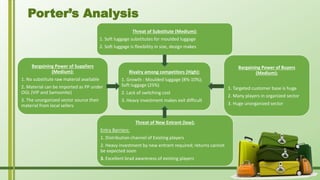

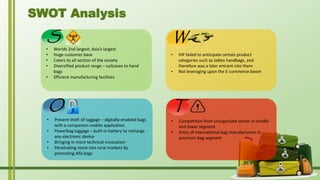

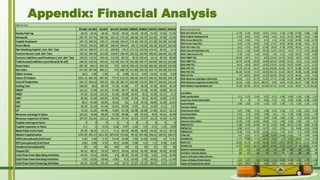

This document provides an overview and analysis of the Indian luggage industry. It discusses the industry's current size and growth rate, as well as trends like consumers shifting to softer luggage. It then analyzes the industry using Porter's Five Forces model and provides a SWOT analysis of major player VIP Industries. Competitors like American Tourister and Samsonite are also analyzed. Issues facing the industry like increasing competition and the prevailing unorganized sector are discussed. The document concludes with recommendations for VIP Industries around innovation, handling competition, expanding e-commerce, and maintaining financial stability.