The document provides an economic forecast and real estate outlook by Ted C. Jones, Chief Economist at Stewart Title Guaranty Co. Some of the key points summarized are:

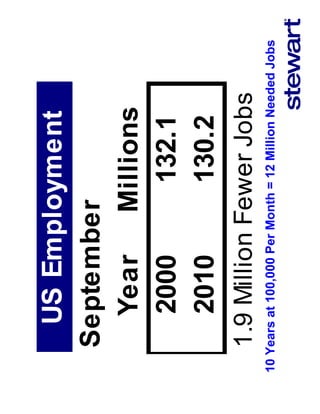

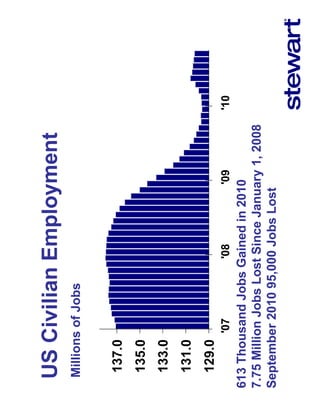

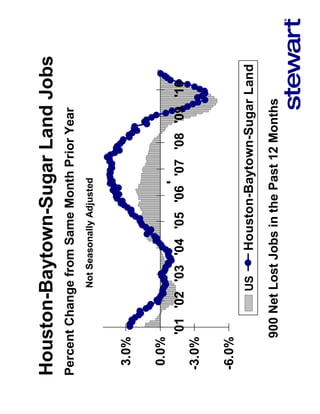

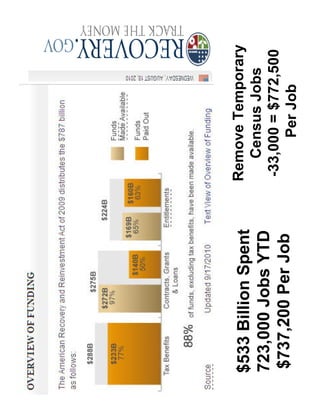

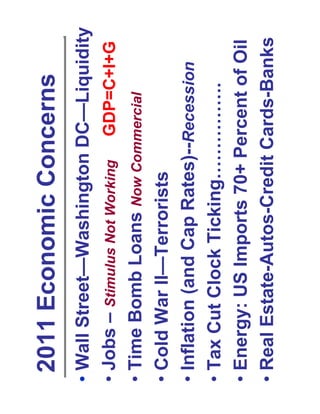

1. The US economy has struggled to recover jobs lost since the recession, and unemployment remains high.

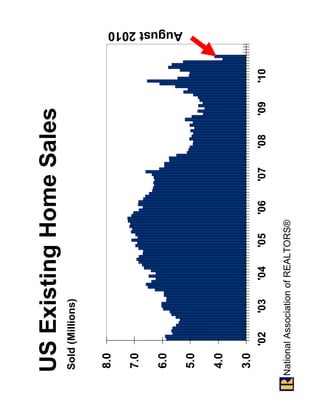

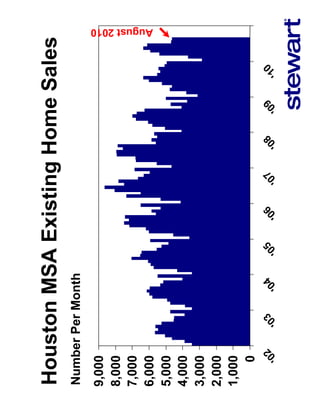

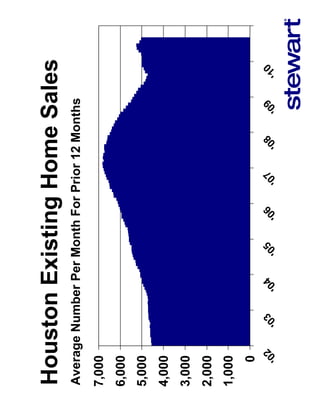

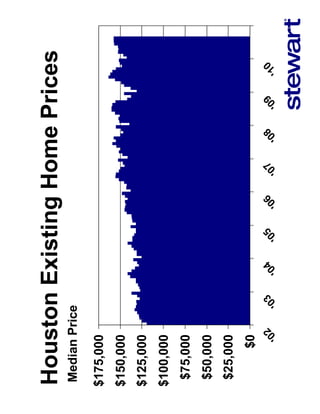

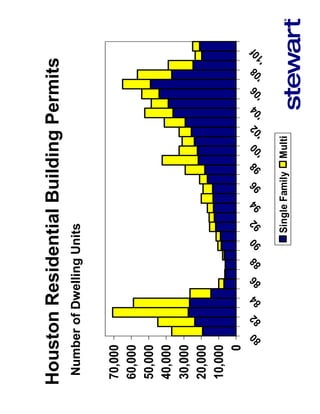

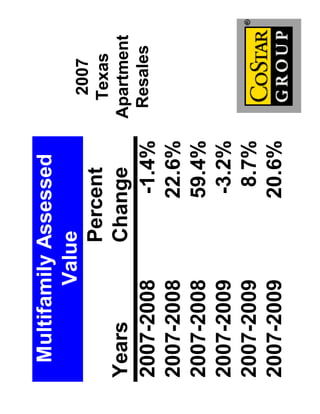

2. The housing market recovery will be important to driving the broader economic recovery, as housing has led previous recession recoveries. However, the housing recovery remains uneven in different local markets.

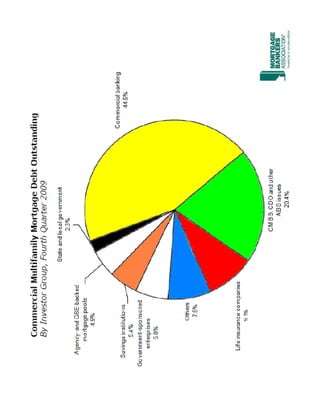

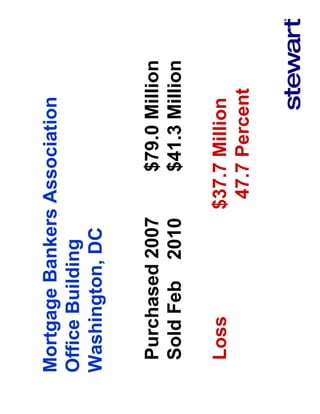

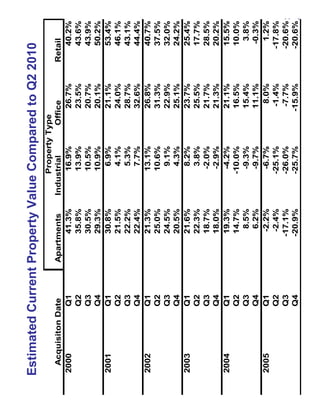

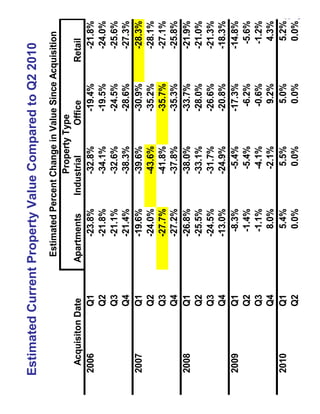

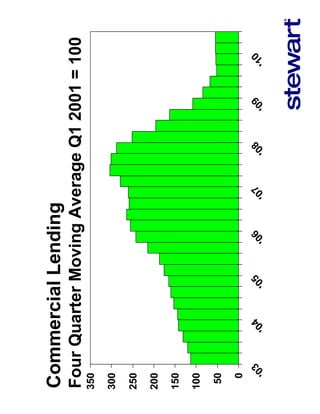

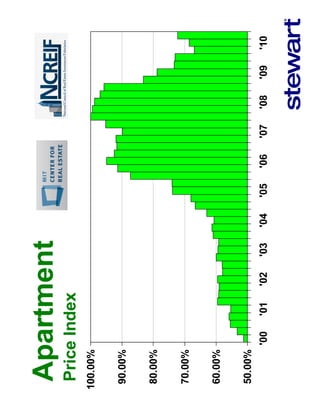

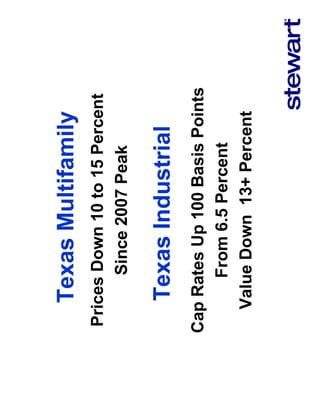

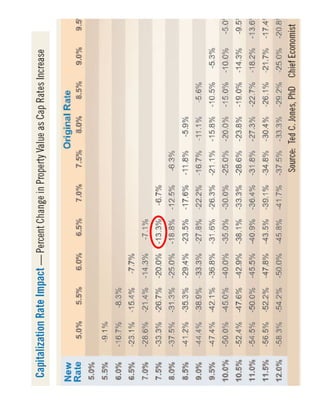

3. Commercial real estate continues to face difficulties with high vacancy rates and falling prices. Property values have declined significantly from their peaks.

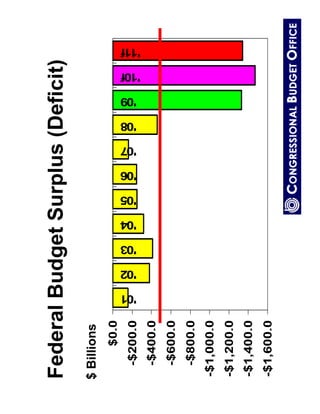

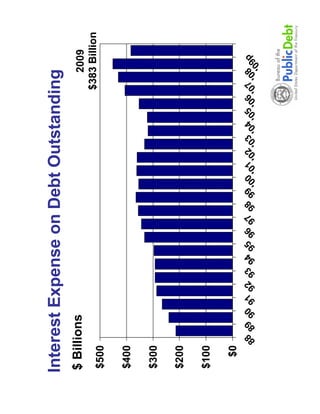

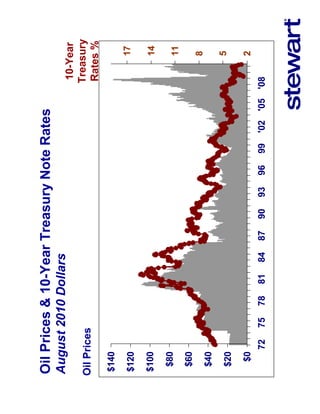

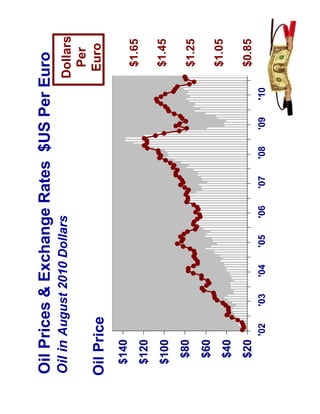

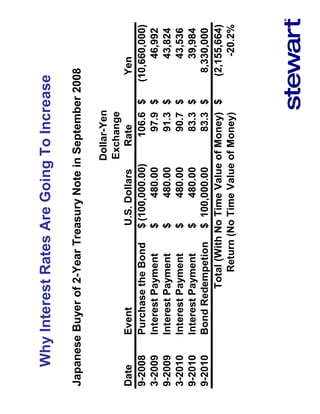

4. Jones forecasts that interest rates will rise in 2011 from current low levels, and outlines some economic concerns