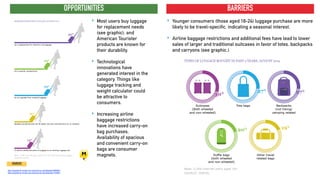

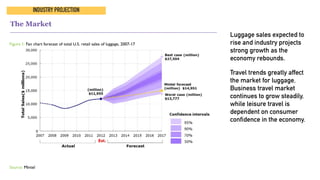

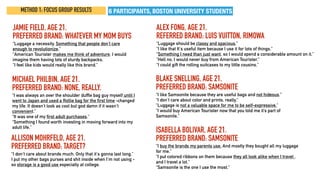

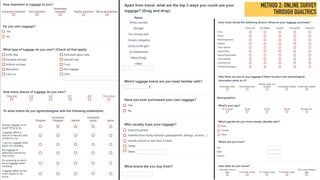

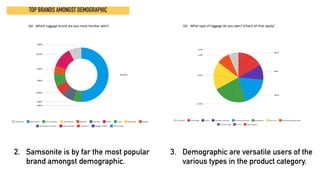

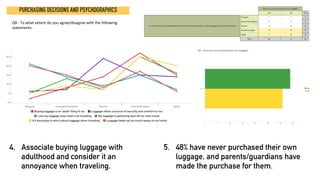

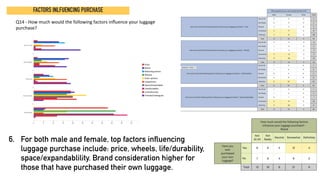

The document discusses the history and branding of American Tourister, a luggage company founded in 1933 and acquired by Samsonite in 1993. It provides insights into the target audience, purchasing behaviors, and market trends regarding luggage, highlighting that consumers tend to prefer durable, high-quality products despite viewing luggage as overpriced. Additionally, the document outlines research methods, including focus groups and online surveys, to gauge college students' perceptions of luggage and brand loyalty, revealing insights about their purchasing priorities and brand associations.