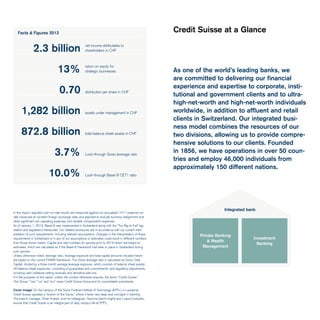

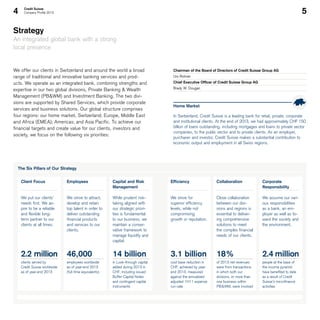

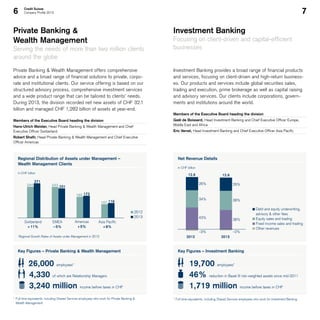

Credit Suisse, founded in 1856, is a leading global bank committed to providing financial solutions to a diverse clientele, including corporate and institutional clients as well as high-net-worth individuals. The bank operates under a Basel III regulatory framework and emphasizes a client-focused integrated business model, delivering services across private banking and investment banking divisions while prioritizing strong capital and risk management. In 2013, Credit Suisse achieved significant progress in its strategic initiatives, including a reduction in leverage exposure and enhancements in operational efficiency, while maintaining a commitment to corporate responsibility and sustainable practices.