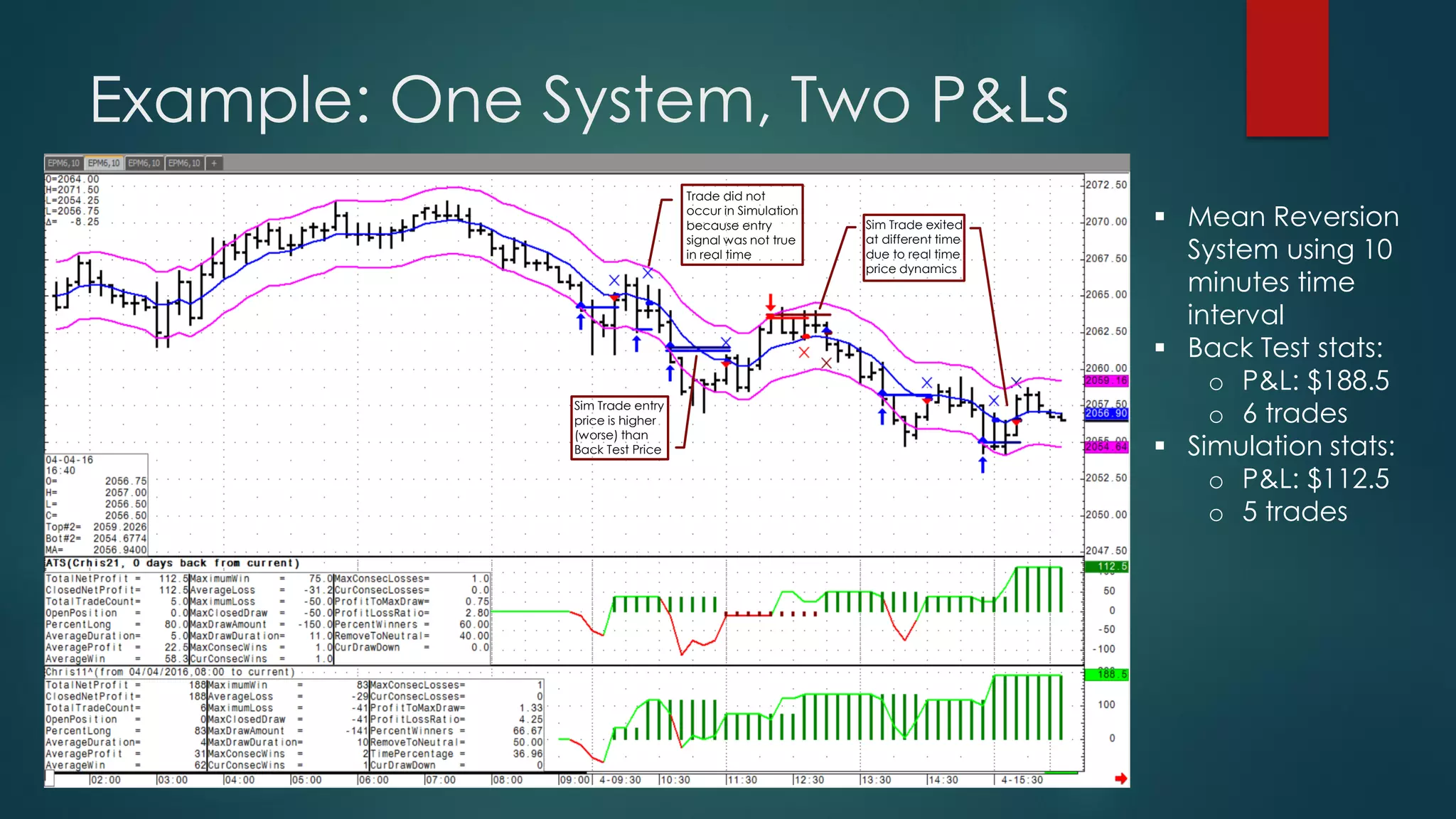

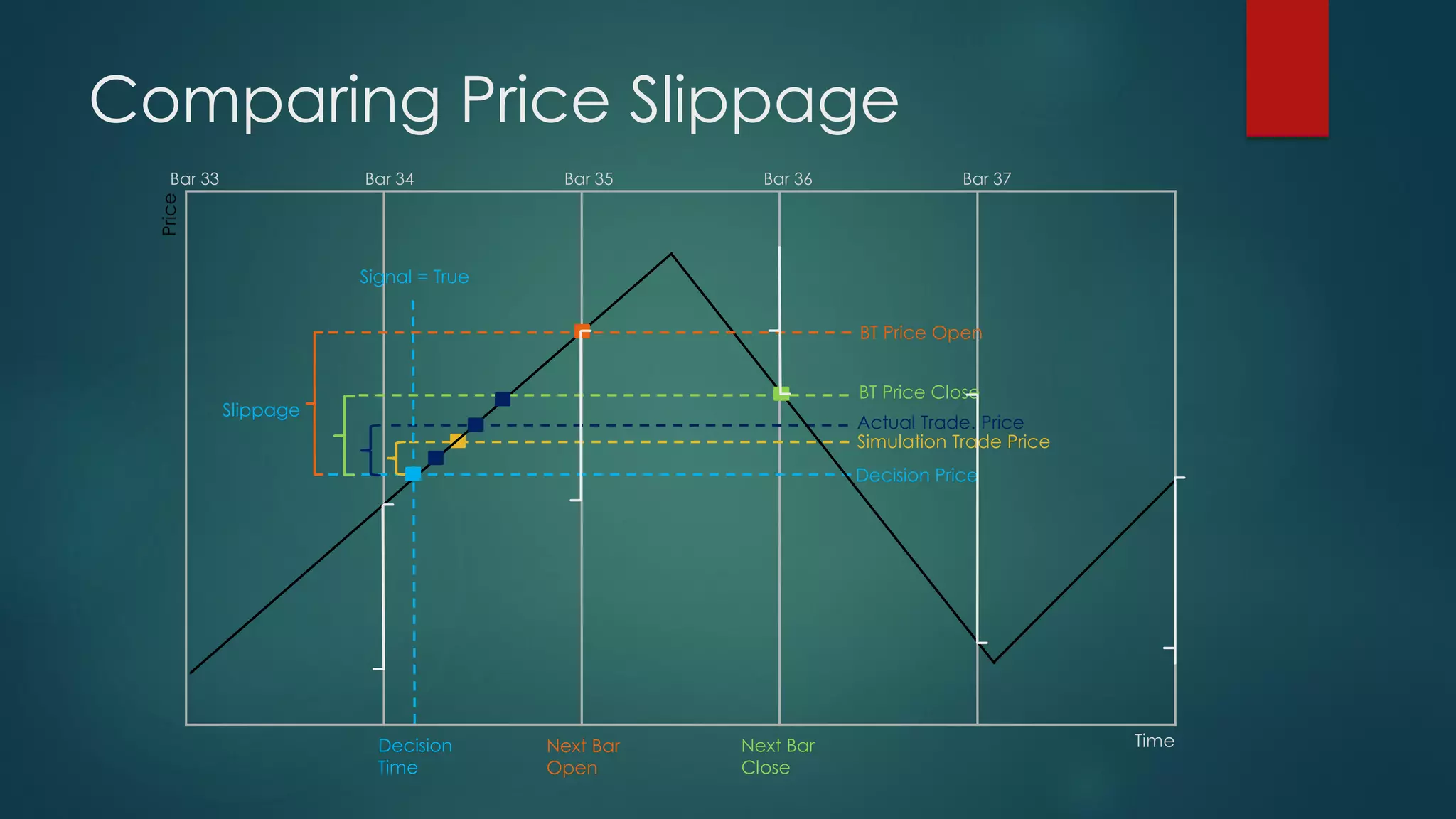

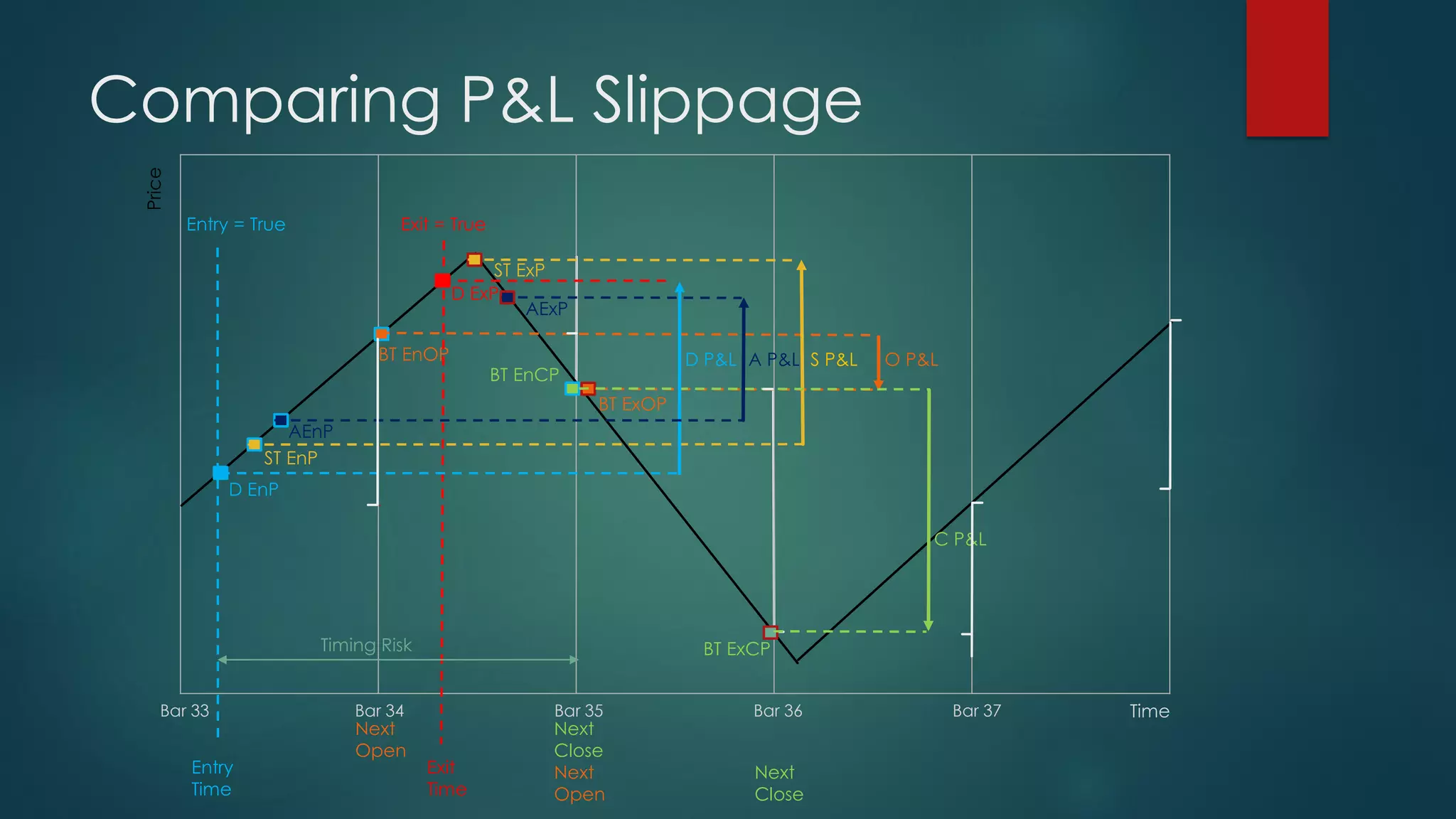

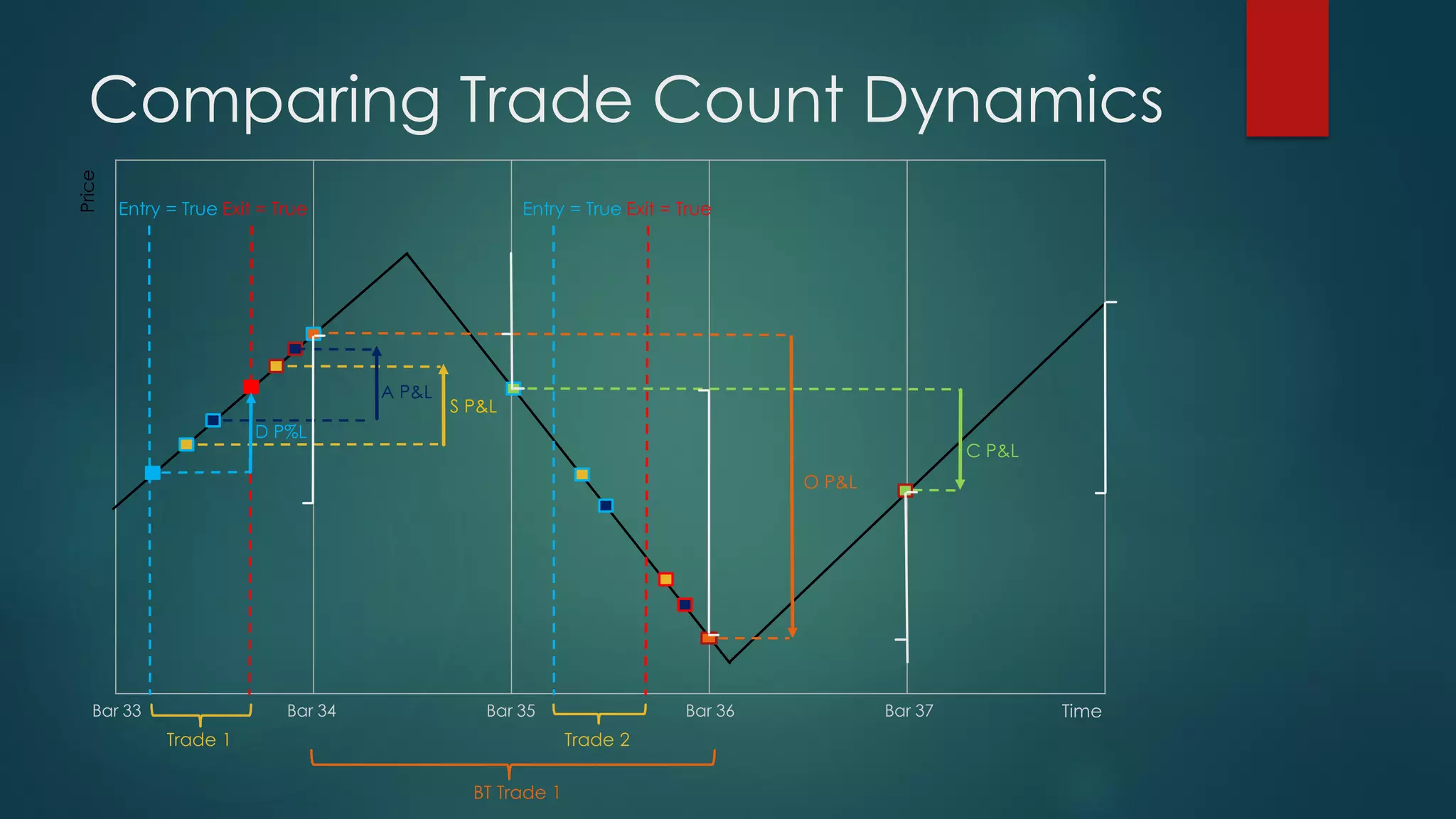

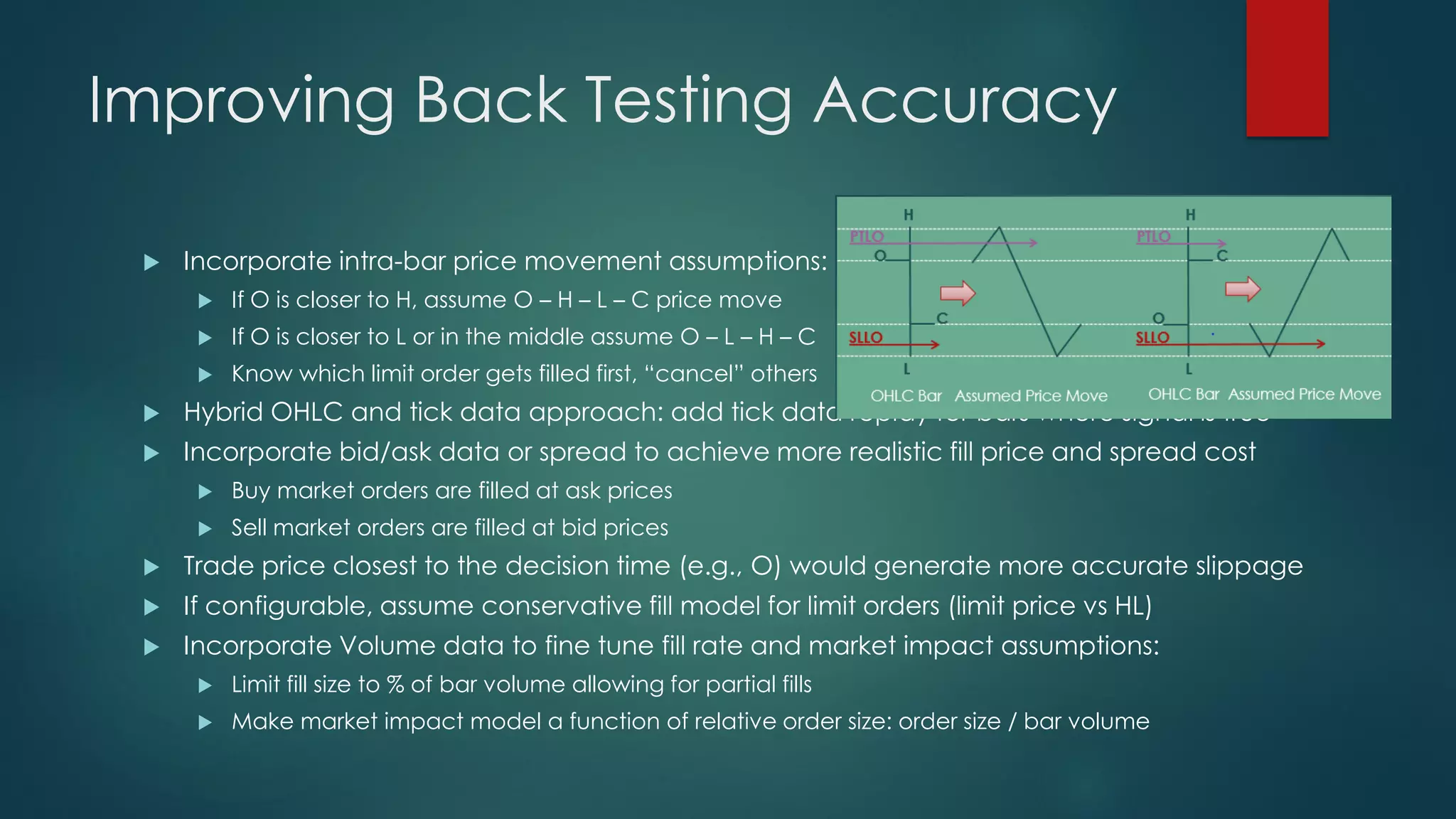

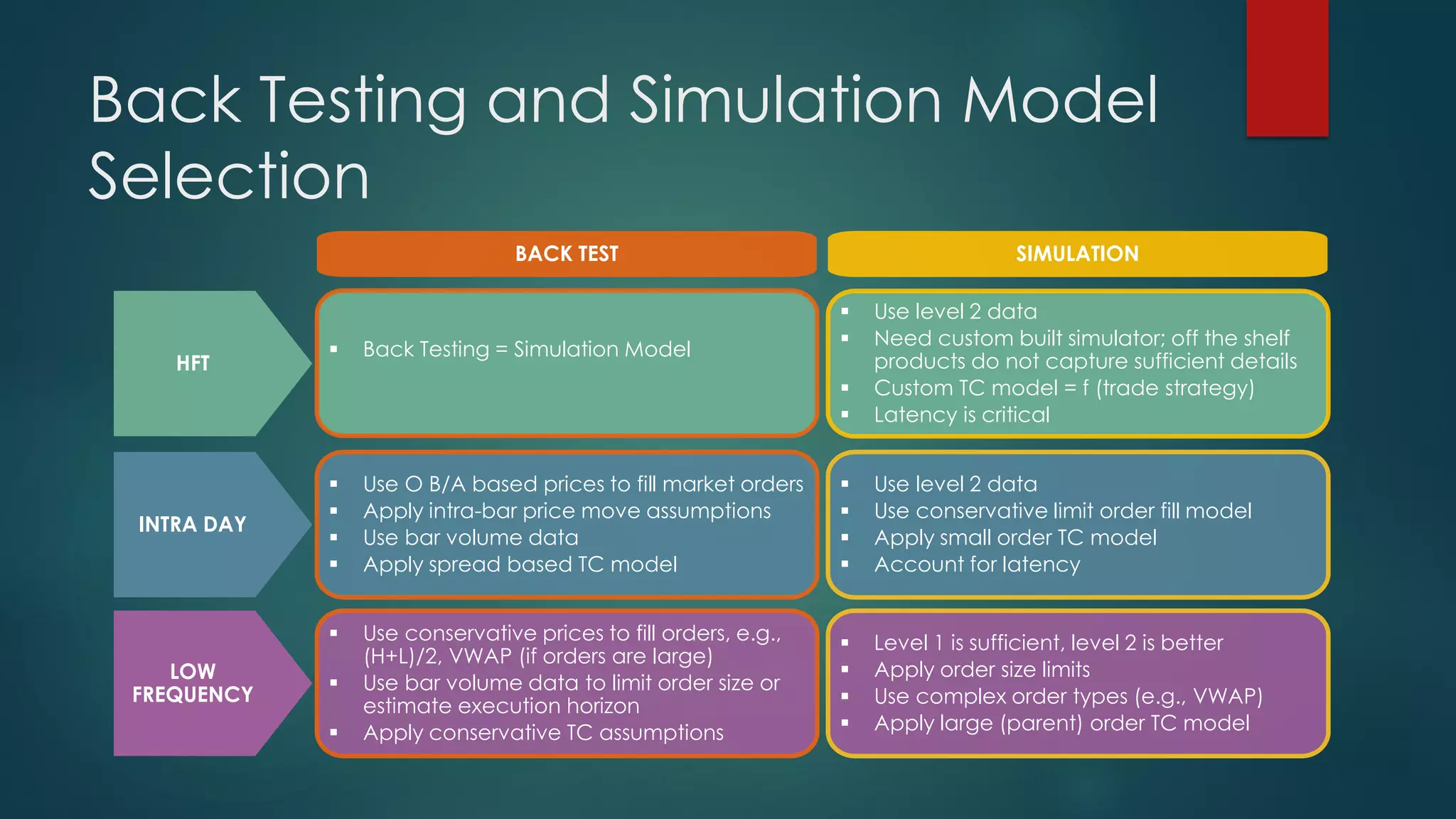

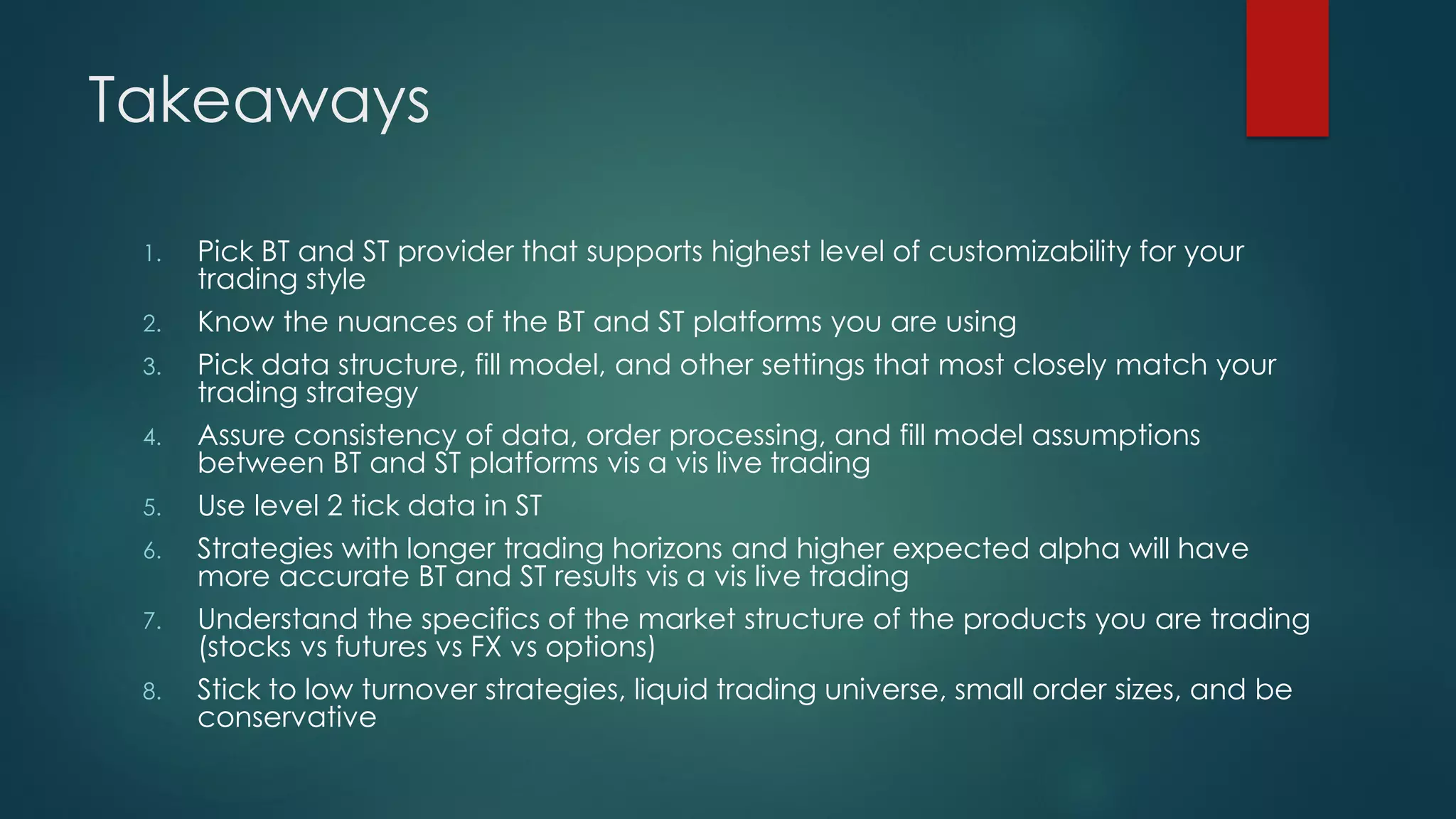

The document outlines the process of transitioning from back testing to live trading for trading systems, covering model design, execution testing, and performance evaluation. It highlights the importance of aligning back testing and simulation parameters with live trading conditions to minimize discrepancies in trading performance. Additionally, it discusses limitations and strategies for improving the accuracy of back testing and simulation, including data consistency, order fill assumptions, and market conditions.