1) The document provides instructions for international students to file their US federal income tax return using an online tax preparation software called Windstar.

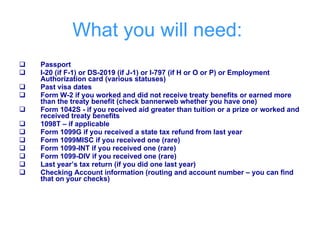

2) It outlines the documentation needed to file such as Forms W-2, 1042-S, 1099 and passport information.

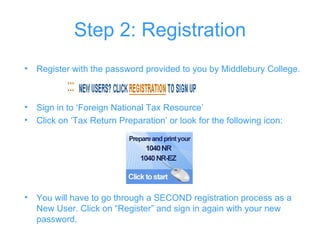

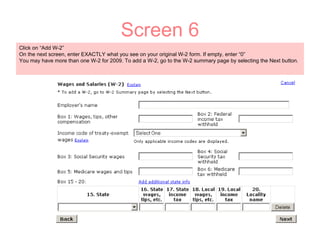

3) The steps include registering with Windstar, entering income and payment information from tax forms, reviewing the completed return, printing copies and mailing the return and related forms to the IRS.

![If Box 5 is less than Box 2 : ignore the form If Box 5 is greater than Box 2, check your 1042-S form. The amount that corresponds to income code 15 should be the same as this figure (Box 5). If they are not the same, PLEASE CONTACT THE MIDDLEBURY COLLEGE TAX OFFICE. [email_address] 1098T FORM](https://image.slidesharecdn.com/taxworkshoppresentation2010-100305131140-phpapp02/85/Tax-Workshop-Presentation-2010-13-320.jpg)