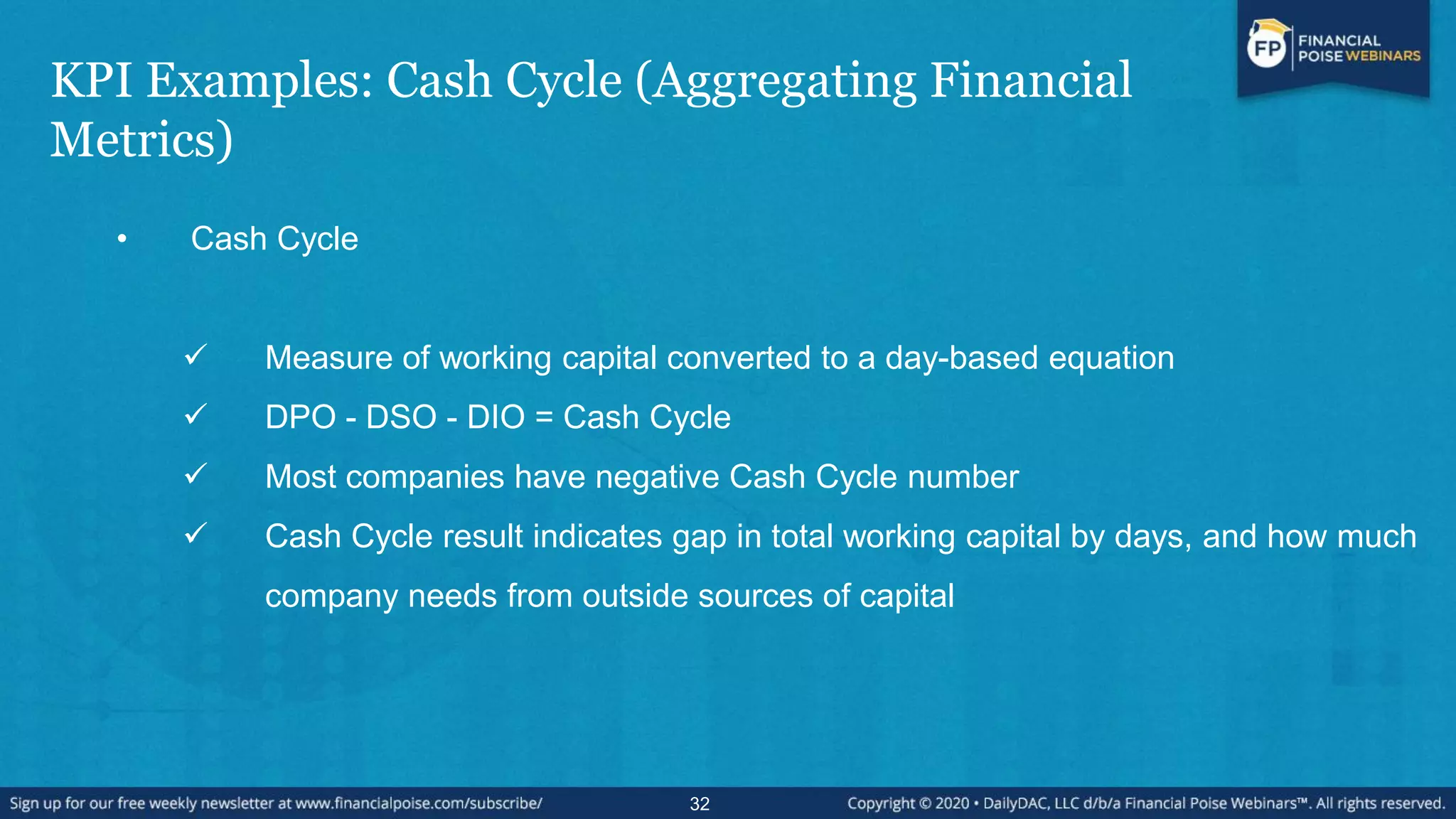

The document presents a webinar series aimed at helping professionals, particularly attorneys and business owners, understand key financial concepts, focusing on cash flow modeling and projections crucial for assessing business health. It discusses the importance of Key Performance Indicators (KPIs), their development, and application across financial, customer, process, and personnel metrics, emphasizing the necessity for tailored business strategies. The faculty consists of experienced professionals in law, finance, and consulting, providing a well-rounded perspective on financial management and decision-making.