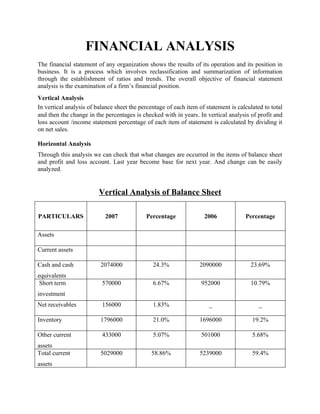

The document analyzes the financial statements of an organization for the years 2006 and 2007. It provides vertical analysis of the balance sheet and income statement to examine changes in percentages of items from the previous year. It also performs ratio analysis to assess the organization's liquidity, solvency, asset management and profitability. Key ratios like current ratio, debt ratio and return on assets are calculated and interpreted to evaluate the organization's financial position.