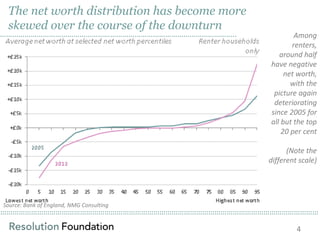

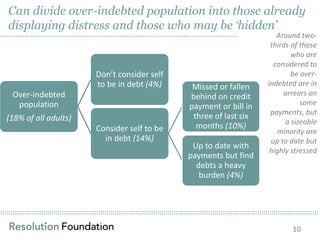

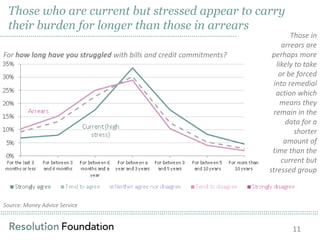

The document analyzes data from the Money Advice Service on households that are over-indebted in the UK. It finds that while aggregate debt levels have not caused a crisis due to loose monetary policy, there remains a significant vulnerable segment of lower-income households. Many of these households have been unable to reduce debts when possible. While most over-indebted households are currently in arrears, there is also a group that is current on payments but still under heavy financial strain, who may be exposed if interest rates rise before their situations improve. This "current but stressed" group resembles those in arrears in many ways, but is less likely to have sought help and more likely to still have access to credit.