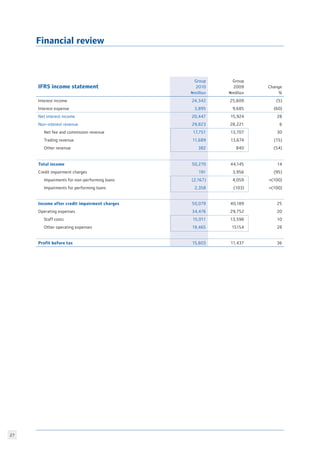

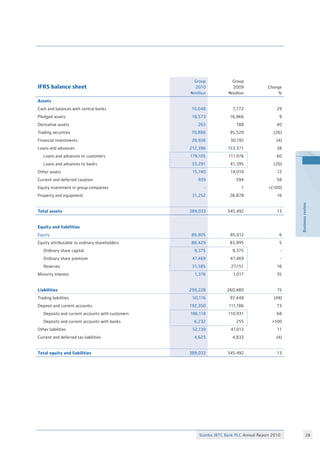

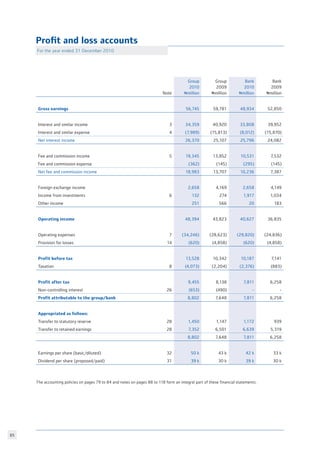

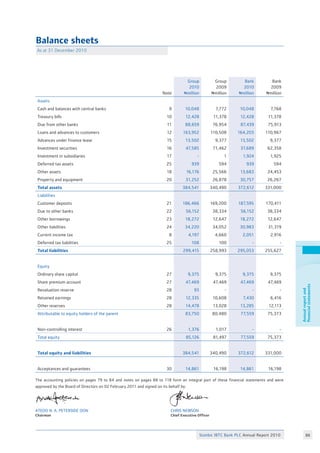

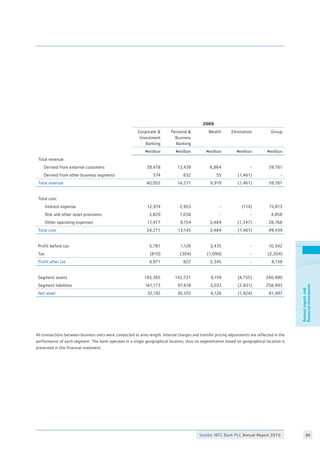

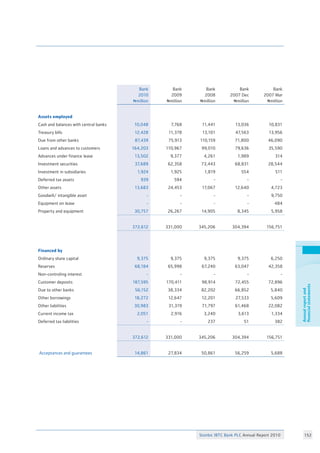

Stanbic IBTC Bank achieved gross earnings of NGN56.7 billion for 2010, down 5% from 2009 due to lower yields from interbank and fixed income investments offset partially by lower deposit interest rates and increased transaction banking volumes. Total assets increased 13% to NGN384.5 billion. The Chairman notes the political transition in Nigeria in 2011 with national elections and changes to the bank's board. Fiscal policies leading up to the elections raised some inflation concerns though core inflation remained below 11%.