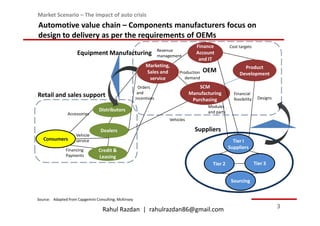

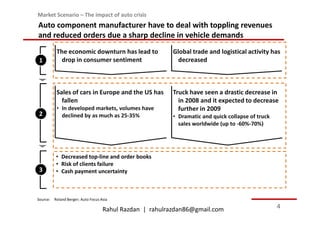

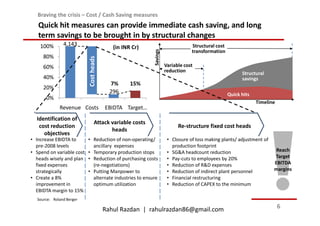

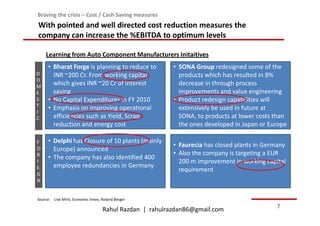

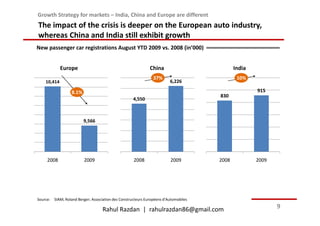

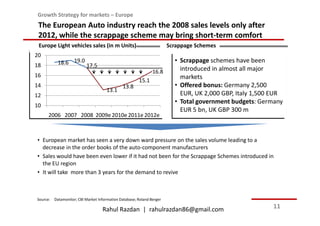

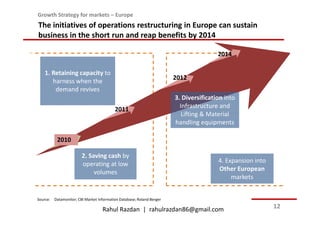

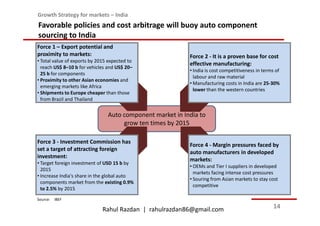

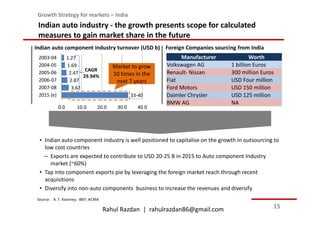

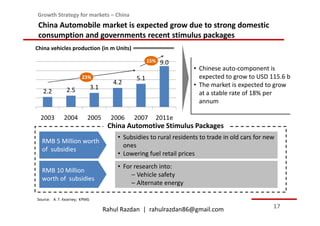

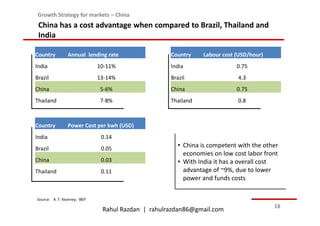

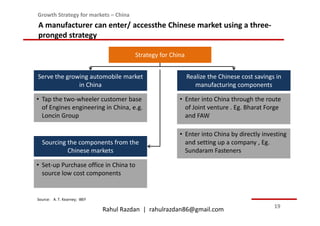

The document discusses strategies for automotive component manufacturers amid the global economic crisis. It summarizes the impact of declining vehicle sales in key markets like Europe and the US. It then outlines cost-cutting measures manufacturers have taken, such as plant closures, headcount reductions, and material cost savings. Finally, it analyzes growth strategies tailored for different regions. In Europe, manufacturers aim to retain capacity while cutting costs until demand recovers by 2012. In India, low costs and export potential will drive the industry's ten-fold expansion. And in China, stimulus packages and the world's largest auto market provide opportunities for companies to enter through joint ventures or direct investment.