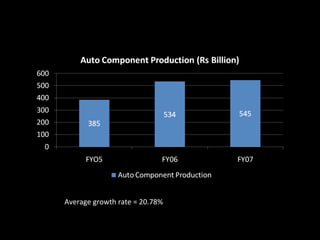

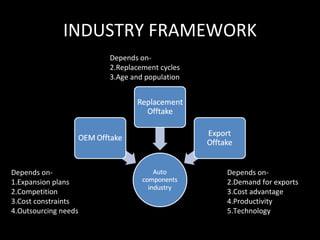

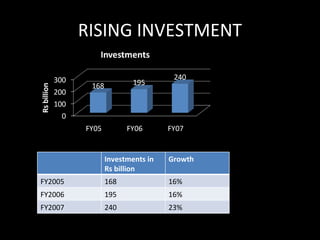

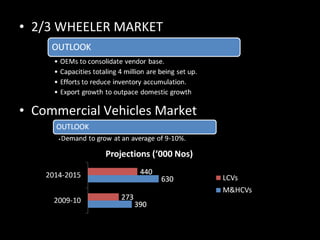

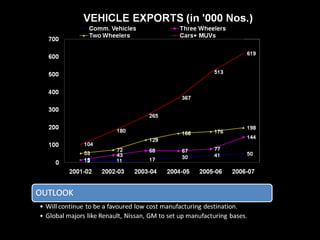

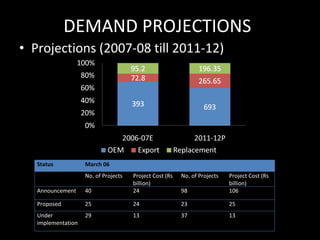

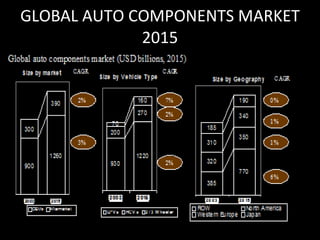

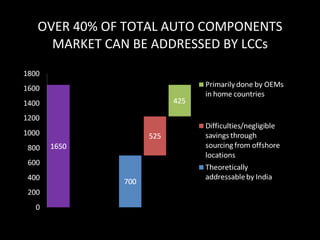

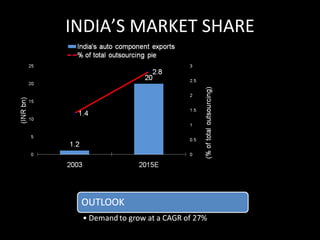

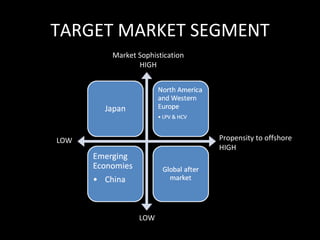

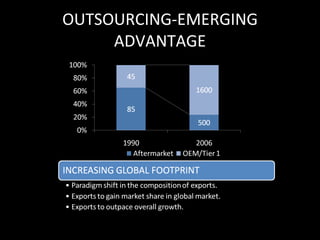

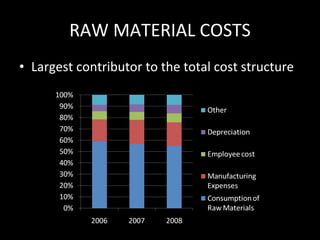

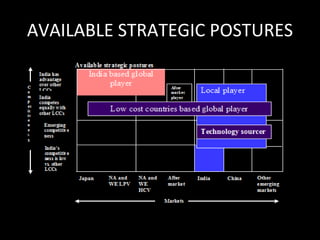

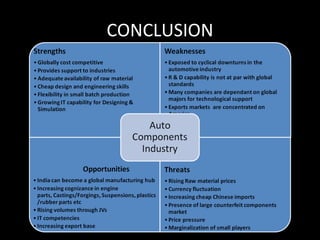

The Indian auto components industry has grown at an average rate of 20.78% annually and is poised to become a global manufacturing hub. It depends on the expansion plans of automakers, competition, costs, and outsourcing needs. Investments in the industry have increased from Rs. 168 billion in FY2005 to Rs. 240 billion in FY2007. Projections estimate demand will continue growing through 2011-12. Over 40% of the global auto components market can be addressed by low-cost countries like India. India's market share has potential to grow as it has advantages over China in areas like labor efficiency and infrastructure. Outsourcing is emerging as a key advantage for the industry.