The document discusses various technical analysis concepts including definitions, assumptions, differences between technical and fundamental analysis, and Dow theory. Some key points:

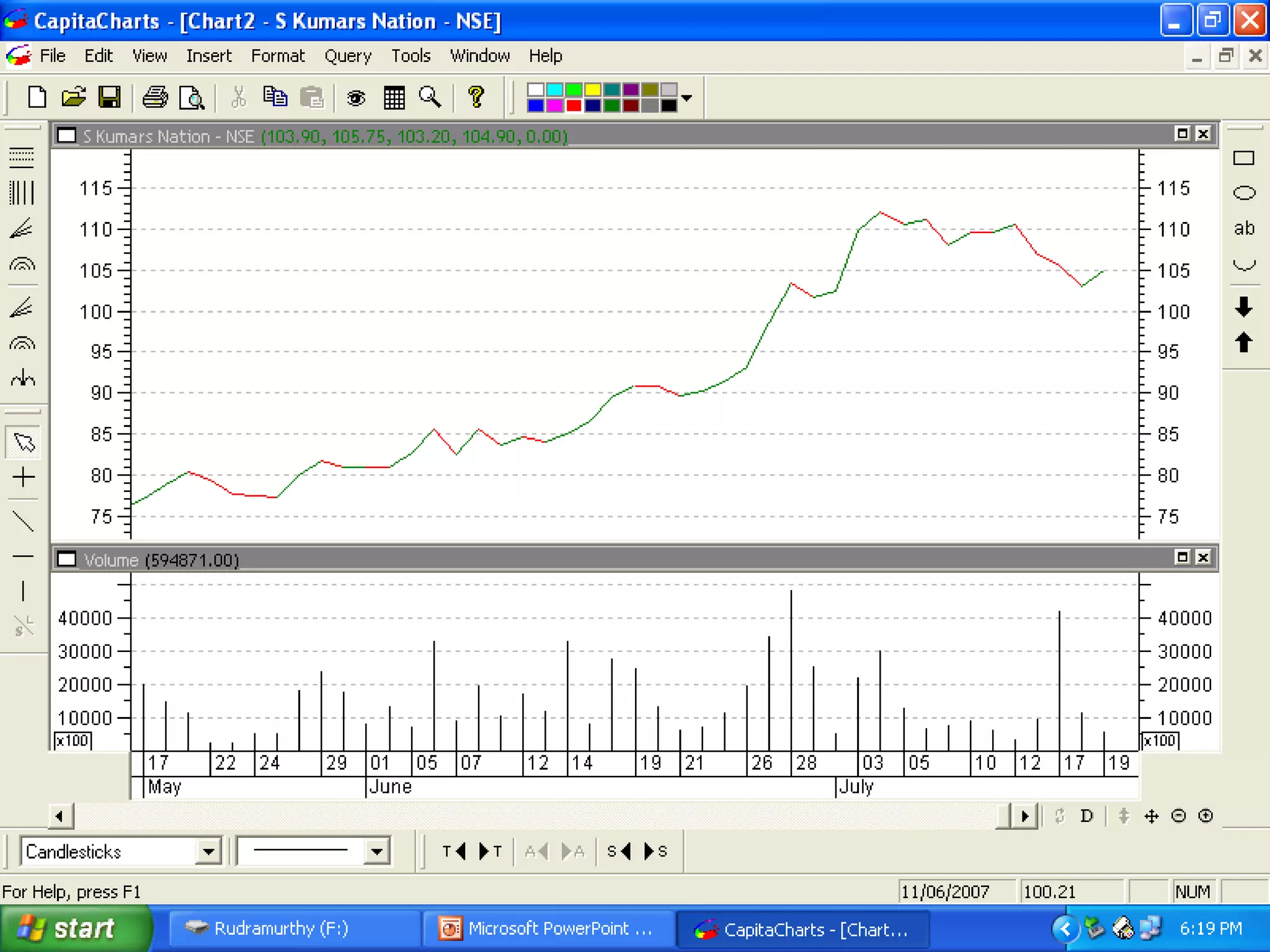

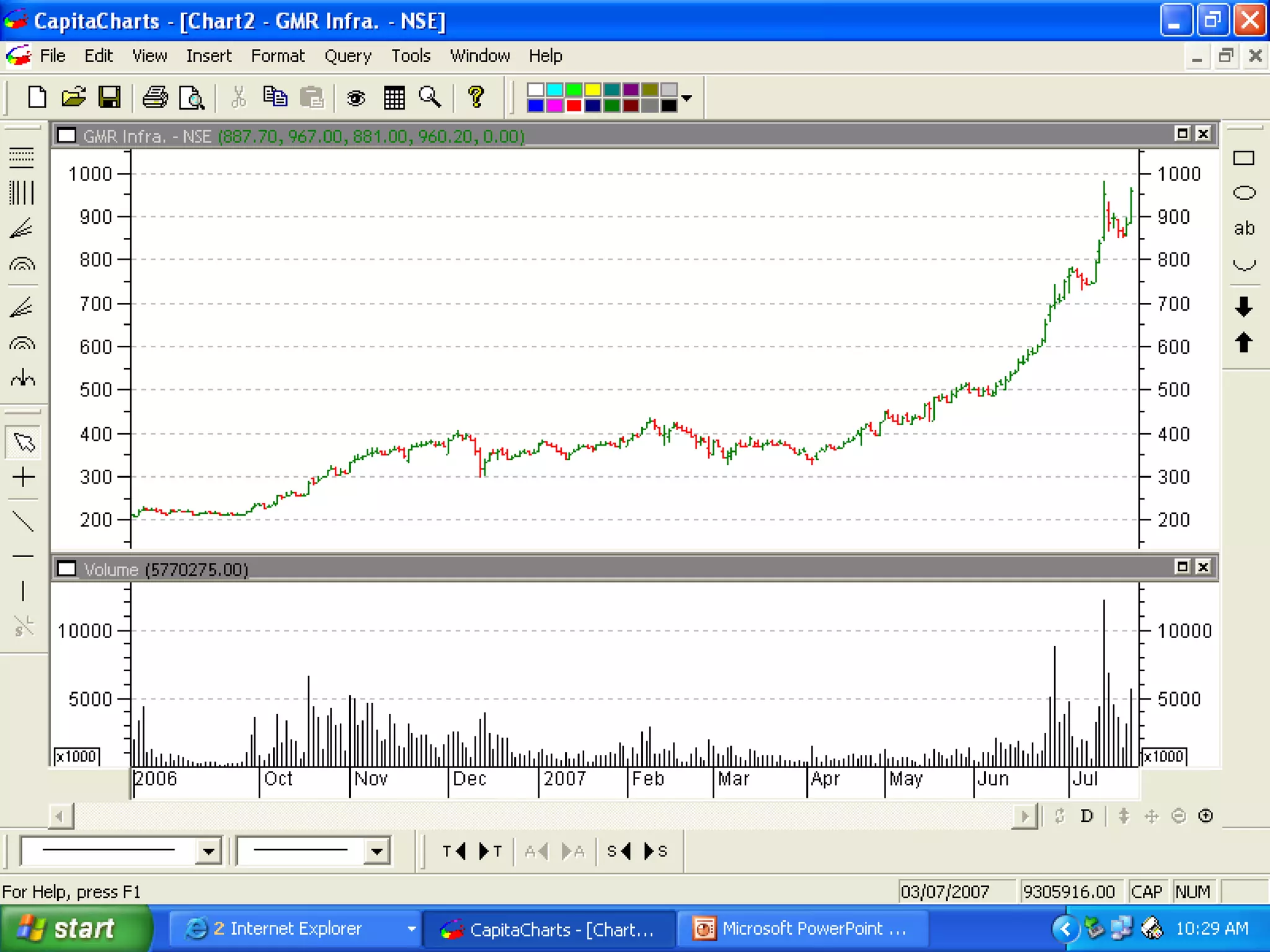

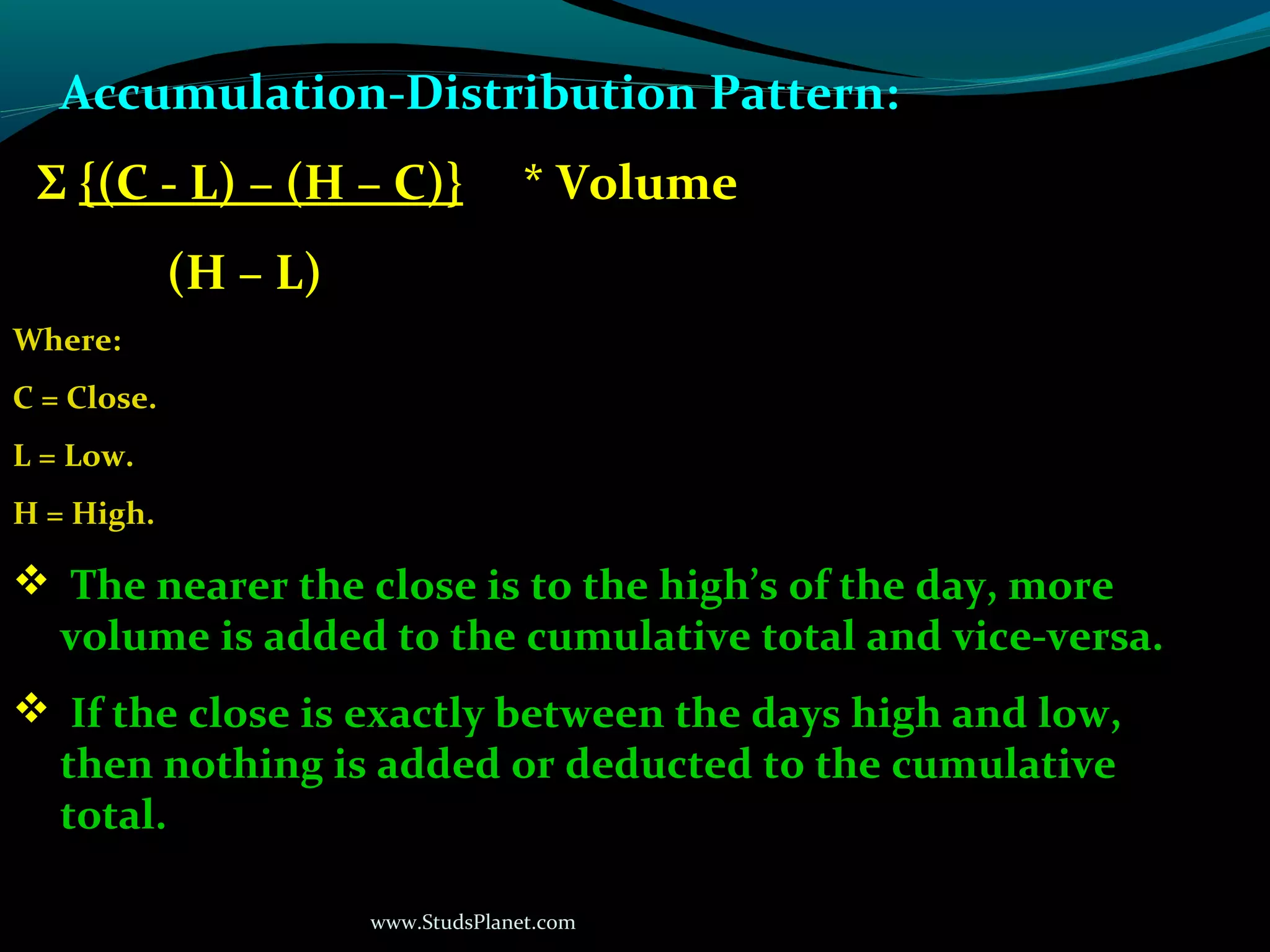

- Technical analysis uses price, volume, and open interest to forecast market trends by analyzing charts and indicators. It assumes current prices reflect all known information and that trends persist.

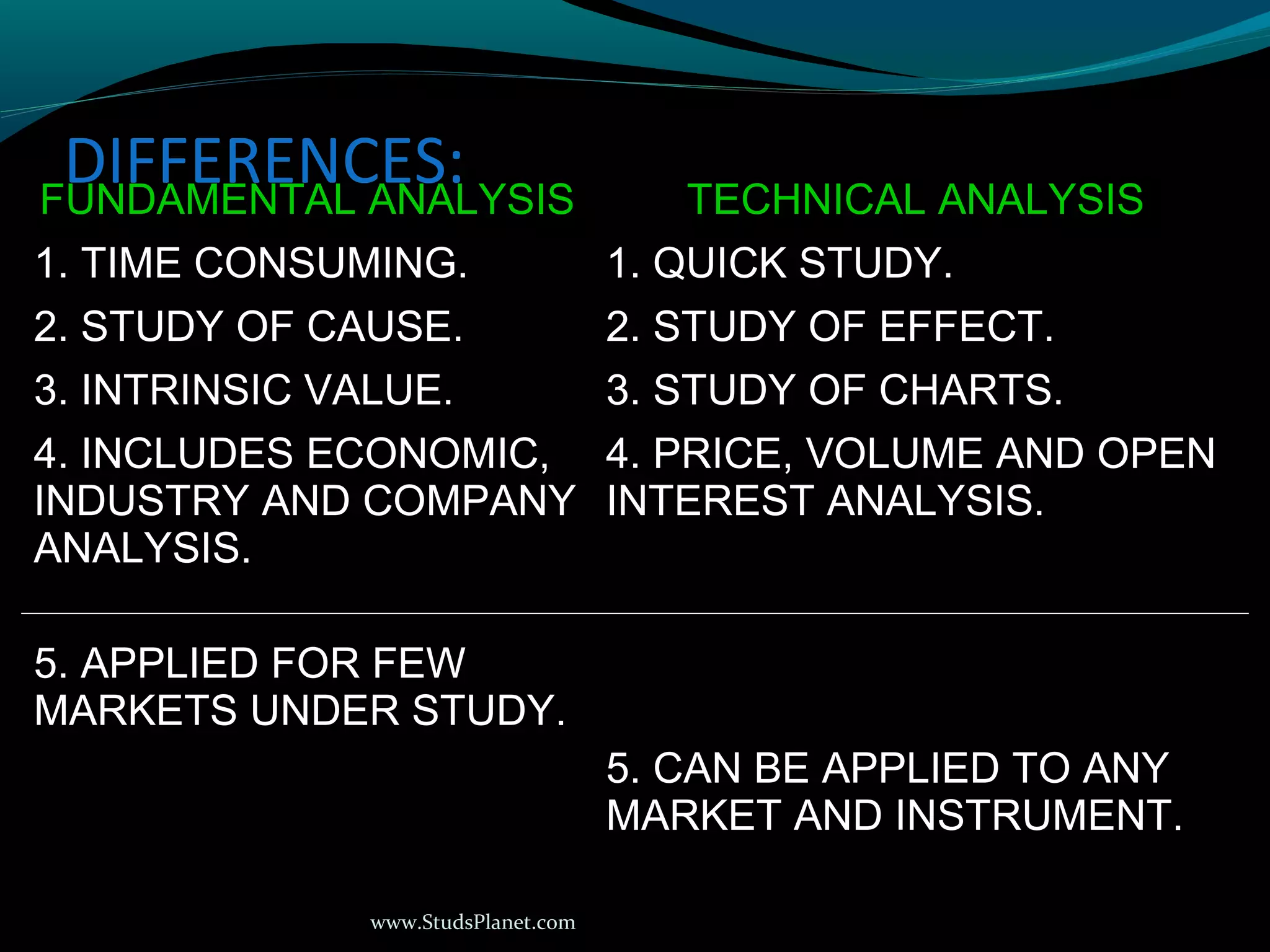

- Compared to fundamental analysis, technical analysis is quicker, studies market effects rather than underlying causes, and analyzes charts rather than economic factors.

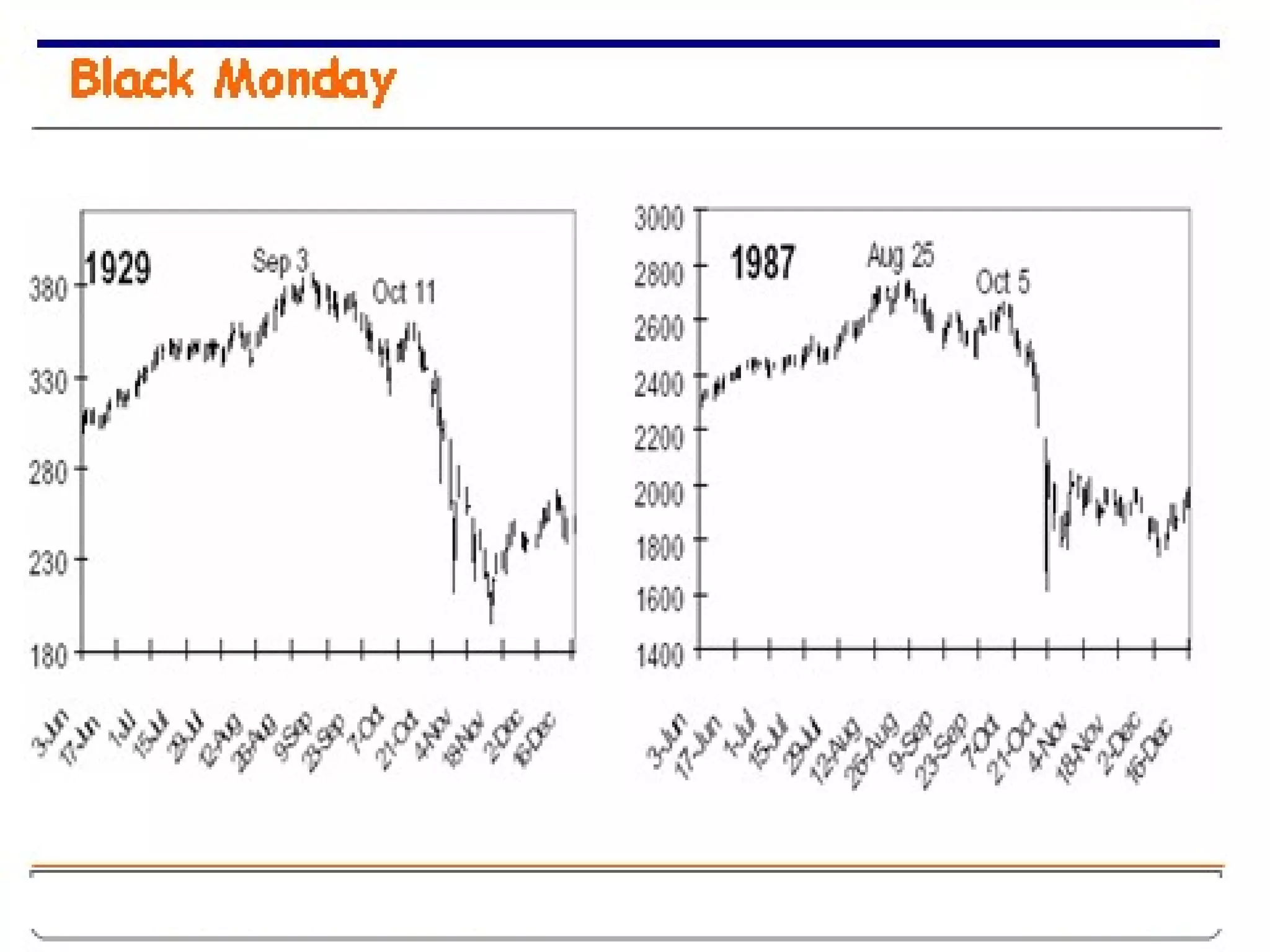

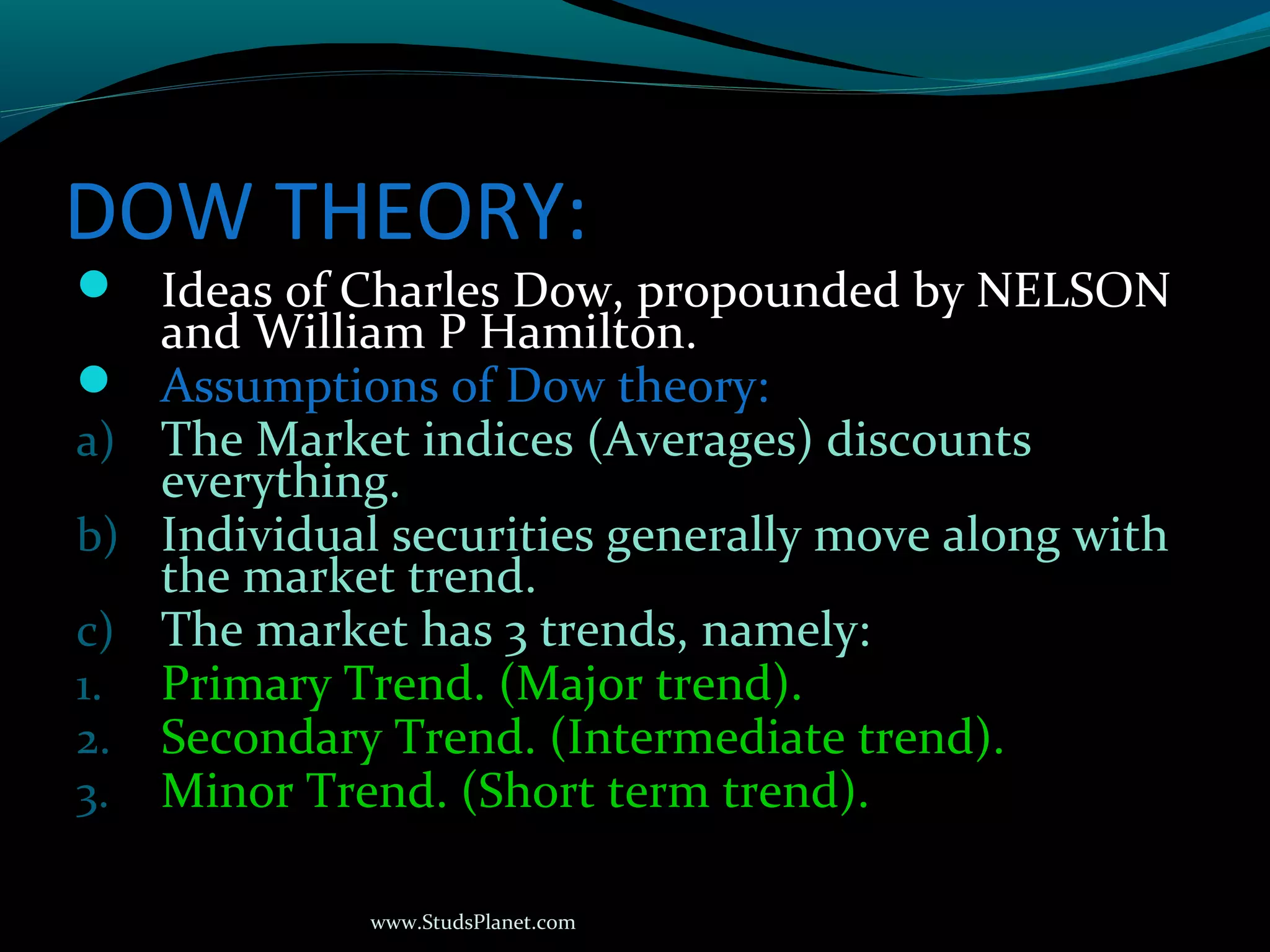

- Dow theory states that market indices discount everything and that individual securities follow the overall market trend, which has primary, secondary, and minor trends of varying time periods. Volume should confirm price trends.

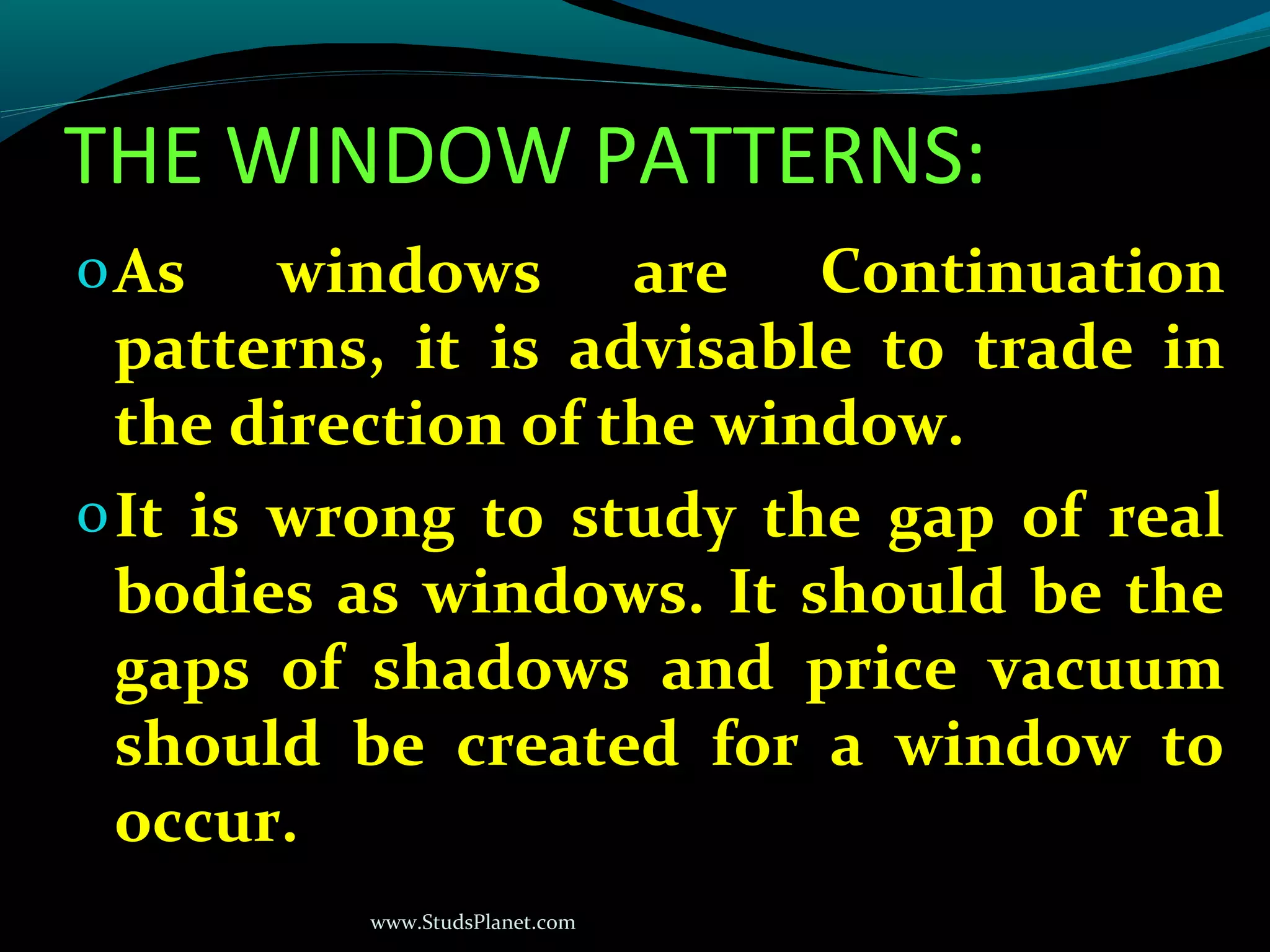

- Support and resistance levels, trend lines, gaps