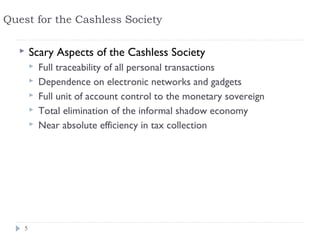

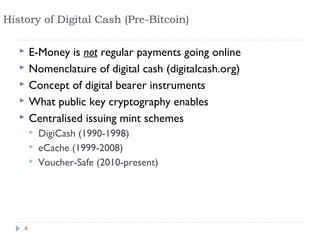

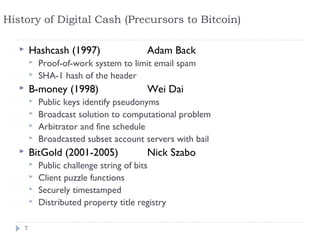

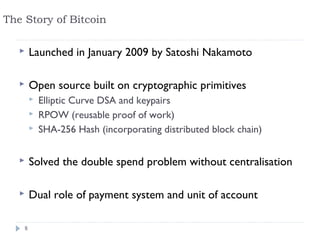

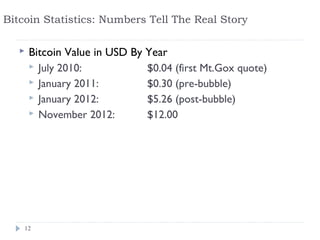

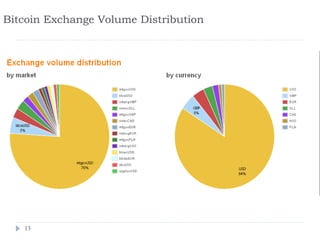

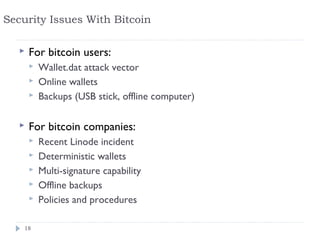

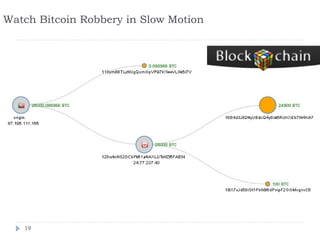

The document discusses the evolution of digital cash and cryptocurrencies like Bitcoin. It provides background on the quest for a cashless society and history of digital cash concepts prior to Bitcoin. It then focuses on describing Bitcoin, including its origins, technology, usage statistics, applications, security issues, and regulatory challenges. Finally, it explores the future prospects of Bitcoin becoming an established currency and opportunities for financial institutions.