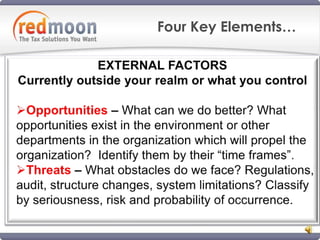

This document outlines a presentation on using a SWOT analysis to plan tax processes. It describes the six steps to conducting a SWOT analysis: (1) define the scope, (2) brainstorm strengths, (3) brainstorm weaknesses, (4) brainstorm opportunities, (5) brainstorm threats, and (6) prioritize and plan based on the SWOT findings. The presentation provides examples of potential strengths, weaknesses, opportunities, and threats that could be considered in a SWOT analysis of a tax process.