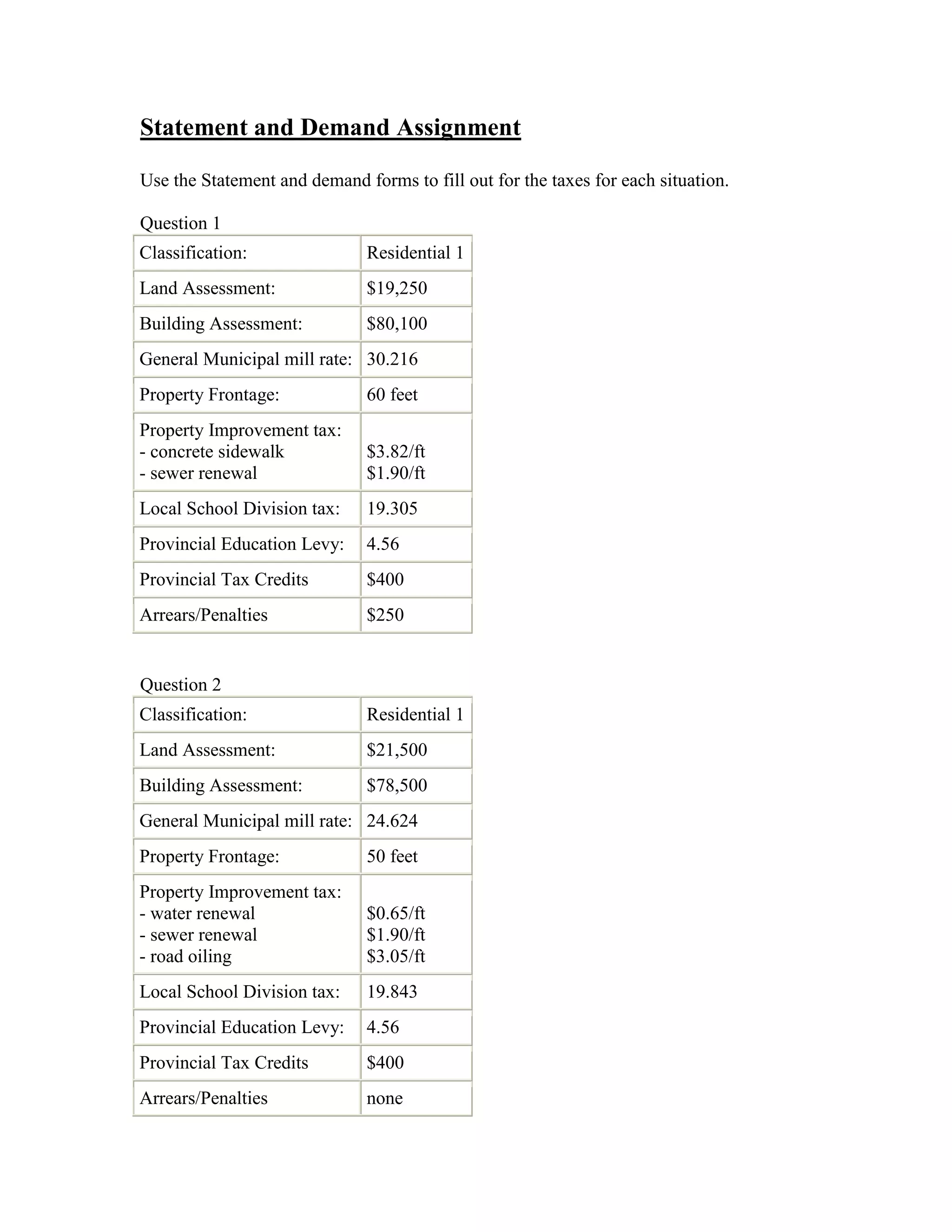

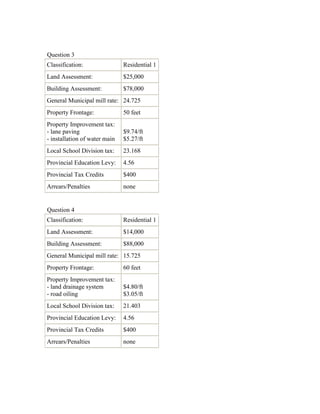

This document provides information for four tax situations including land and building assessments, mill rates, property frontages, improvement taxes, school and education levy taxes, tax credits, and penalties. The questions involve calculating statements and demands for residential properties with varying assessments, mill rates, improvement taxes, and school division taxes.