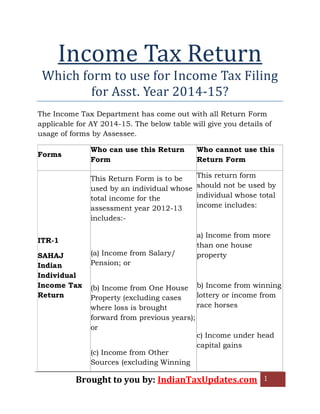

Income tax return assessment year 2014 15

- 1. Brought to you by: IndianTaxUpdates.com 1 Income Tax Return Which form to use for Income Tax Filing for Asst. Year 2014-15? The Income Tax Department has come out with all Return Form applicable for AY 2014-15. The below table will give you details of usage of forms by Assessee. Forms Who can use this Return Form Who cannot use this Return Form ITR-1 SAHAJ Indian Individual Income Tax Return This Return Form is to be used by an individual whose total income for the assessment year 2012-13 includes:- (a) Income from Salary/ Pension; or (b) Income from One House Property (excluding cases where loss is brought forward from previous years); or (c) Income from Other Sources (excluding Winning This return form should not be used by individual whose total income includes: a) Income from more than one house property b) Income from winning lottery or income from race horses c) Income under head capital gains

- 2. Brought to you by: IndianTaxUpdates.com 2 from Lottery and Income from Race Horses) Further in case of income of another person like spouse, minor child, etc is to be clubbed with the Assessee, this return form can be used only if income being clubbed falls into above form category d)Income from Agriculture / Exempt income of more than Rs 5000/- . e) Income from Business or Profession f) Loss under income from Other Sources g) Person Claiming relief under Section 90 ot 91 h) any resident having any asset (including financial interest in any entity) located outside India or signing authority in any account located outside India. ITR-2 For Individuals and HUFs not This Return Form is to be used by an individual or a Hindu Undivided Family whose total income for the This Return Form should not be used by an individual whose total income for the

- 3. Brought to you by: IndianTaxUpdates.com 3 having Income from Business or Profession assessment year 2014-15 includes: a) Income from Salary / Pension; b) Income from House Property c) Income from Capital Gains d) Income from Other Sources (including Winning from Lottery and Income from Race Horses) Further, in a case where the income of another person like spouse, minor child, etc. is to be clubbed with the income of the assessee, this Return Form can be used where such income falls in any of the above categories assessment year 2014- 15 includes Income from Business or Profession. NOTE: A resident assessee having any assets (including financial interest in any entity) located outside India or signing authority in any account located outside India, shall fill out schedule FA and furnish the return in return electronically under digital signature or transmit data electronically and submit ITR V ITR-3 This Return Form is to be used by an individual or an Hindu Undivided Family who is a partner in a firm and where income chargeable to This Return Form should not be used by an individual whose total income for the assessment year 2013-

- 4. Brought to you by: IndianTaxUpdates.com 4 income-tax under the head “Profits or gains of business or profession” does not include any income except the income by way of any interest, salary, bonus, commission or remuneration, by whatever name called, due to, or received by him from such firm. In case a partner in the firm does not have any income from the firm by way of interest, salary, etc. and has only exempt income by way of share in the profit of the firm, he shall use this form only and not Form ITR- 2. 14 includes Income from Business or Profession under any proprietorship. ITR-4S SUGAM This Return Form is to be used by an individual or a Hindu Undivided Family whose total income for the assessment year 2014-15 includes: a) Business income were income is computed in accordance with the special provision under section 44AD and 44AE This return form should not be used to file following incomes a) Income from more than one house property b) Income from winning lottery or income from race horses

- 5. Brought to you by: IndianTaxUpdates.com 5 b) Income from Salary / Pension c) Income from other source(Excluding Income from Lottery and income from race horse ) Further, in a case where the income of another person like spouse, minor child, etc. is to be clubbed with the income of the assessee, this Return Form can be used where such income falls in any of the above categories c) Income under head capital gains d) Income from Agriculture / Exempt income of more than Rs 5000/- . e) Income from Speculative Business f) Income from Profession g) Person Claiming relief under Section 90 ot 91 h) any resident having any asset (including financial interest in any entity) located outside India or signing authority in any account located outside India

- 6. Brought to you by: IndianTaxUpdates.com 6 ITR-4 This Return Form is to be used by an individual or a Hindu Undivided Family who is carrying out a proprietary business or profession. NA ITR-5 This Form can be used a person being a firm, LLPs, AOP, BOI, artificial juridical person referred to in section 2(31)(vii), cooperative society and local authority. However, a person who is required to file the return of income under section 139(4A) or 139(4B) or 139(4C) or 139(4D) shall not use this form. This return form should not be used by individual and HUF and Companies ITR -6 This Form can be used by a company, other than a company claiming exemption under section 11. This return form should not be used by person other than Companies ITR- 7 This Form can be used by persons including companies who are required to furnish return under section 139(4A) or section 139(4B) or section 139(4C) or section 139(4D). This return form should not be used by person other than Companies

- 7. Brought to you by: IndianTaxUpdates.com 7 Manner of filing the return form: a) By furnishing the return in paper form b) By furnishing return electronically with digital signature c) By transmitting the data in the return electronically and there after submitting ITR V to be send by speed post to Bengaluru. A resident assessee having any assets (including financial interest in any entity) located outside India or signing authority in any account located outside India, shall fill out schedule FA and furnish the return in the manner provided at either B) or c) above. From the assessment year 2013-14 onwards all the assessees having total income more than 5 lakh rupees are required to furnish the return in the manner provided at B) or c) Also in case of an assessee claiming relief under section 90, 90A or 91 to whom Schedule FSI and Schedule TR apply, he has to furnish the return in the manner provided at either B) or c) From assessment year 2013-14 onwards in case an assessee who is required to furnish a report of audit under sections 10(23C)(iv), 10(23C)(v), 10(23C)(vi), 10(23C)(via), 10A, 12A(1)(b), 44AB, 80-IA, 80-IB, 80-IC, 80-ID, 80JJAA, 80LA, 92E or 115JB he shall file the report electronically on or before the date of filing the return of income. Further, the assessee who is liable to file the above reports electronically shall file the return of income in the manner provided at either B) or c)

- 8. Brought to you by: IndianTaxUpdates.com 8 Where the Return Form is furnished in the manner mentioned at c), the assessee should print out two copies of Form ITR-V. One copy of ITR-V, duly signed by the assessee, has to be sent by ordinary post to Post Bag No. 1, Electronic City Office, Bangaluru–560100 (Karnataka). The other copy may be retained by the assessee for his record.