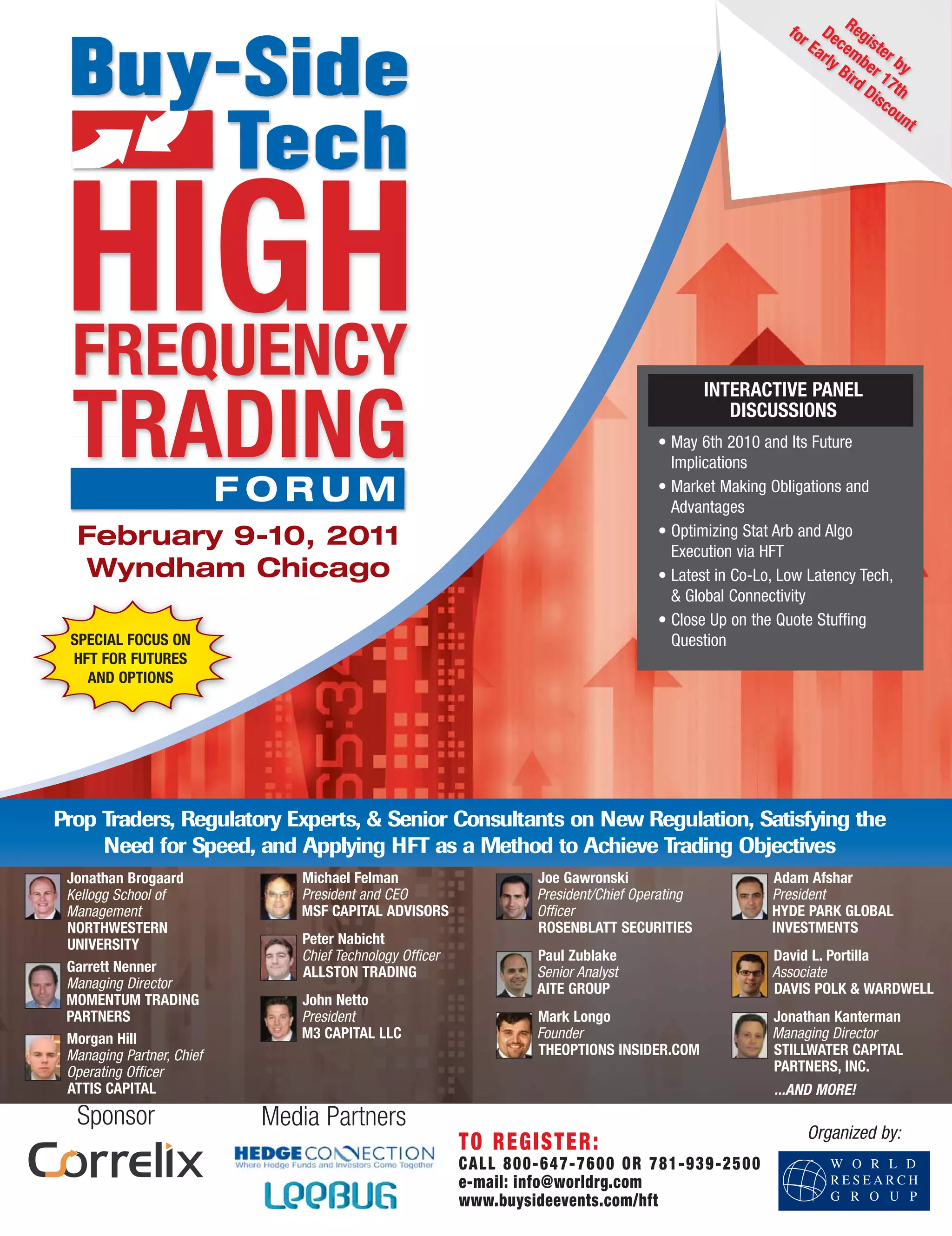

The document promotes the High-Frequency Trading (HFT) conference scheduled for February 9-10, 2011, in Chicago, focusing on the impact of new regulations such as the Dodd-Frank Act and technological advancements in HFT. It highlights discussions on topics including market making obligations, optimizing algorithmic execution, and the future implications of HFT, featuring insights from regulatory experts and industry leaders. Registration details and networking opportunities are also provided to encourage participation from a diverse range of financial professionals.