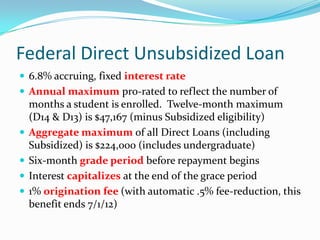

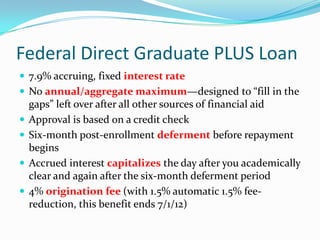

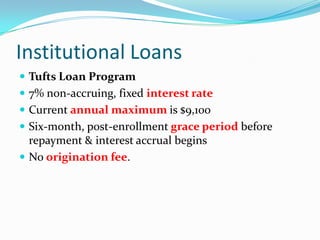

This document summarizes information about student loans for dental students at Tufts Dental School. It discusses the types of federal and private student loans available, as well as the costs of tuition and living expenses. It provides details on loan terms and limits. The document also offers tips for managing costs, such as creating a budget, seeking additional funding sources, and monitoring existing loans. Resources for loan repayment programs and online information about student loans are also listed.