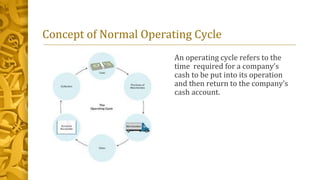

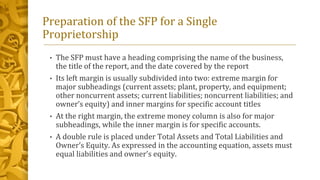

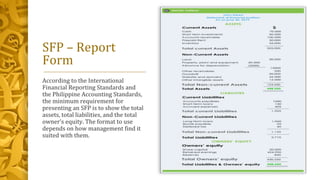

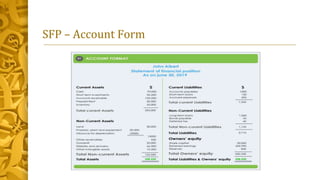

The document discusses the statement of financial position (SFP), also known as the balance sheet. The SFP shows a business's assets, liabilities, and capital/equity at a single point in time. It presents the business's financial condition. Assets are what the business owns that provide future economic value. Liabilities are amounts owed to creditors and capital/equity is the owners' investment in the business. Current assets and liabilities are expected to be converted to cash or used within one operating cycle or one year. The SFP is prepared using account titles organized under classifications with assets equal to liabilities plus equity.