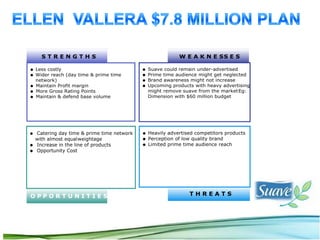

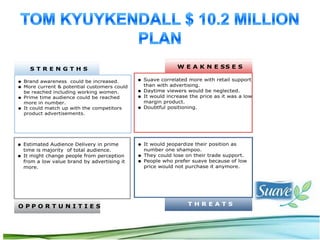

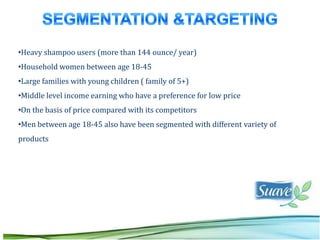

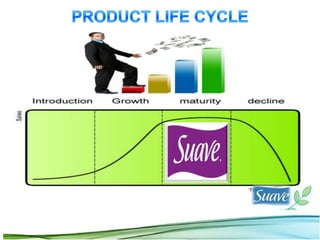

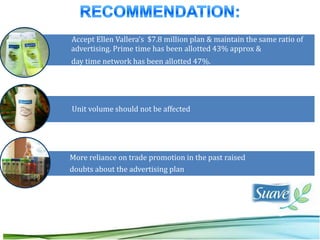

The document analyzes two advertising plans for Suave shampoo - a $7.8 million plan focusing on daytime and primetime TV proposed by Ellen Vallera, and a $10.2 million plan focusing entirely on primetime TV proposed by Tom Kuykendall. The shampoo market is highly competitive and brands face threats from new entrants. Suave needs an advertising strategy to maintain its market position and retail shelf space. The document performs a SWOT analysis of the plans and recommends accepting Vallera's plan with higher allocation to primetime TV, while targeting light users through new products.