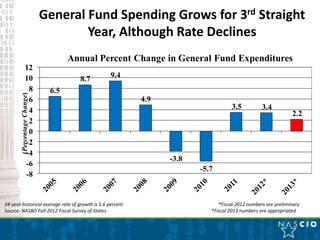

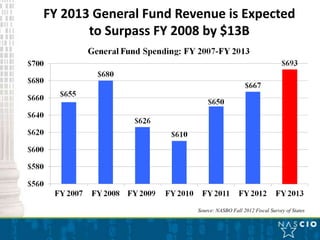

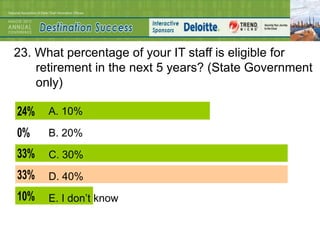

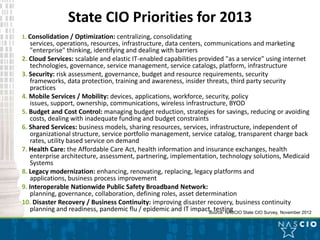

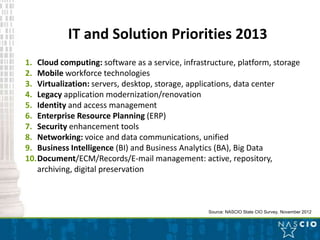

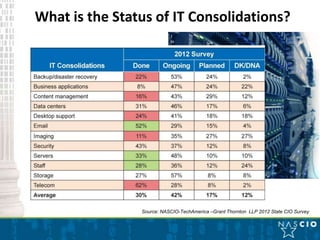

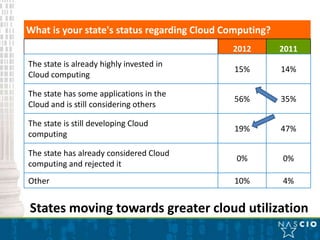

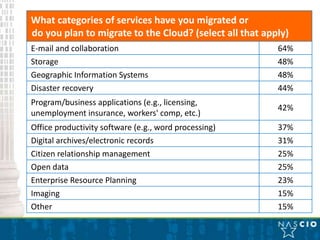

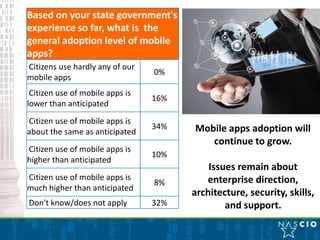

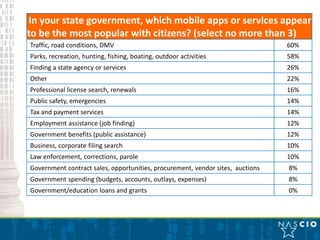

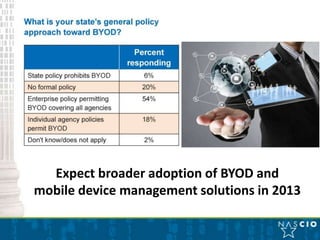

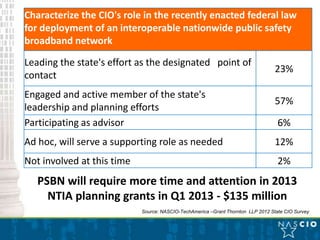

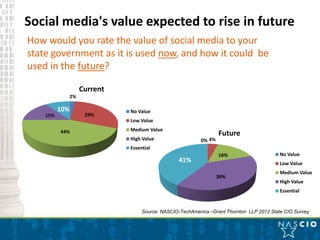

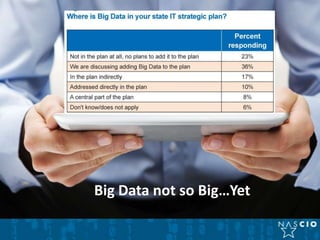

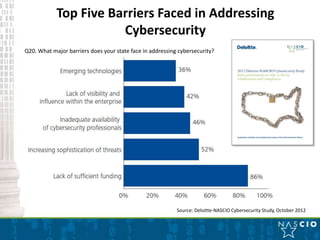

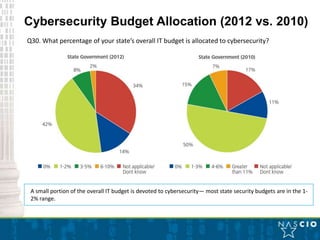

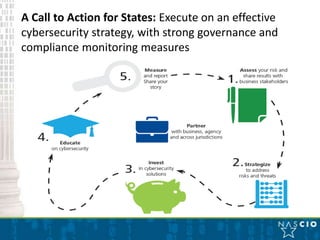

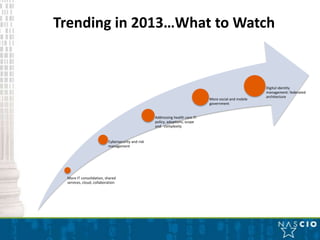

The 2013 technology forecast for state and local governments highlights challenges such as fiscal recovery, IT operational cost savings, workforce retirement, and security risks. CIOs are prioritizing strategies like cloud services, mobile workforce technologies, and cybersecurity, while managing the balance between legacy systems and innovation. As states adopt more cloud services and mobile applications, they face barriers related to budget constraints and workforce skills, necessitating a strong cybersecurity strategy.