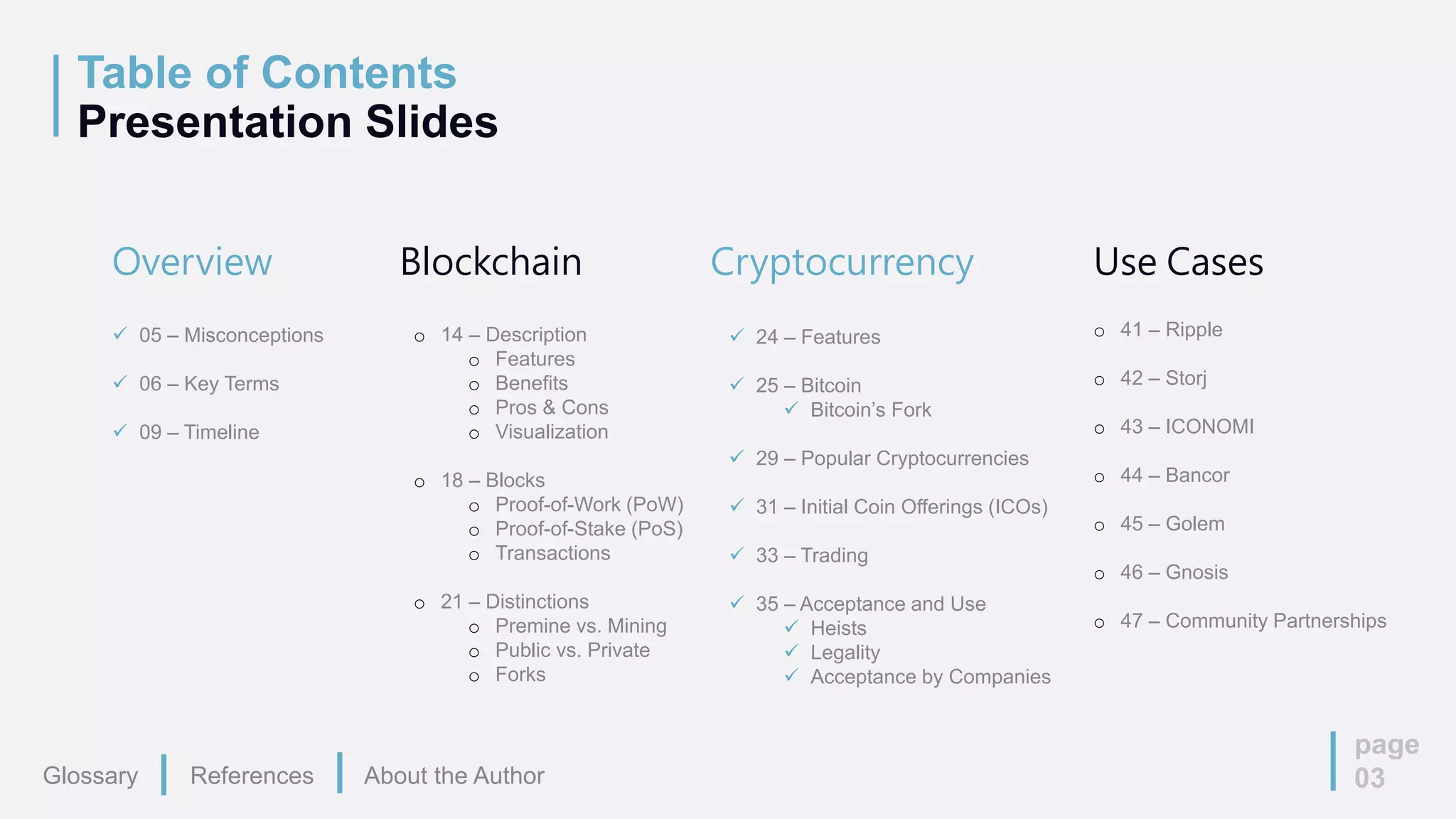

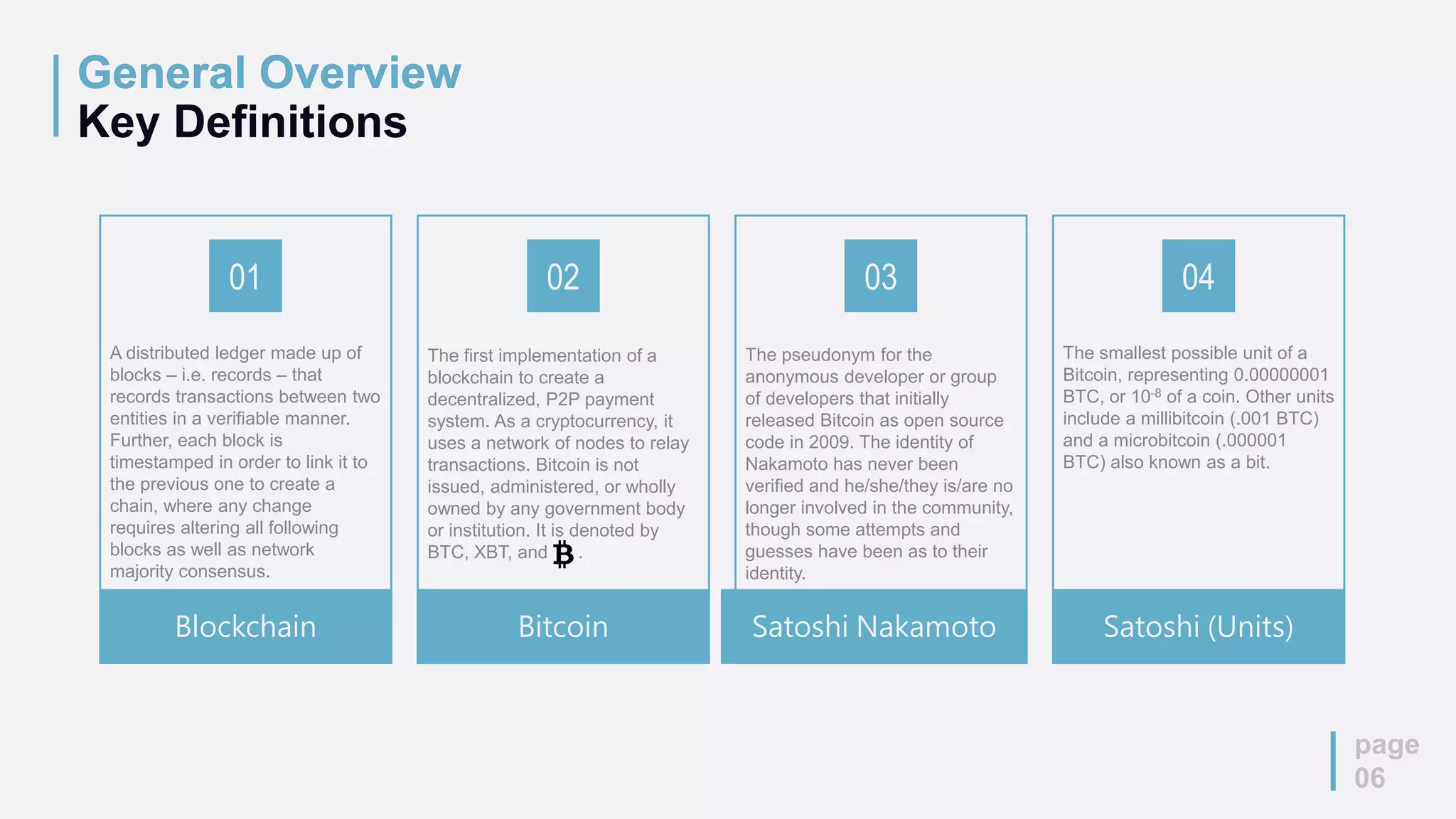

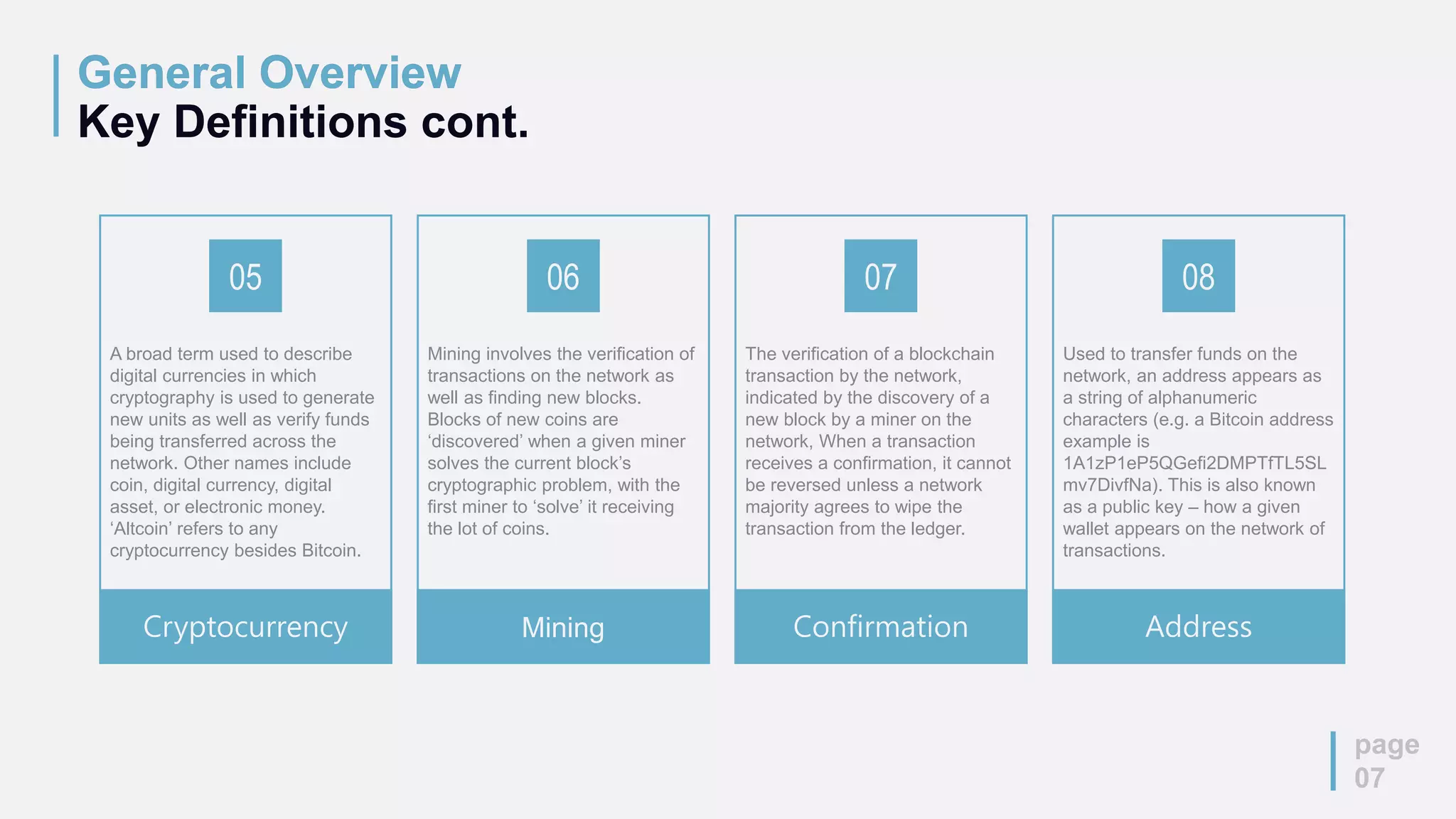

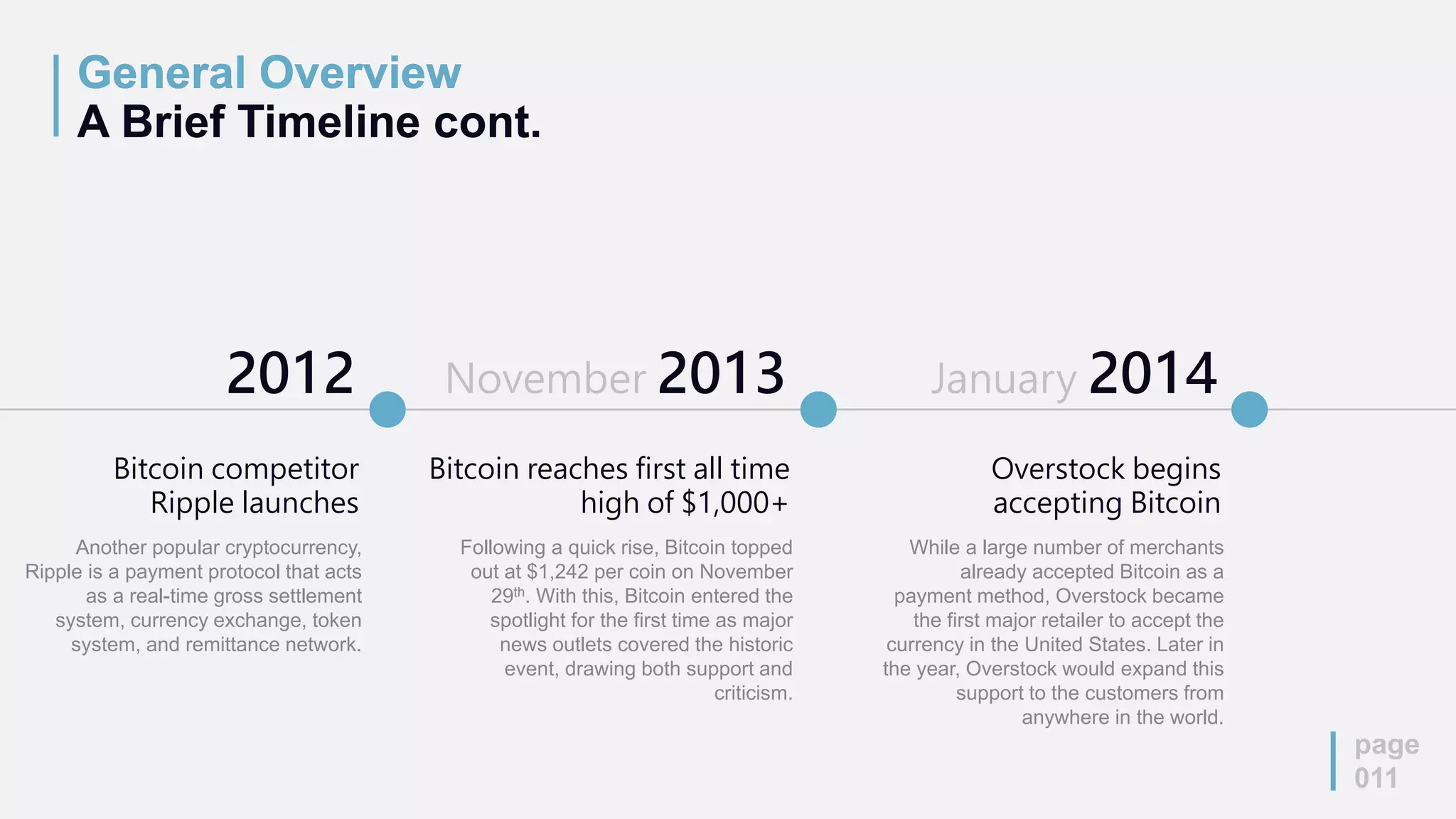

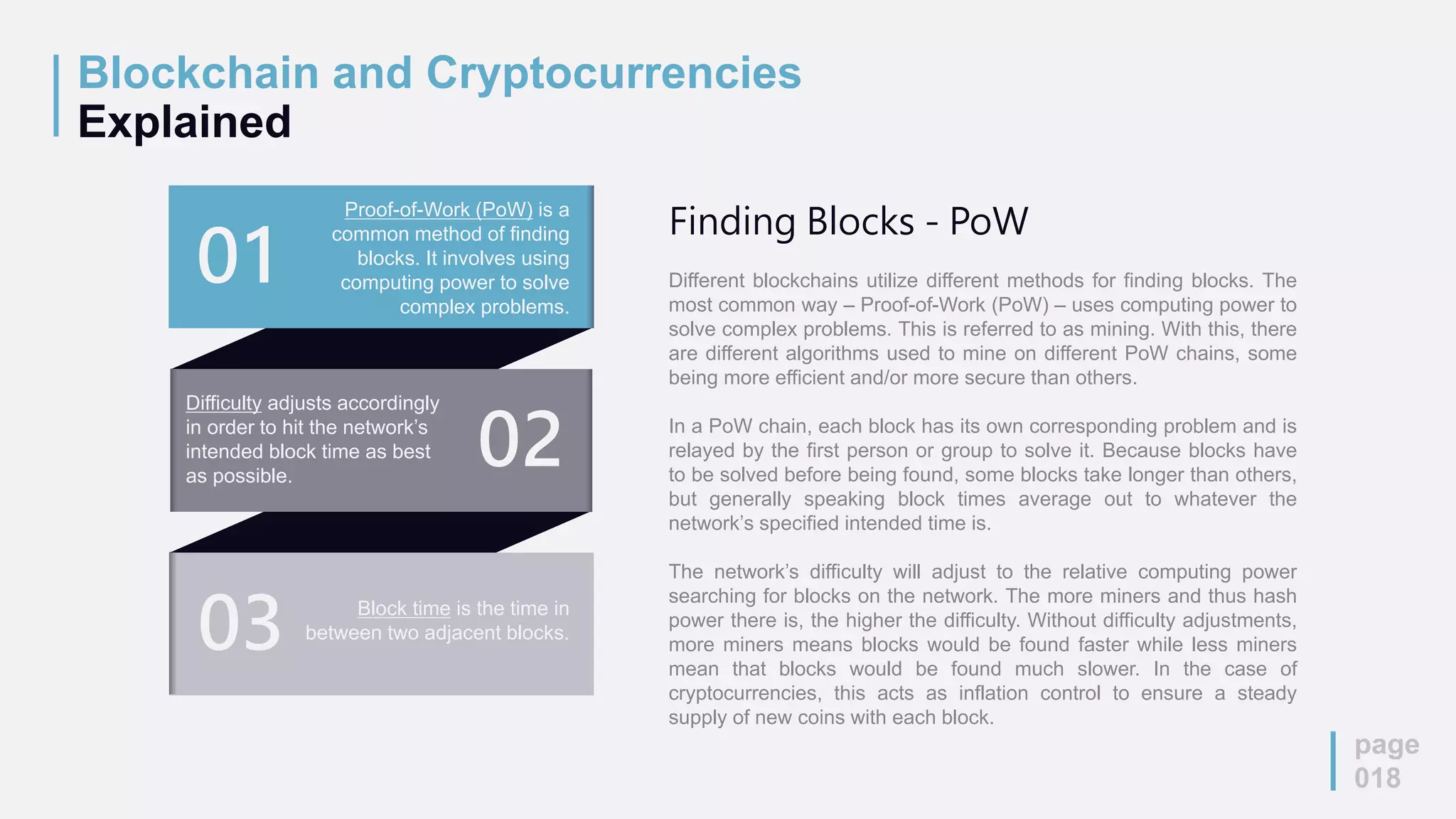

The document provides a comprehensive overview of cryptocurrencies and blockchain technology, covering essential definitions, historical timelines, and features of major cryptocurrencies like Bitcoin and Ethereum. It addresses misconceptions surrounding ownership, anonymity, and legality while explaining fundamental concepts like mining, proof-of-work, and proof-of-stake. Additionally, it explores the pros and cons of blockchain technology and highlights notable use cases and trends in cryptocurrency adoption.

![J. Orlin Grabbe

Economist

“Cryptology represents the

future of privacy [and] by

implication [it] also represents

the future of money, and the

future of banking and finance.”

Peter Thiel

Co-Founder of PayPal

“I do think Bitcoin is the first

[encrypted money] that has

the potential to do

something like change the

world.”

John McAfee

Founder of McAfee

“You can’t stop things like

Bitcoin. It will be everywhere

and the world will have to

readjust. World governments

will have to readjust.”

Larry Summer

Former U.S. Treasury Secretary

“I am reasonably confident…

that the blockchain will change a

great deal of financial practice

and exchange.”](https://image.slidesharecdn.com/crypto-170807192754/75/Cryptocurrencies-and-the-Blockchain-2-2048.jpg)