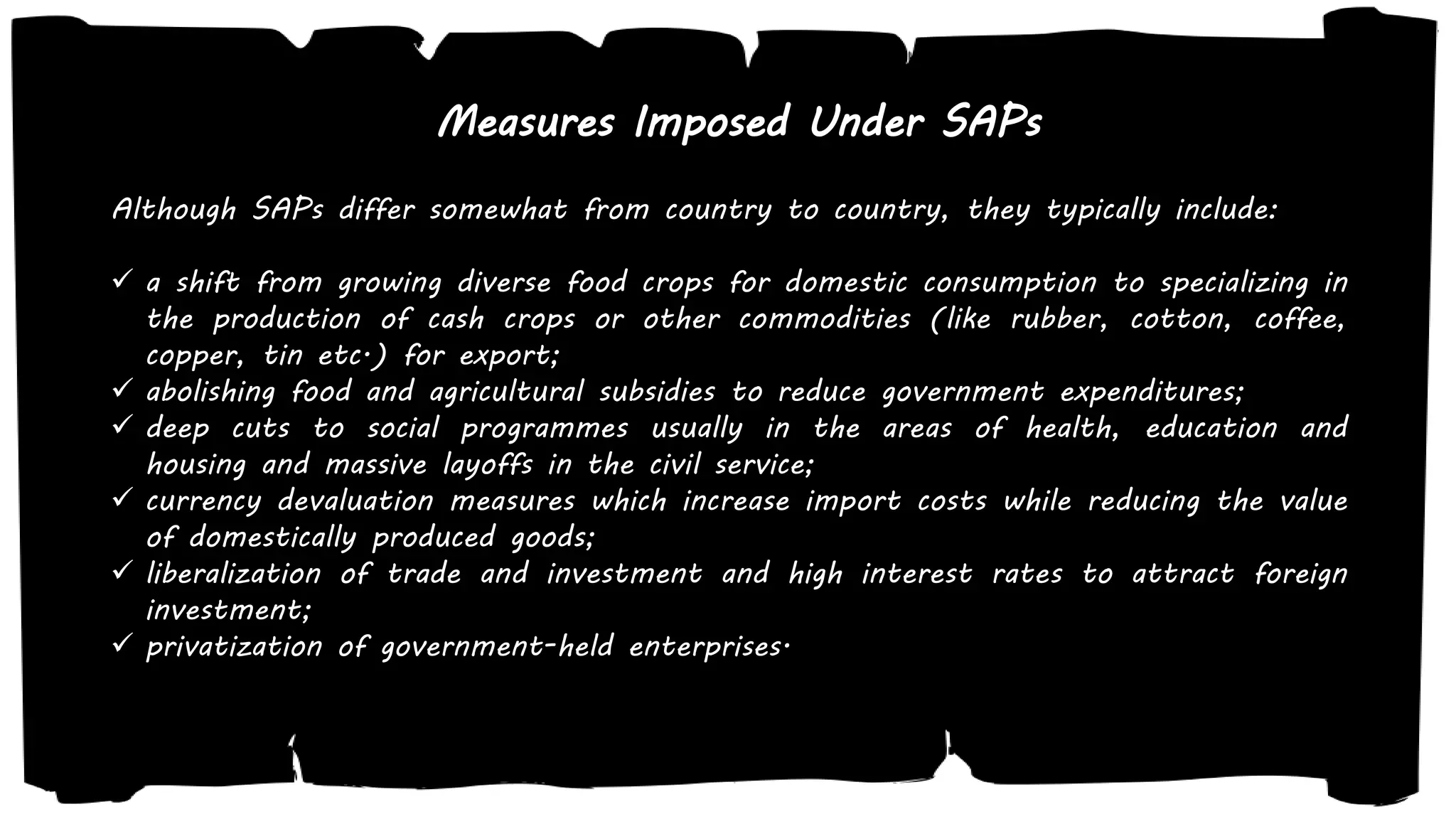

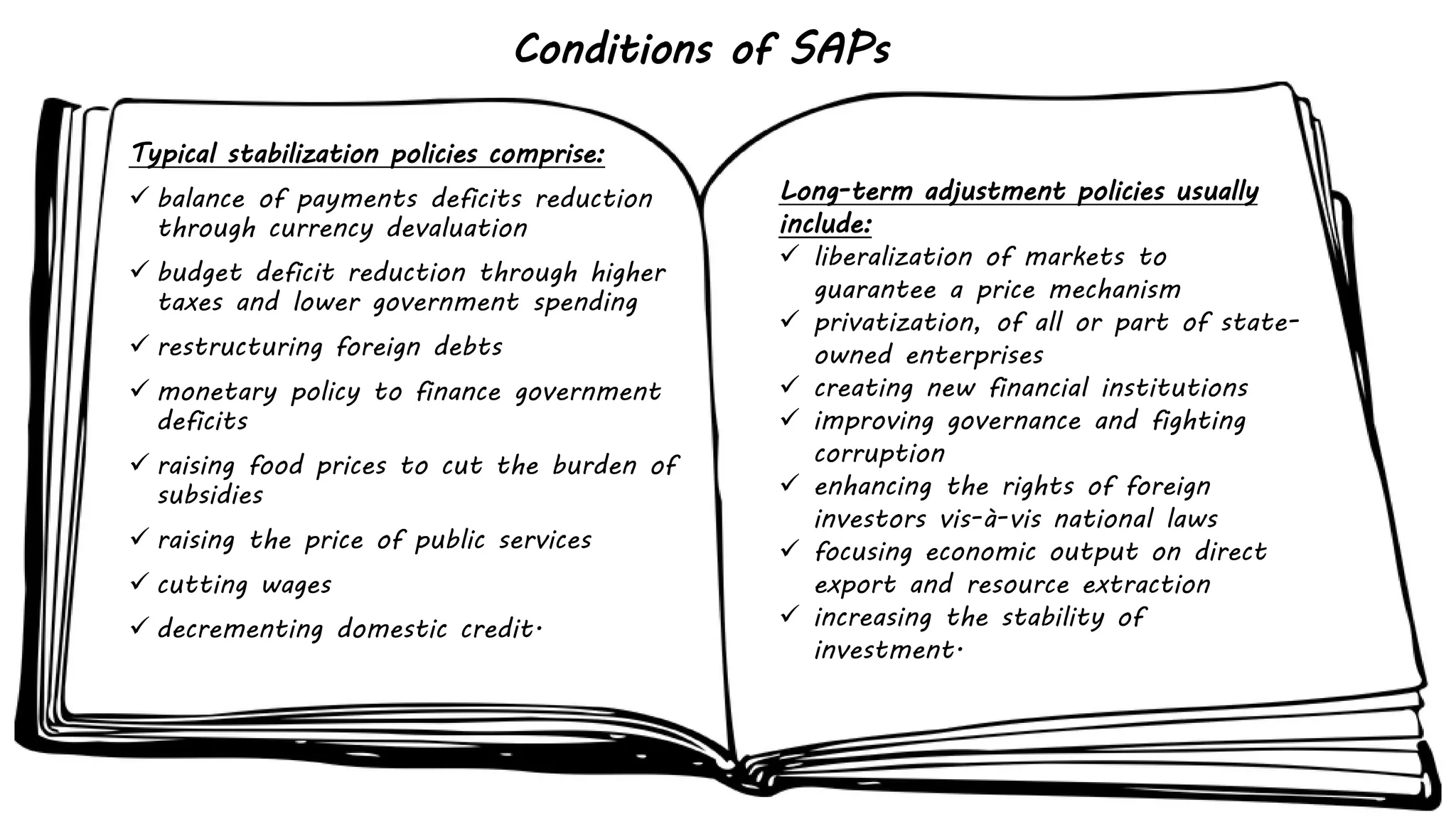

Structural adjustment programs (SAPs) are economic reform policies imposed by the IMF and World Bank on developing countries as conditions for receiving loans. SAPs began in the 1980s and involved 187 programs across 64 countries. They aimed to boost exports, reduce government deficits, and improve investment climates. Typical SAP measures included currency devaluation, cutting social spending, privatizing industries, and deregulating markets. While SAPs achieved some economic growth in countries like Ghana, they also had many negative social impacts by reducing education, healthcare and living standards. Critics argue SAPs undermine national sovereignty and prioritize private profits over public welfare. In response to criticisms of SAPs, the IMF and World Bank introduced Poverty

!["Structural adjustment" is the name given

to a set of "free market" economic policy

reforms imposed on developing countries

by the Bretton Woods institutions [the

World Bank and International Monetary

Fund (IMF)] as a condition for receipt of

loans.

Developed in the early 1980s

Initiated in Turkey

Gaining stronger influence over the

economies of debt-strapped

governments in the South

187 SAPs negotiated for 64 developing

countries

Structural Adjustment Programmes (SAPs)](https://image.slidesharecdn.com/structuraladjustmentprogrammessapsppt-190422163052/75/Structural-Adjustment-Programmes-SAPs-ppt-2-2048.jpg)