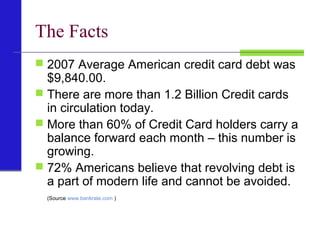

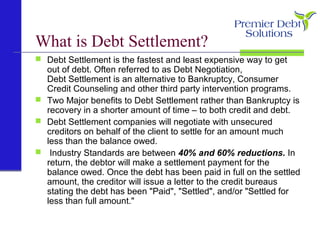

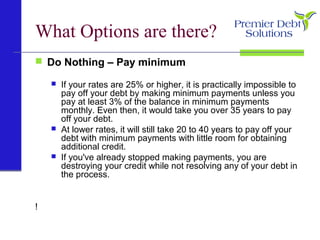

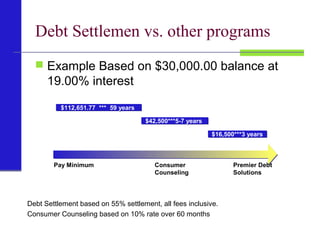

This document provides information about Americans' high levels of credit card and other debt. It notes that in 2007, the average credit card debt per American was $9,840, and over 60% of credit card holders carry a monthly balance. It then discusses options for dealing with debt, including doing nothing, bankruptcy, debt consolidation loans, credit counseling, and debt settlement. It argues that debt settlement can eliminate 30-50% of unsecured debt and allow people to become debt free in 3-7 years, making it the fastest and least expensive option for most people facing financial hardship and unable to pay all their monthly debt obligations.