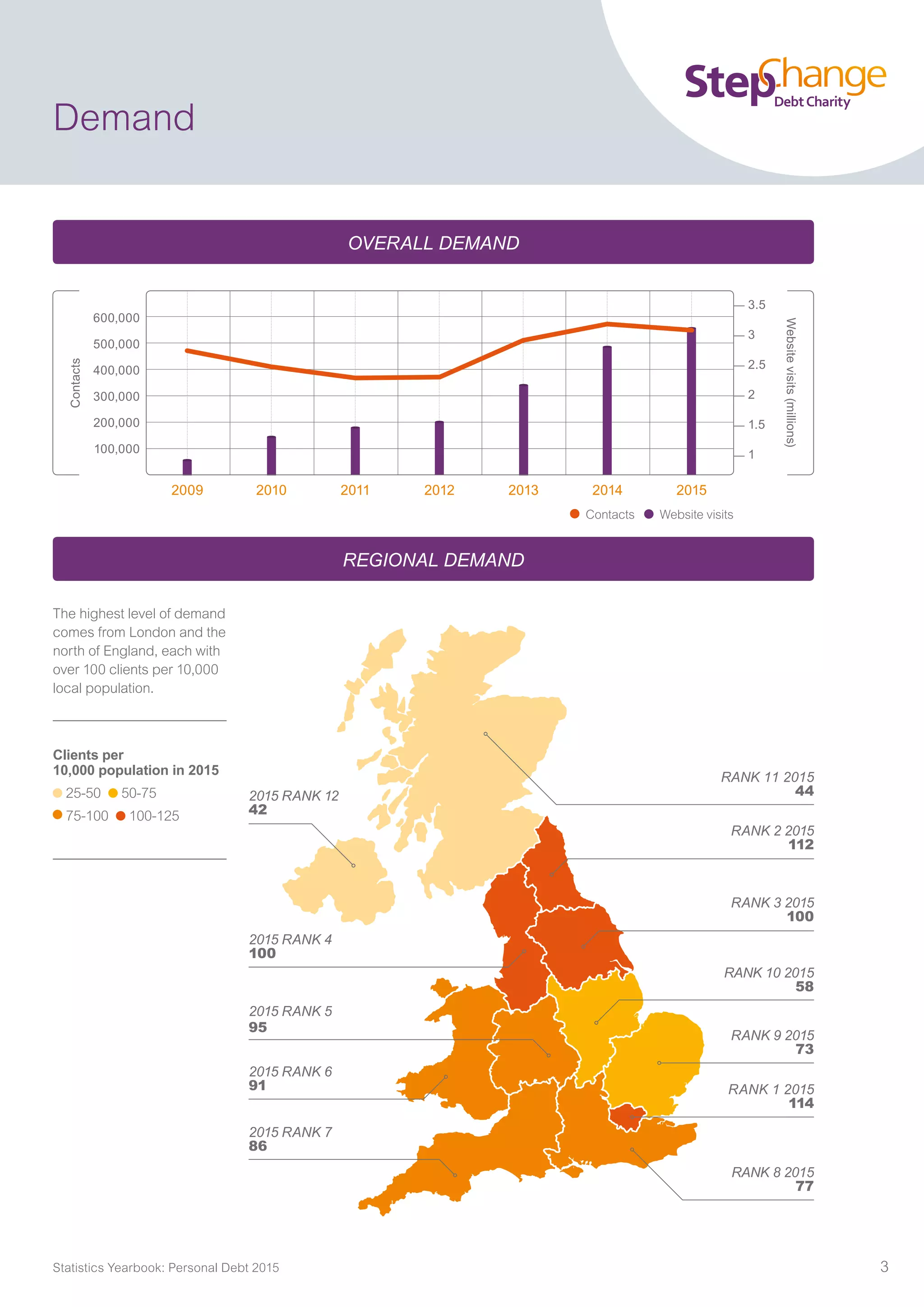

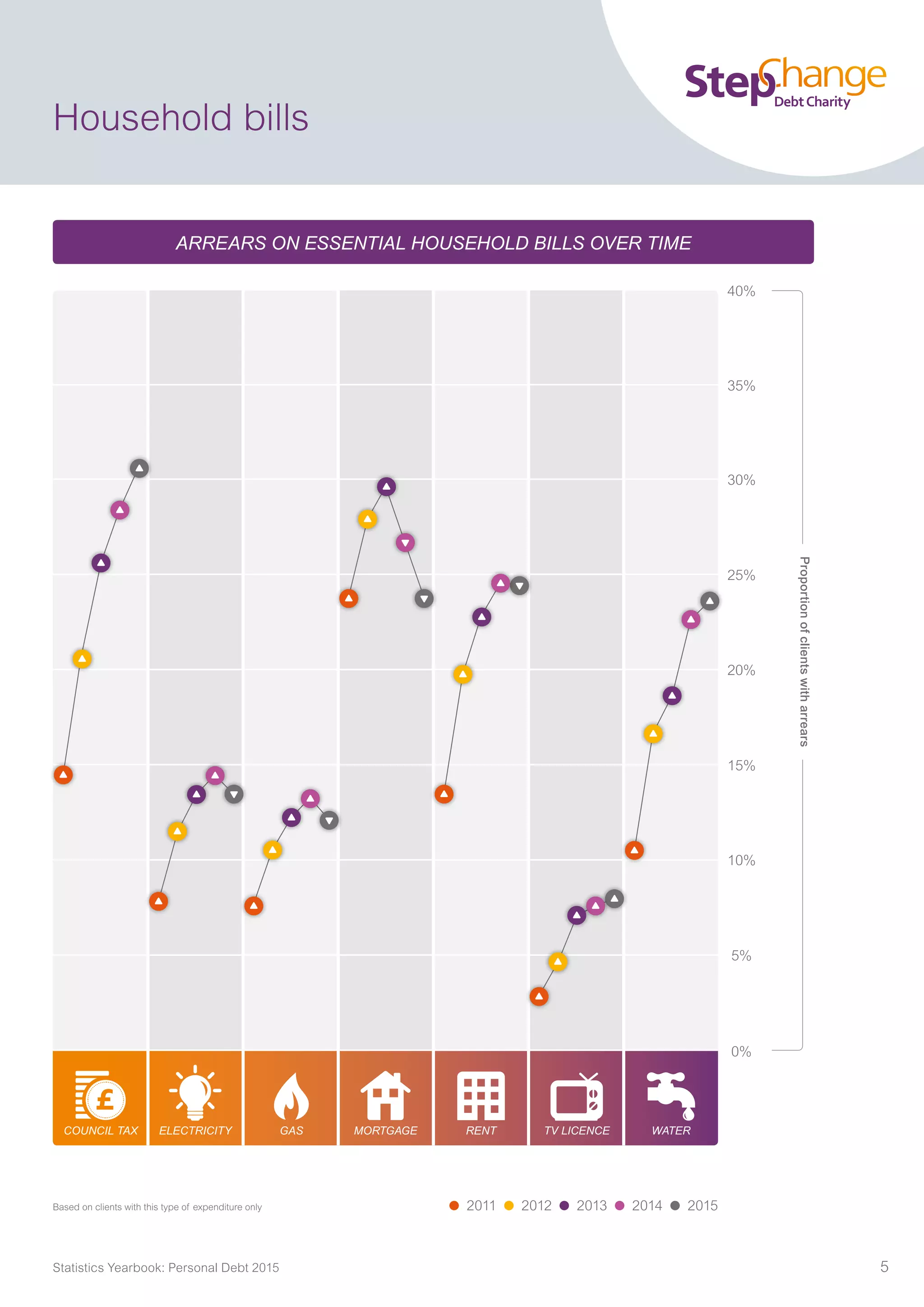

The document summarizes statistics from StepChange Debt Charity on personal debt in the UK. It finds that the average unsecured debt was £13,900 with most having credit card debt. Over 40% had arrears on essential bills like utilities. More young people and renters are seeking advice, with the average income being under £16,000. Losing one's job or having irregular income were the leading causes of falling into problem debt. In 2015, over 549,000 people contacted the charity for debt advice.