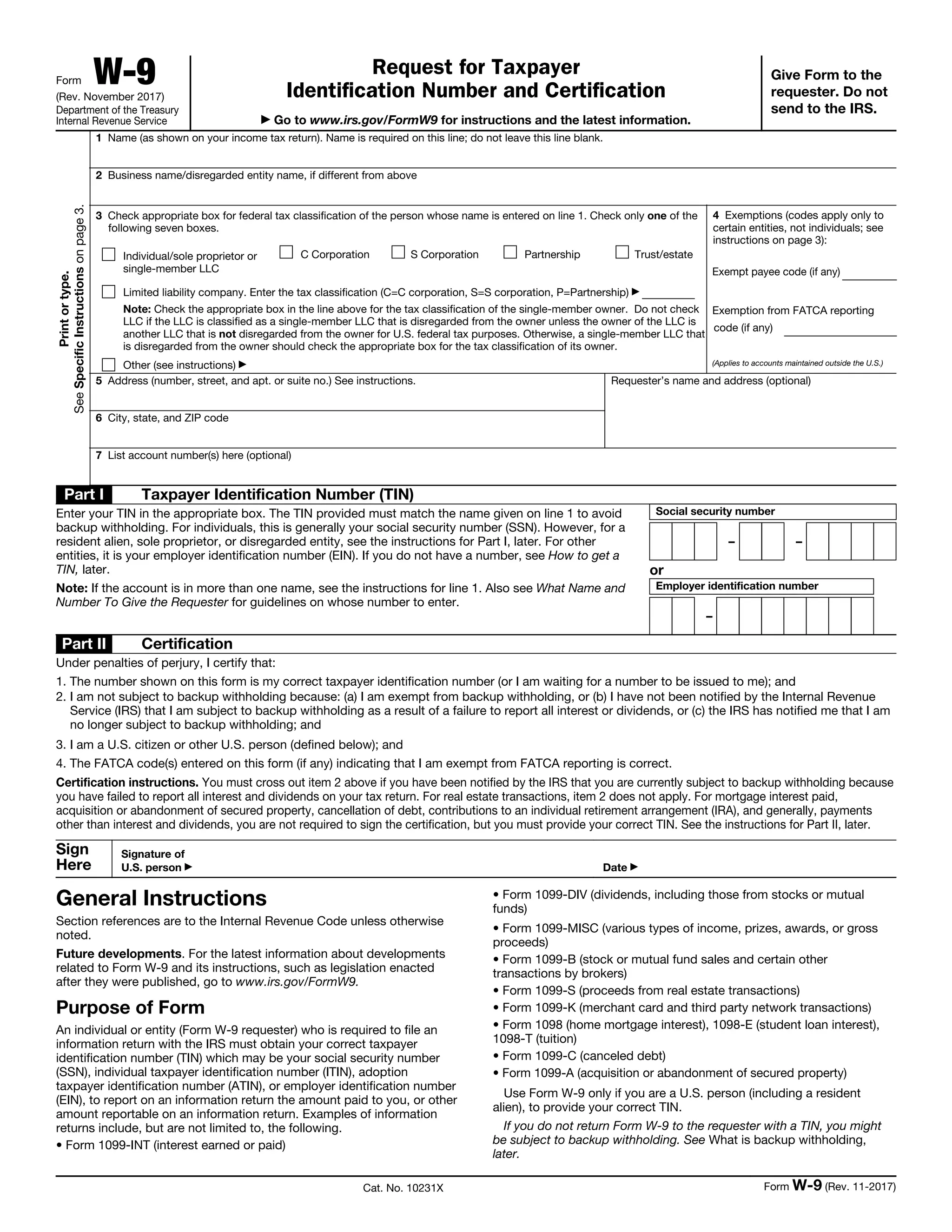

This document is an IRS Form W-9 used to request a taxpayer's identification number and certification. It provides instructions for individuals and entities to give accurate identifying information to persons making certain payments to help the requester comply with tax reporting obligations. Key details include:

- Lines are provided to enter the taxpayer's name, business name if different, and tax classification.

- Part I requests the taxpayer's identification number, either a Social Security Number for individuals or an Employer Identification Number for entities.

- By signing Part II, the taxpayer certifies their information is correct and whether they are subject to backup withholding.

- Additional pages provide general instructions, definitions of terms like U.S. person,