Cecilia Hermansson, Chief Economist at Swedbank, delivered a speech at a conference in Riga celebrating Latvia's completion of its IMF and EU support program. In her speech, she:

1) Praised Latvia's strong economic recovery and commitment to reforms following the deep recession, while noting remaining challenges.

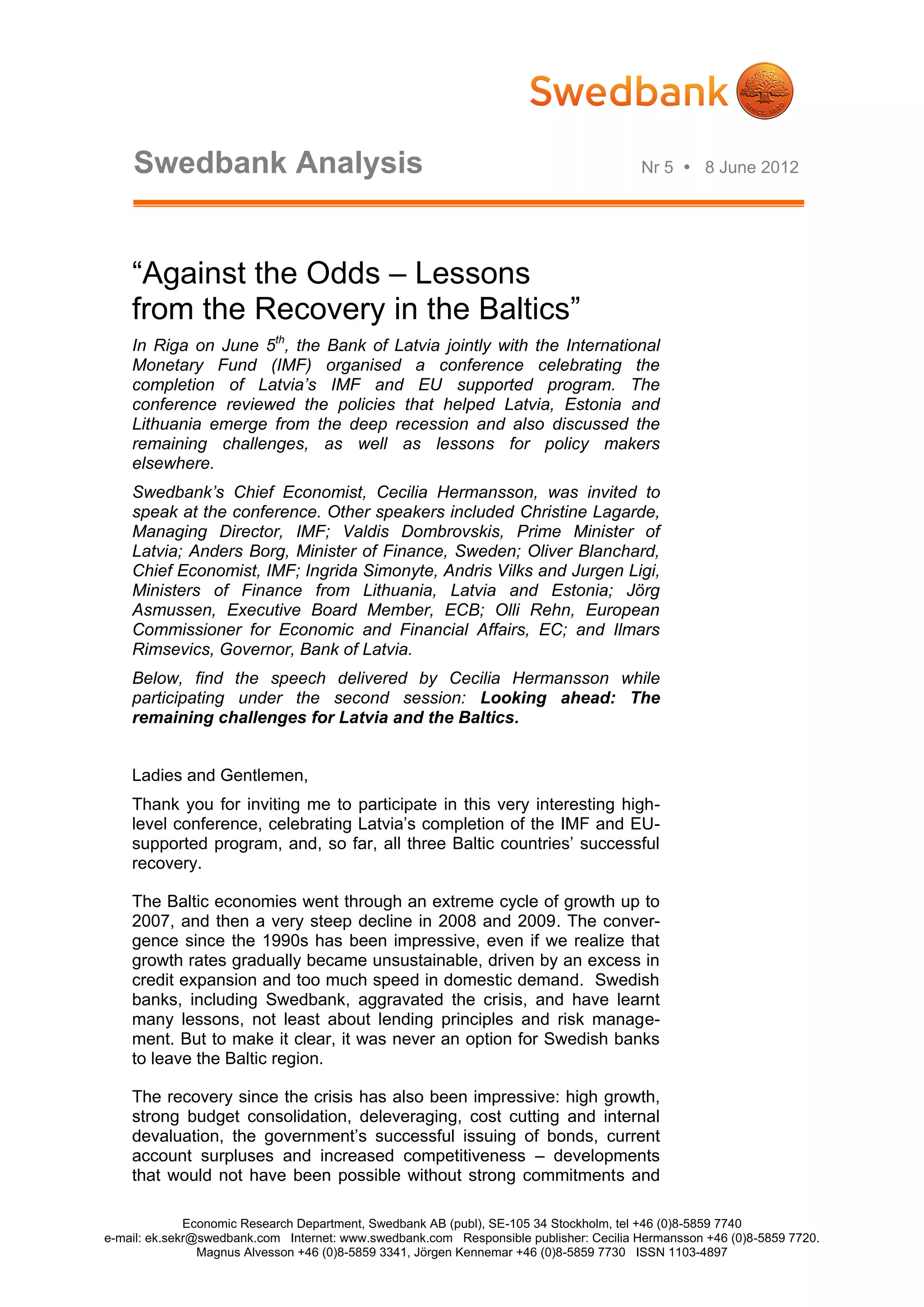

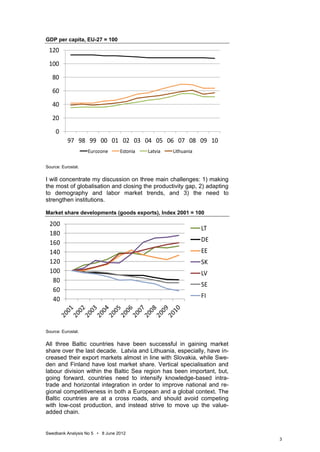

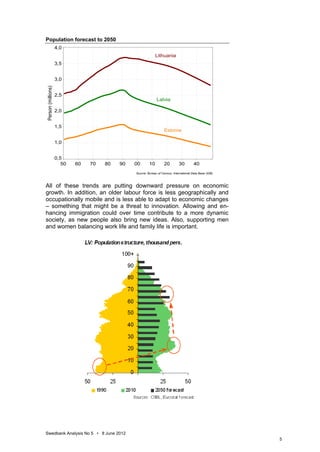

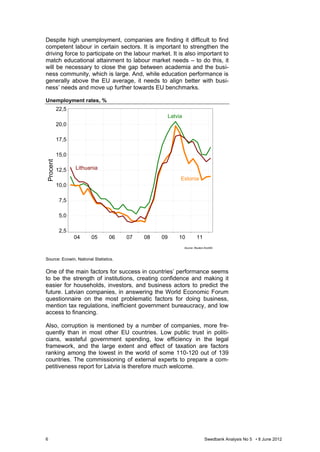

2) Emphasized the need to close productivity gaps, adapt to demographic changes, and strengthen institutions to sustain recovery.

3) Concluded that Latvia and other Baltic states must maintain reform momentum to avoid problems seen in Southern Europe and further improve competitiveness.