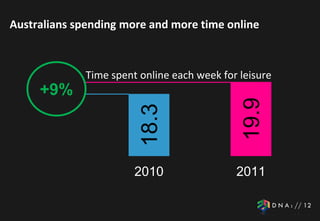

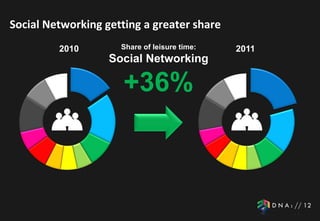

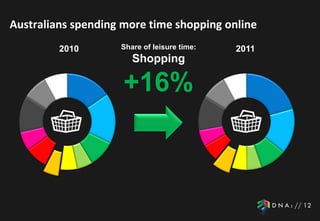

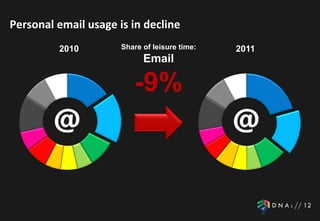

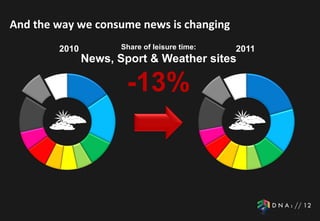

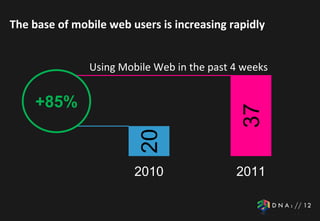

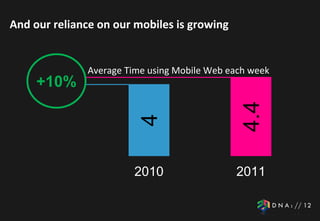

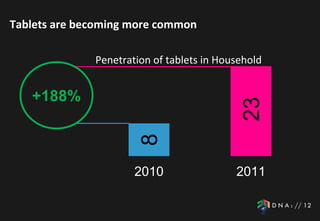

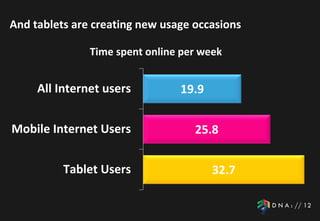

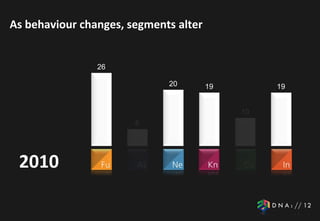

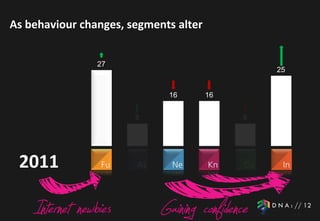

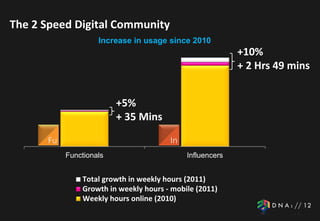

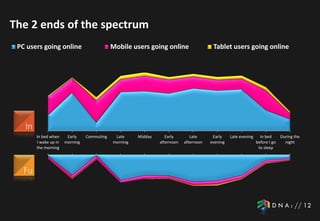

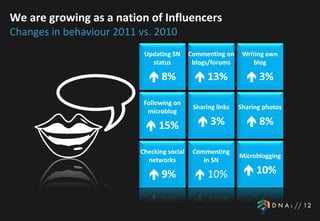

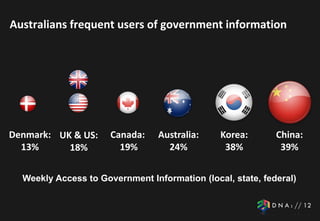

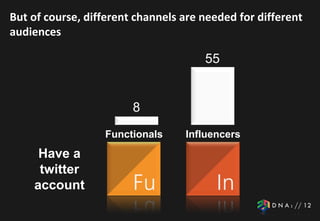

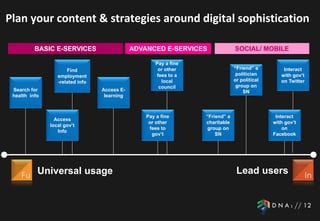

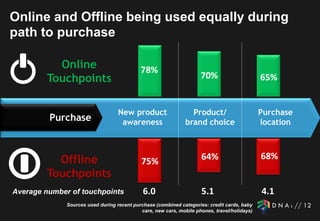

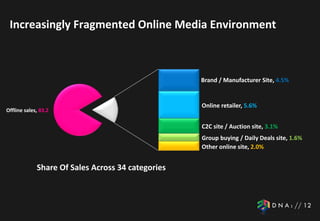

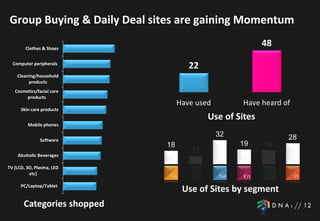

This document discusses trends in online consumer behavior in Australia based on a large study of internet usage. It finds that Australians are spending more time online, especially on mobile devices and tablets. More time is being spent shopping and using social media online, while personal email usage is declining. Government websites are frequently accessed for information. Australians are increasingly interacting with brands and commenting online about purchases. The document advocates for governments to provide both basic and advanced online services tailored to different audience levels of digital sophistication.