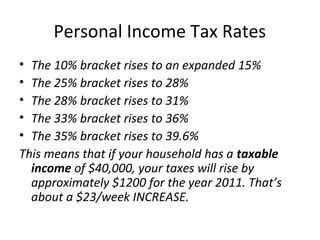

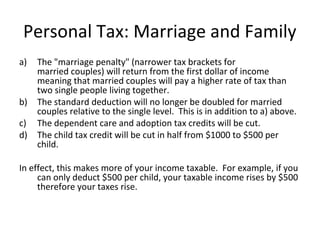

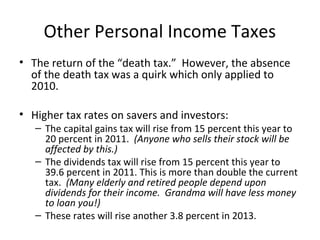

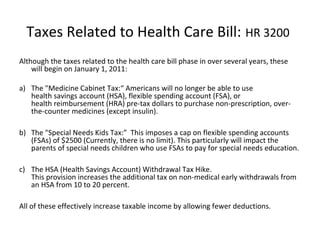

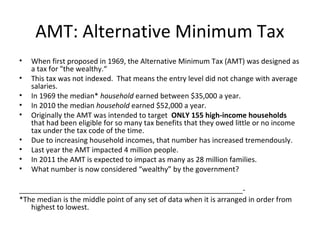

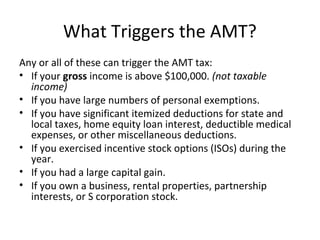

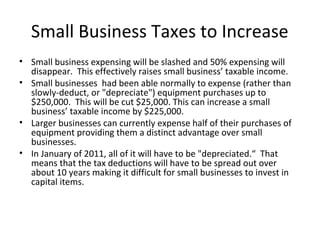

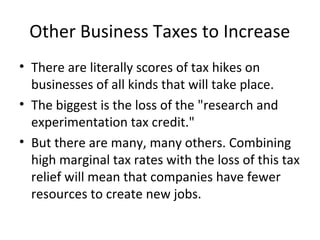

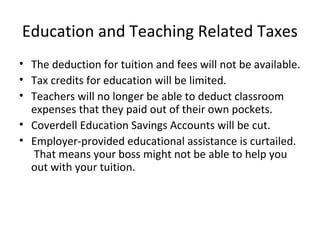

Beginning January 1, 2011, there will be significant tax increases affecting personal income taxes, health care taxes, small business taxes, and more. This combination of tax increases will result in the largest tax increase in US history. For individuals, income tax rates will rise substantially. The standard deduction and many tax credits will be reduced or eliminated. Health insurance provided by employers will become taxable income. Small businesses will see reductions in expensing and credits. The increases will reduce disposable income for most Americans and businesses, potentially limiting growth.