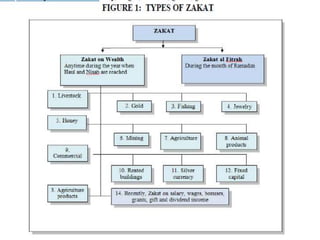

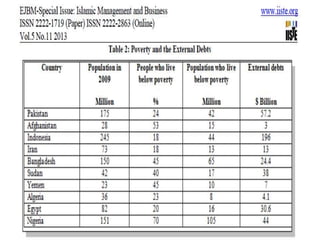

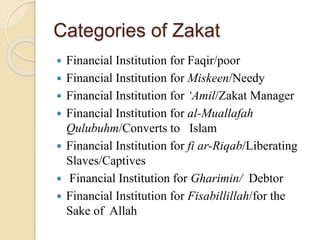

Zakat is an obligatory charitable contribution in Islam that can help reduce poverty. It is collected from Muslims according to a fixed percentage of savings and distributed to eight categories of recipients, including the poor and needy. If zakat is properly implemented, it can provide financial support to the poor through institutions and help eliminate interest-based debts of Muslim nations and individuals. Some researchers argue zakat could be an effective tool for poverty alleviation. While taxation systems also aim to redistribute wealth, zakat is preferable because its rates are fixed and do not tax the poor.