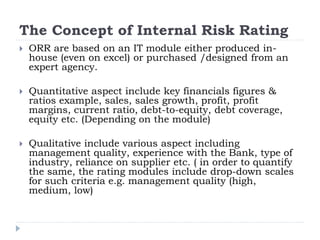

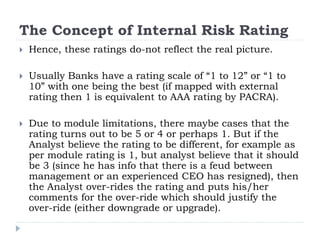

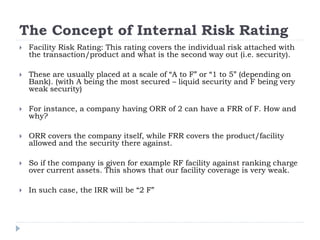

The document discusses risk ratings, which are assessments of financial risk provided by rating agencies. The top three global agencies are Standard & Poor's, Moody's, and Fitch, which provide risk ratings for companies, financial instruments, and countries. Internal risk ratings are also used by banks and other financial institutions to assess risk at the customer level. These internal ratings consider both quantitative financial data and qualitative factors to determine an overall risk level.