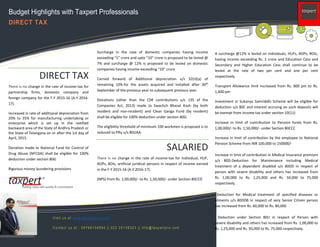

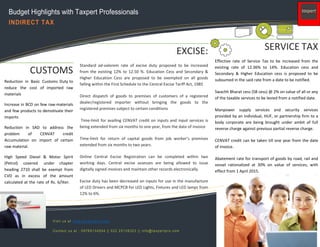

The document summarizes key changes in direct and indirect taxes in India's 2015-16 budget. For direct taxes, there is no change in income tax rates but additional depreciation was increased for manufacturing in backward areas of two states. Donations to certain funds are now eligible for a 100% tax deduction. Surcharge rates on companies were increased. For indirect taxes, excise duty rates were increased slightly and education cess exempted. Service tax rates were increased to 14% and a new Swachh Bharat cess of 2% was introduced. Customs duty was reduced on some imports. International tax changes include a reduced 10% tax rate on foreign royalty and technical fees. GAAR provisions were deferred and tax benefits