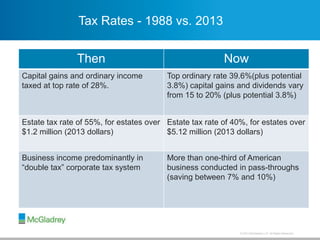

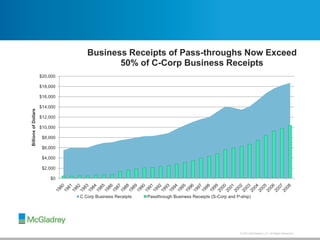

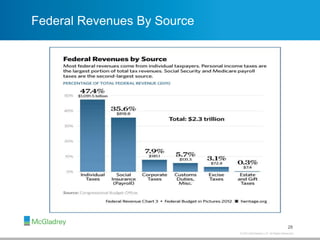

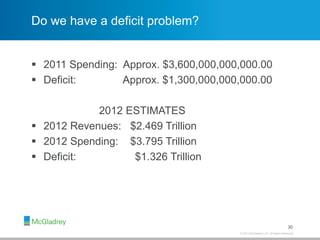

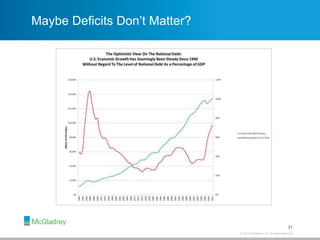

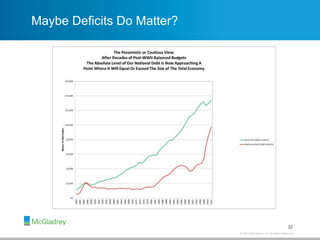

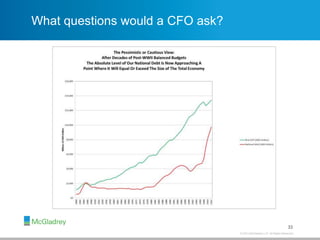

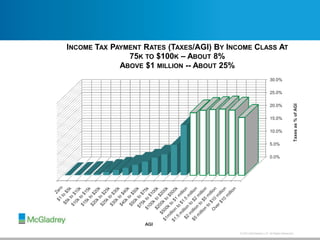

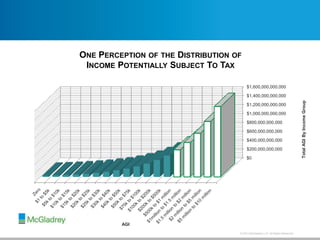

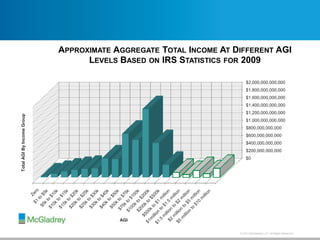

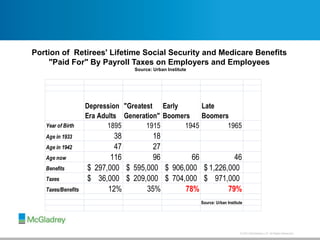

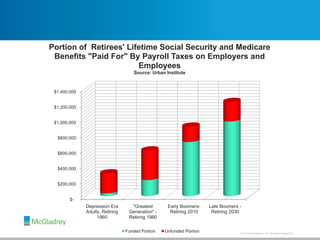

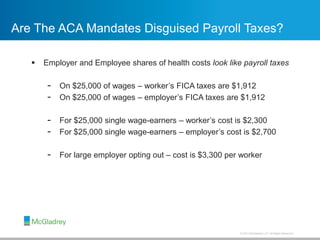

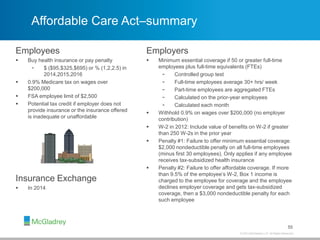

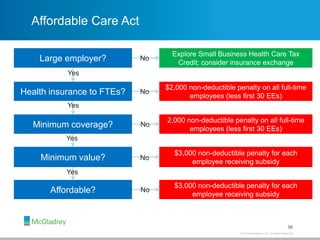

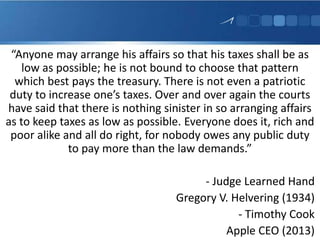

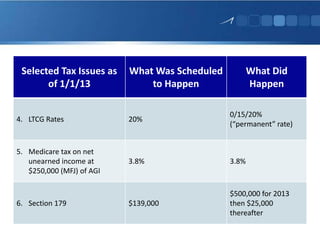

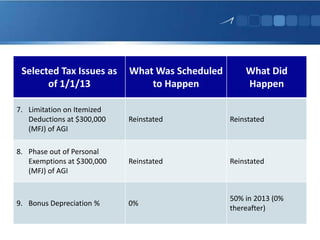

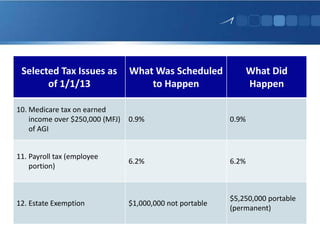

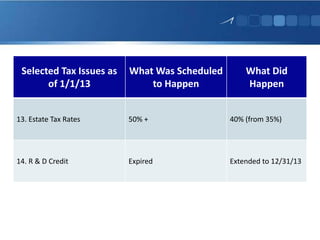

The document provides an overview of the 4th annual tax update featuring presenters Steven Mills, Don Susswein, and Mark Peterson, discussing individual tax brackets, alternative minimum tax exemptions, dividend rates, and other significant tax issues as of January 1, 2013. It also includes recommendations for tax planning amidst the evolving tax landscape, emphasizing the importance of being proactive in managing tax liabilities and understanding the implications of the Affordable Care Act. The document concludes with various observations about tax reform and its historical context.

![© 2013 McGladrey LLP. All Rights Reserved.

Important Tax Policy Themes of the 20th Century

“Federal Insurance Contributions Act” - 1935

“A rising tide lifts all boats” - 1963

“154 [Millionaires] Who Didn’t Pay Any Taxes” - 1969

“Tax expenditure” - 1967

“The tax code is a disgrace to the human race” - 1976

“Broaden the base, lower the rates.” - 1986](https://image.slidesharecdn.com/06-18-13all-130620084226-phpapp02/85/4th-Annual-Tax-Update-22-320.jpg)