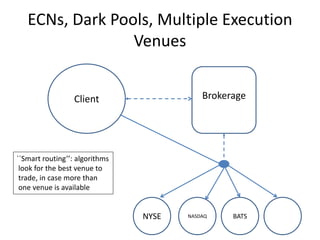

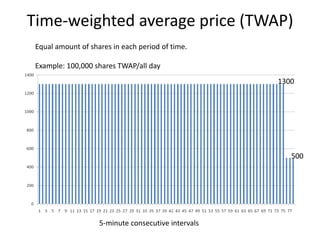

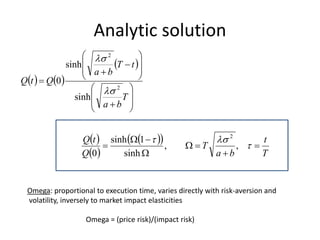

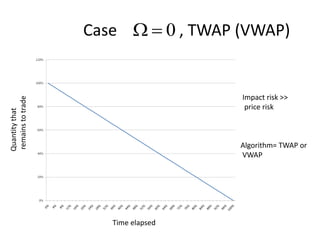

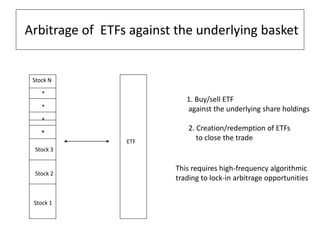

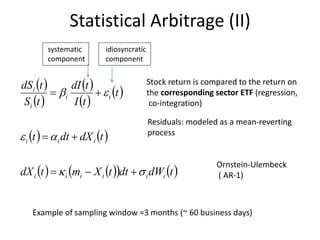

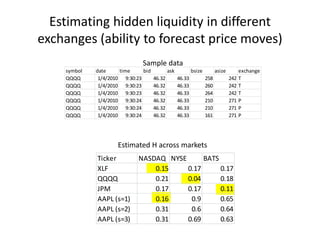

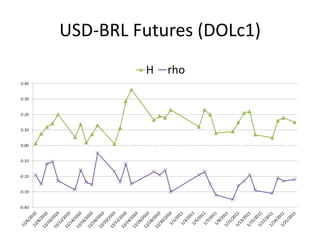

Algorithmic trading uses computer programs to generate and execute large orders in electronic markets. The main objectives are to control execution costs and market risk. Algorithms split large orders into many small orders and determine how to execute them over time. Popular execution strategies include time-weighted average price (TWAP), volume-weighted average price (VWAP), and percentage of volume (POV) which aim to minimize market impact. The Almgren-Chriss model optimizes execution based on both market impact and price risk over time. Various quantitative strategies employ algorithms, such as statistical arbitrage, market making, and index/ETF arbitrage.