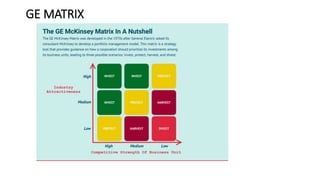

The document discusses several strategic management concepts including experience curves, life cycle analysis, portfolio analysis models like BCG matrix and GE matrix, generic strategies, strategic group analysis, contingency strategies, strategic choice process, and subjective factors in strategic choice. The key points are that experience curves show lower production costs with greater experience, life cycle assessment evaluates environmental impacts over a product's lifetime, and portfolio models analyze business units based on market factors.