This document provides a summary of key proposals in the Indian Budget 2014-2015 relating to direct taxes, transfer pricing, international taxation, indirect taxes, and other proposals. Some of the key points included are:

- No change in individual or corporate tax rates. Basic exemption limit increased for individuals and senior citizens. Deductions under section 80C and for housing loans increased.

- New investment allowance introduced for manufacturing companies investing over Rs. 25 crores.

- Changes introduced to alternate minimum tax calculations and restrictions on certain expense disallowances.

- Presumptive taxation amounts increased for certain businesses.

- Clarifications provided on taxation of foreign dividends, CSR contributions, and trading losses for

![BUDGET 2014-2015 12

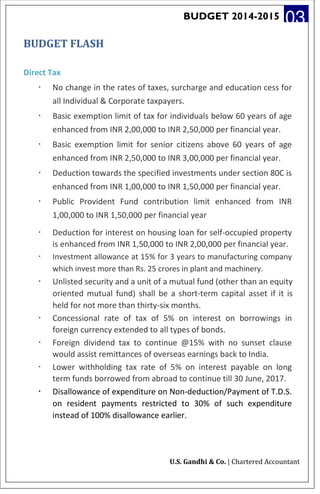

The tax authorities may place identification marks on the books of

accounts, take extracts/copies, record statements but shall not impound

or retain any books of accounts or make inventory of any cash, stock or

any other valuables.

This amendment will take effect from 1st

October, 2014.

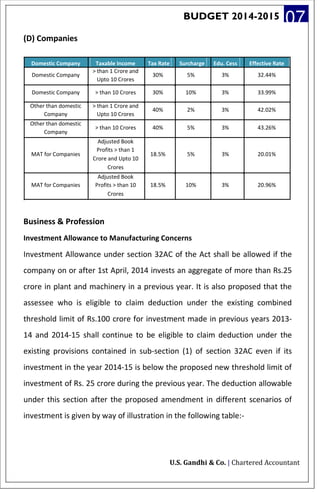

Tax withholding on specified interest income earned by a business

trust [Section 194LBA]

· Interest received by a business trust from an Indian company in

which such trust holds controlling interest and specified

percentage shareholding is not subject to tax withholding by the

borrower. Corresponding income is not liable to tax in the hands

of business trust

· However, at the time of distributing such interest income to its unit

holders, business trusts to withhold tax at the following rates:

(a) for resident unit holders - 10%

(b) for non-resident unit holders - 5%

(c) These provisions will take effect from 1 October 2014

Additional time limit for issue of order deeming person as "assessee in

default"

Time limit for passing an order deeming a person as "assessee in

default" is extended to seven years from the end of the financial year in

which payment is made or credit is given as against the current timelines

of two years (where withholding tax statement is filed) / six years (in any

other case)

U.S. Gandhi & Co. | Chartered Accountant](https://image.slidesharecdn.com/budget2014-15-ananalysis-140721020230-phpapp02/85/Budget-2014-15-An-analysis-13-320.jpg)

![BUDGET 2014-2015 20

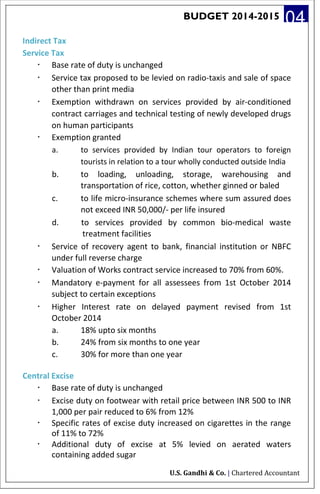

Assessment of Income of person other than person who has been

searched

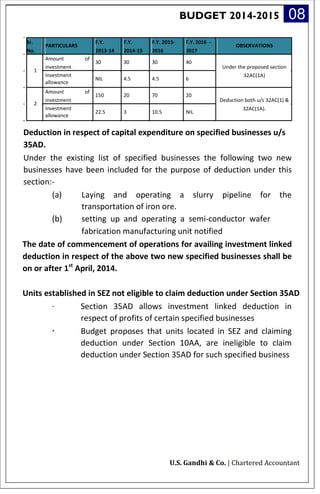

It is proposed to amend section 153C of the Act to provide that assessing

officer of person other than person who has been searched will proceed

against such other person in accordance with provisions of section 153A

(Block assessment) if he is satisfied that books of accounts or documents

or assets seized have bearing on determination of total income of such

other person.

In other words, proceedings u/s 153A shall not be initiated to such other

person if there is no bearing on determination of total income.

Dividend and Income Distribution Tax

It is proposed to amend Section 115O Dividend Distribution Tax and 115R Tax

on income to unit holders w.e.f 1.10.2014 – Amount of distributable income

and dividends received by unit holders and shareholders needs to be Thus,

where the amount of dividend paid or distributed by a company is Rs. 85,

then DDT under the amended provision would be calculated as follows:

Dividend amount distributed = Rs. 85

Increase by Rs. 15 [i.e. (85*0.15)/(1-0.15)]

Increased amount = Rs. 100

DDT @ 15% of Rs. 100 = Rs. 15

Tax payable u/s 115-O is Rs. 15

Dividend distributed to shareholders = Rs. 85

U.S. Gandhi & Co. | Chartered Accountant](https://image.slidesharecdn.com/budget2014-15-ananalysis-140721020230-phpapp02/85/Budget-2014-15-An-analysis-21-320.jpg)

![BUDGET 2014-2015 21

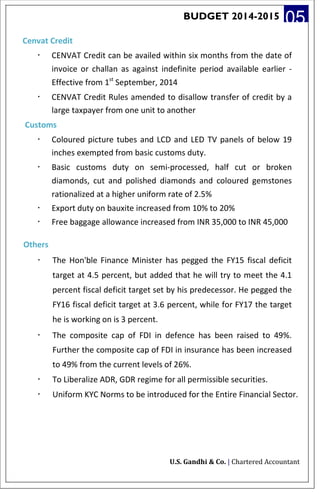

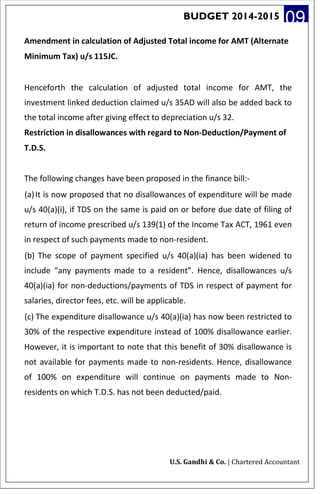

Taxation Regime for Real Estate Investment Trust (REIT) and Infrastructure

Investment Trust (Invit)

Salient features of REITs and Infrastructure Investment Trust:

· Units of REIT and Inv Trust to be listed on recognised stock

exchanges in India

· Income bearing assets to be held under Indian Special Purpose

Vehicle (SPVs), which in turn would be held by REITs / InvTrust

· Units of REITs / InvTrust to be granted same status as listed equity

shares i.e. same levy of STT as well capital gains tax rates

· Swap of shares of SPV by Sponsors for units of REITs / InvTrust

would be exempt

In order to facilitate financing and taxation aspects of these business

trusts, Budget has introduced a separate regime for taxation of business

trusts through introduction of Section 115UA and other enabling

provisions in this regard. As per the said provisions, business trusts have

been accorded a pass-through status for taxation purposes.

INTERNATIONAL TAX PROPOSALS

Deemed international transactions

· “Deemed international transactions” concept stipulates that any

transaction between an unrelated party (URP) and an associated

enterprise (AE) qualifies as an international transaction if such

transaction was a result of a prior agreement/ terms of such

transaction were in substance determined between/by such URP

and AE (i.e., when a third party is interposed between 2 AEs)

· Earlier, there was a view that such URP had to be a non-resident

to fall within above provisions and hence transactions between 2

residents fell outside the purview

· This loophole is now plugged by the clarificatory amendment that

stipulates that such URP could be either resident or non-resident

[Section 92(B)(2) of the Act with effect from 1 April 2015]

U.S. Gandhi & Co. | Chartered Accountant](https://image.slidesharecdn.com/budget2014-15-ananalysis-140721020230-phpapp02/85/Budget-2014-15-An-analysis-22-320.jpg)

![BUDGET 2014-2015 24

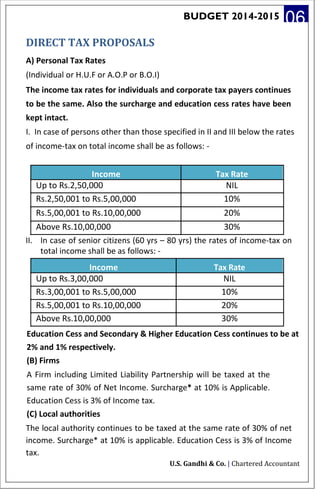

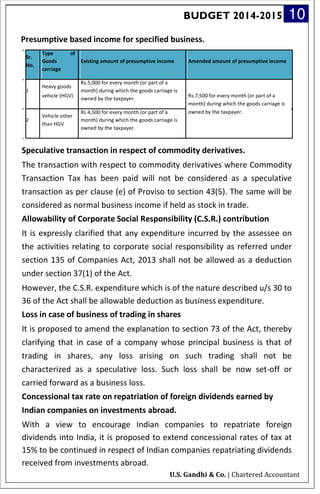

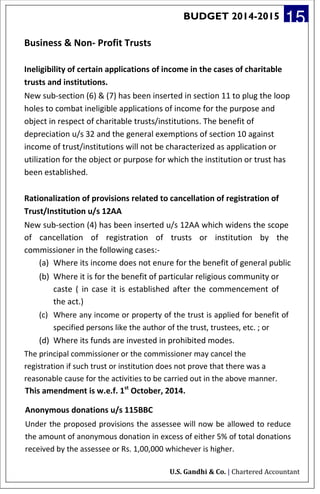

Introduction of variable interest on late payment of service tax

To encourage prompt payment of service tax, it is being proposed to

introduce interest rates which would vary on the extent of delay

[Notification No.12/2014-ST]. Simple interest rates per annum payable on

delayed payments under section 75, are prescribed as follows:

Extent of Delay Simple interest rate per annum

Upto six months 18%

More than six months &upto one year 18% for first six months and 24% for the period of

delay beyond six months

More than one year 18% for first six months, 24% for second six

months and 30% for the period of delay beyond

one year

This new interest rate regime will become operational only on 1st

October

2014. In other words, upto 1st October, 2014, the rate of interest of 18%,

presently applicable, will continue to apply. The variable interest rates will

apply only on or after 1st October, 2014.

These amendments are to be effective from 1st

October, 2014.

Mandatory E-payment of Service Tax

Presently E-payment of service tax is mandatory for service tax liability of

Rs. 1 Lakhs. However, E-payment of service tax is being made mandatory.

Relaxation from e-payment may be allowed by the Deputy

Commissioner/Asst. Commissioner on case to case basis.

Inclusion in the definition of reverse charge mechanism

· Reverse charge mechanism extended to include recovery agent

services provided to banks, NBFC's and other financial institutions.

Service receiver shall be liable to pay service tax under full reverse

charge (Effective from 11th

July, 2014).

· Services provided by Director to a Body Corporate. Service receiver

who is a Body Corporate will be the person liable to pay service tax

under full reverse charge. (Effective from 11th

July, 2014).

· Proportion of service tax payable under partial reverse charge by a

service recipient of rent-a-cab services (non-abated) increased to 50%

(Effective from 1st

October, 2014).

U.S. Gandhi & Co. | Chartered Accountant](https://image.slidesharecdn.com/budget2014-15-ananalysis-140721020230-phpapp02/85/Budget-2014-15-An-analysis-25-320.jpg)