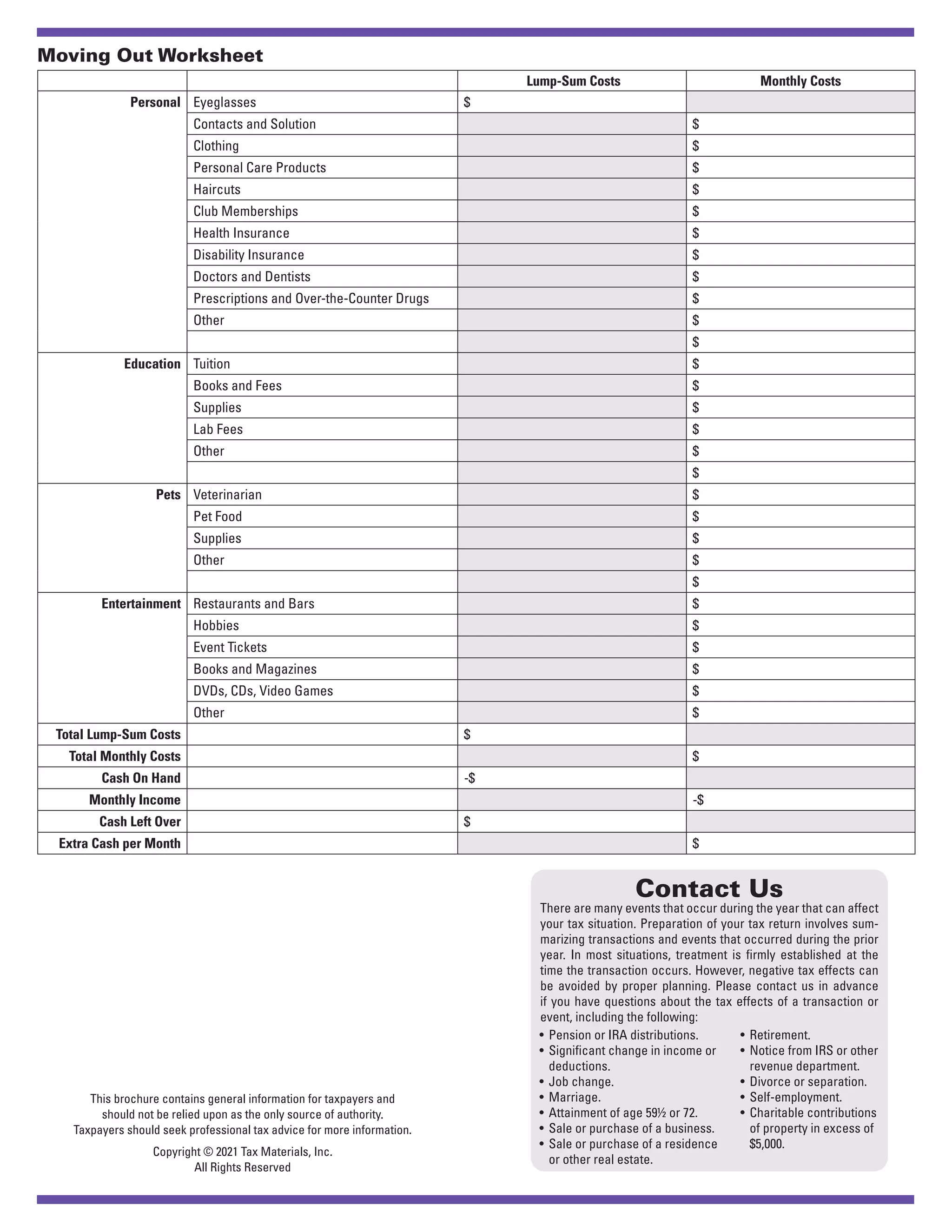

The document is a moving out worksheet designed to help young people assess their financial readiness to live independently. It categorizes various one-time and monthly costs, including lodging, food, transportation, personal expenses, and education, to help users estimate total expenses. Additionally, it includes a disclaimer regarding tax advice and encourages users to seek professional help for tax-related questions.