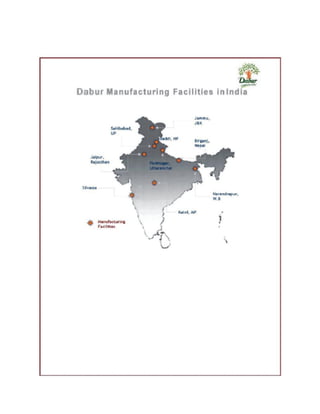

This document provides an overview of Dabur India Limited, a leading FMCG company in India. It discusses Dabur's product portfolio, marketing strategies, business model, and CEO. Key points include: Dabur operates in categories like healthcare, personal care, and foods with brands like Dabur, Vatika, Hajmola, and Real. It uses a three-tier distribution system and umbrella branding strategy. The CEO is Mr. Sunil Duggal and marketing strategies include advertisements, digital marketing, and focusing on rural and urban consumers.