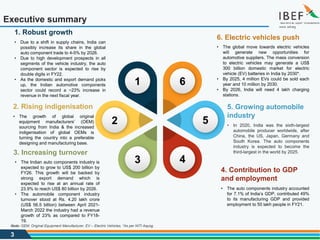

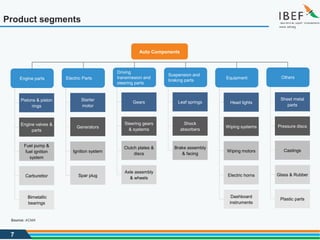

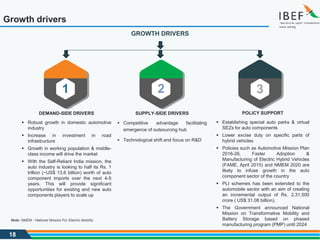

The document discusses recent trends and strategies in India's auto components industry. Key points include:

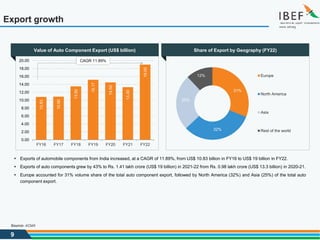

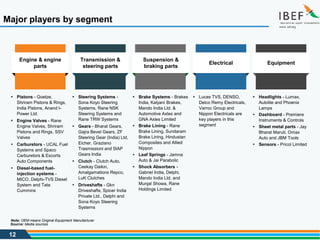

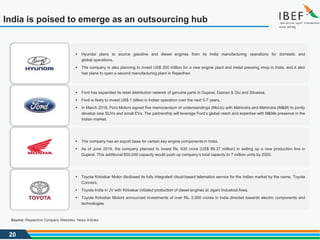

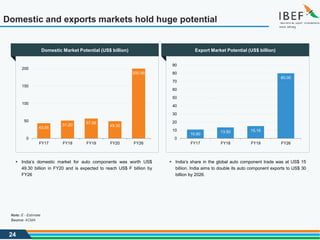

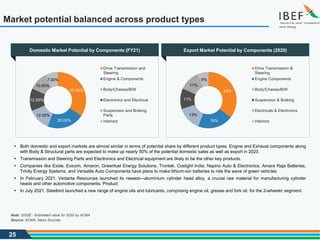

1) India is emerging as a global sourcing hub for major auto companies and their suppliers.

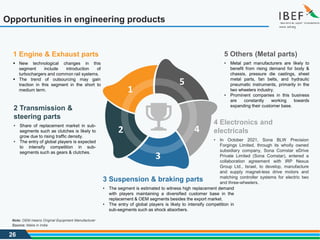

2) Companies are improving R&D capabilities in India through new technology centers and labs.

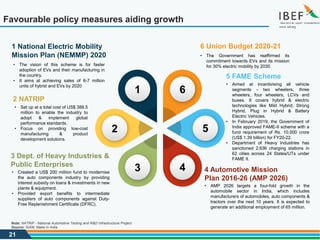

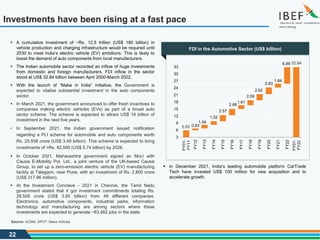

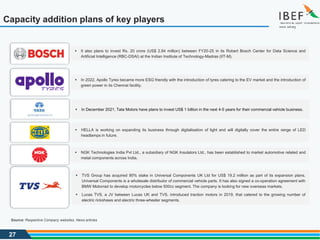

3) Major investments are being made through production-linked incentive schemes and expansion plans by companies like Tata Motors, ZF, and MG Motor.

4) New strategies include targeting untapped markets, exploring exports, and partnerships to boost electric vehicle infrastructure. Capacity expansions are also underway across companies.