The document outlines Standard Bank's role and capabilities in financing power projects across Africa, highlighting its extensive presence in 17 countries and emphasizing its understanding of the region's infrastructure needs. It discusses challenges and requirements for successful private sector involvement in power projects, along with examples of ongoing projects the bank is involved in. The document serves to present Standard Bank as a key partner for financing and advisory in the African energy sector.

![8

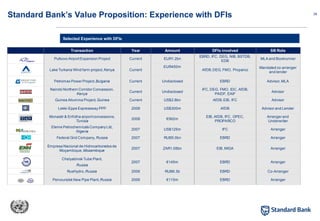

Ongoing – Scatec Solar, South Africa

Standard Bank has been mandated as Sole Financial Arranger and Underwriter, and BEE funding provider to Scatec Solar on its

various Solar PV project in the Northern Cape and Eastern Cape provinces of South Africa

Ongoing – Solar Reserve, South Africa

Standard Bank has been mandated as financial advisor to Solar Reserve on its Solar CSP plants, using molten salt storage

technology, totalling [80-100]MW, in South Africa

Ongoing – Confidential, Africa

Standard Bank has been mandated for a confidential Equity raise in Africa

Ongoing – The Power Company/Built Africa, South Africa

Mandated as financial advisor for The Power Company/Built Africa [20]MW Solar PV Project, over several South African sites

Ongoing – Gitson Energy, Kenya

Mandated lead arranger & financial advisor for Gitson Energy’s [300MW] Wind Power Project in Bubisa, Kenya

Ongoing – Solar Capital, South Africa

Standard Bank has been mandated as financial advisor and main lead arranger for Solar Capital on its five Solar PV plants in the

Northern Cape

Ongoing – African Clean Energy Developments, South Africa

Standard Bank has been mandated as main lead arranger for African Clean Energy Development (ACED) to develop a [400MW]

wind farm in cookhouse in the Eastern Cape

Ongoing – CGNPC, South Africa

Standard Bank has been mandated as a financial advisor to China Guangdong Nuclear Power Corporation (“CGNPC”), China’s

largest Nuclear Energy company, in support of their bid to build South Africa’s potential nuclear power programme

Ongoing – Just Energy, South Africa

Financial Advisor to Oxfam’s energy subsidiary, Just Energy, to develop [74MW] of wind farms in the Eastern Cape

Ongoing – Italgest, South Africa

Standard Bank has been mandated as Financial Advisor to Italgest on its [100 MW] Solar PV project.

Recent Energy, Power & Renewables Credentials (1/3)](https://image.slidesharecdn.com/pppjeannot-250110095739-cc35e0fa/85/financing-power-projects-2011-report-by-jeannot-8-320.jpg)

![9

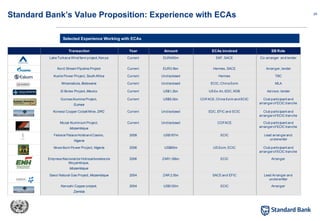

Ongoing – BHP Billiton, DRC

Mandated Transaction Advisor to BHP Billiton SA (Pty) Limited on the INGA 3 hydro-electric project concept study in the Democratic

Republic of Congo.

Ongoing – Mphanda Nkuwa Hydropower Project, Mozambique

Financial advisor to the Mphanda Nkuwa consortium on the development of 1500 MW hydro electric project in Mozambique

Ongoing – Anglo American, South Africa

Standard Bank has been mandated as the Financial Advisor to Anglo American’s [450MW] discard coal-fired IPP near Witbank

Ongoing – SARGE, South Africa

Standard Bank has been mandated as the sole Project and Equity Raising Financial Advisor and Lead Arranger to the SARGE 50 MW,

Solar PV project in the Northern Cape, as well as 216 MW of wind projects

Ongoing – Forest Oil Corporation, South Africa

Standard Bank has been mandated as Financial Adviser to Forest Oil Corporation in connection with the development of an

integrated [750-800 MW] natural gas to power project

Ongoing - Oelsner Group Wind Farms , South Africa

Standard Bank mandated Financial Advisor and Lead Arranger to Oelsner Groups’ two wind farms being Kerrifontein (20.8MW) and

Langefontein (50MW)

Ongoing – Confidential , South Africa

Standard Bank has been mandated as the sole Project and Equity Raising Financial Advisor and Lead Arranger to a SA renewable

energy company on a multiple wind farm project

Ongoing – Volta River Authority, Ghana

Standard bank has been mandated as Financial advisor to VRA on the expansion of the Takoradi power plant

Ongoing - Aldwych International, Kenya

Joint Lead Arranger for long-term financing to Aldwych International for the 300MW Lake Turkana Wind Project valued at US$760m

Ongoing - Gulf Power, Kenya

Co-lead Arranger of the Greenfield 84MW Athi River HFO power plant developed by Gulf Energy

Recent Energy, Power & Renewables Credentials (1/2)](https://image.slidesharecdn.com/pppjeannot-250110095739-cc35e0fa/85/financing-power-projects-2011-report-by-jeannot-9-320.jpg)

![20

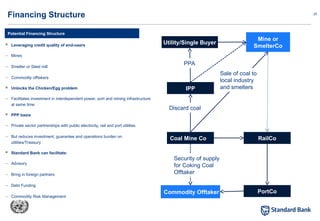

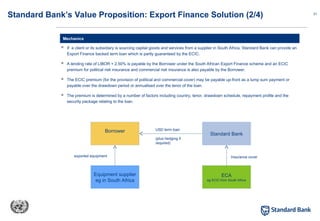

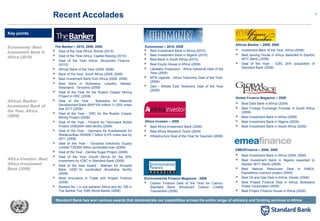

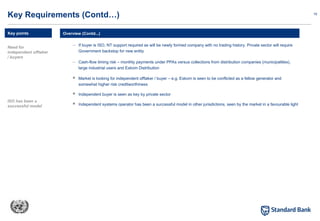

The PPA grants the concession and sets the tariff. It is the primary document that the SBO would focus on. To some extent all

the others are secondary

PPA 101

Key Requirements (Contd…)

Key points

Grants the concession Grants the concession - gives the project the right to

exist, and the right to generate electricity. Term

typically 20-25 years from completion of construction

Ownership BOO or BOT

Sale and purchase of

Net Electricals

Variable O&M costs recovered through the sale of the

net electrical energy dispatched

Sale and purchase of

capacity

Generator (IPP) paid on the availability of net

dependable power capacity irrespective of despatch

sufficient to cover debt service, equity return and fixed

O&M

Procurer (SBO) takes price and despatch risk

Take or Pay

Indexation Tariff payments may be indexed for inflation and

movements in Foreign Exchange rates

Procurer may take inflation and forex movements

risk

The responsibilities will be split

Specifications and

Performance Standards

of the Plant

PPA sets out the responsibility of the Generator to

build by a given date a plant to very precisely

documented specifications, operating standards and

designs

Generator / EPC Contractor takes the responsibility

and risk of building the plant to the requirements of

the Procurer

Revenue Write Down

provisions for non-

Performance

PPA includes provisions to reduce the payments

payable to the Generator if the tested dependable

capacity at any time or the actual availability [or the

heat rate] is worse then the levels the Generator is

contracted to provide

Generator takes performance risk

Delay LD’s for late

commissioning

Delay LDs payable for late commissioning payable by

Generator/ EPC Contractor

Generator takes risk of late commissioning

Performance criteria](https://image.slidesharecdn.com/pppjeannot-250110095739-cc35e0fa/85/financing-power-projects-2011-report-by-jeannot-20-320.jpg)

![21

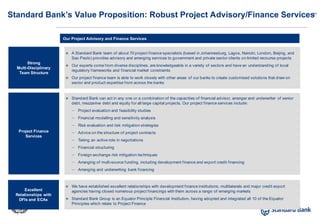

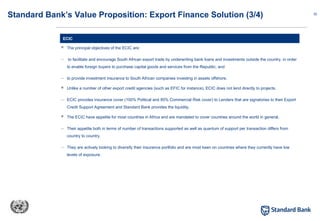

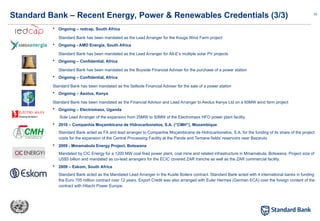

The responsibilities will be split (Contd…)

PPA 101 (Contd...)

Key Requirements (Contd…)

Key points

Third party

responsibilities

Force majeure /

political events

Water and Power

Transmission

interconnections

Generator would seek to make it an

obligations of the Procurer to design build

and commission all required water and

transmission linkages by an agreed date

and prior to scheduled testing

Procurer takes responsibility for providing Water and Power

Interconnections

The PPA sets out provisions for the Procurer to keep the

Generator whole and / or pay compensation if such

facilities are late

Supply of Gas / Coal / Fuel In many markets, the Generator would seek

to make it an obligation of the Procurer to

supply Gas / Coal / Fuel (ie energy

conversion)

Generator may take fuel / hydrology risk

assuming satisfactory pricing and supply

risks

Procurer takes risk of fuel supply and pays deemed

commissioning if fuel is not available Generator takes

efficiency risk through an incentive penalty regime

Permits PPA allocates responsibility for obtaining

permits

Split between Procurer and Generator

Natural Force Majeure PPA sets out provisions in relation to relief

of liability and the provision of insurance

(both damage and business interruption) to

mitigate Natural Force Majeure Risk

(Lightening, fire, earthquake, accidents,

explosions, epidemics etc.)

Insurance

Political Force Majeure There are certain risks which are

uninsurable, political in nature and which

Generators will not accept and need to be

taken by the Procurer

(Act of war, blockade, boycott, rebellion,

civil commotion, Change in Law and / or

unjustified failure to renew permits)

Procurer Risk

Payments of deemed commissioning [or termination buyout

if prolonged] or tariff adjustments to compensate for

additional costs or revenue losses](https://image.slidesharecdn.com/pppjeannot-250110095739-cc35e0fa/85/financing-power-projects-2011-report-by-jeannot-21-320.jpg)